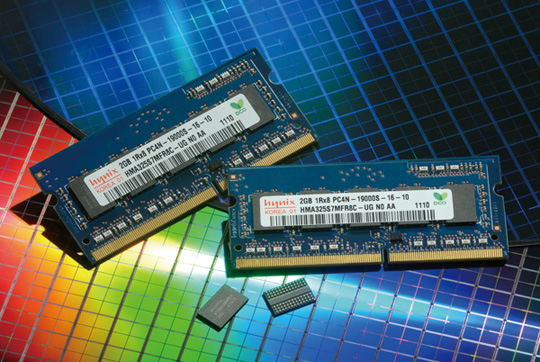

Memory boom

SK Hynix CEO bullish on memory outlook, eyes $12 billion profit

By Apr 30, 2021 (Gmt+09:00)

3

Min read

Most Read

The chief executive of SK Hynix Inc., the worldŌĆÖs second-largest memory chipmaker, aims to achieve as much as 13 trillion won ($12 billion) in operating profit this year amid growing signs that the memory market is entering a boom cycle.

According to SK Hynix and industry officials on Apr. 30, CEO Lee Seok-hee told employees while appearing on an in-house broadcast program on Wednesday that the company targets to earn 13 trillion won in profit in 2021.

That beats the market consensus of 12.8 trillion won and compares with an operating profit of 5.13 trillion won SK Hynix posted in 2020.

The CEO also presented the companyŌĆÖs lower end of its 2021 profit target at 7.7 trillion won, officials said.

The company last made a 13-trillion-won range profit in 2017 when the memory chip market was booming on surging demand from makers of servers and mobile gadgets. Back then, SK Hynix reported 13.7 trillion won in operating profit as DRAM and NAND flash memory prices rose 78.9% and 32.7%, respectively, from the previous year.

His bullish goal comes amid signs that the global DRAM market is entering a boom cycle again with chip prices on an ascending trendline and major chipmakers spending generously to ramp up facilities.

BOOM CYCLE AGAIN

According to market data provider DRAMeXchange, the contract price of DDR4 8Gb 2133MHz, one of the most common DRAM products, rose 26.7% to $3.8 in April from the previous month, while the price of 128Gb MLC NAND memory increased 8.6% to $4.56.

The latest surge in chip prices is thanks to higher consumer demand for TVs, smartphones, laptops and cars, which bounced back from the COVID-19 crisis sooner than expected.

Industry leaders such as┬ĀSamsung Electronics Co.┬Āand┬ĀSK Hynix┬Āare┬Āalready running their plants at full capacity, but a shortage is increasingly becoming an issue as makers of cars, smartphones and electronic devices compete for chips amid depleting supplies.

Samsung is the worldŌĆÖs largest DRAM maker with a 42.1% market share, followed by SK Hynix (29.5%), according to market research firm TrendForce.

Executives at both Samsung and SK Hynix have said they are optimistic about the market outlook for the rest of the year, adding that DRAM and NAND memory demand for consumer electronics, autos and technology gear will continue to grow.

After posting strong first-quarter earnings earlier this week, SK Hynix said it is moving some of its 2022 capital expenditure into the second half of this year in order to build more chipmaking equipment.

TALENT OUTFLOW CONCERNS

During SK HynixŌĆÖs in-house broadcast program, Co-Vice Chairman and Co-CEO Park Jung-ho tried to boost employeesŌĆÖ morale in a bid to retain experienced workers from fleeing to rival chipmakers.

ŌĆ£Our company is the worldŌĆÖs top chipmaker that produces memory chips, which are as important as the COVID-19 vaccines to the world. You all should be proud of this,ŌĆØ he said.

His comments come as the industryŌĆÖs intensifying hiring war raises concerns among some chipmakers over talent outflow.

Earlier this year, SK Hynix workers vented their dissatisfaction over the companyŌĆÖs performance bonus plans, with some engineers hinting at moving to rival companies for better pay.

SK Hynix said in January its employees will get a bonus equivalent to 20% of their annual basic salary, but some workers publicly complained that the amount is too low given the companyŌĆÖs decent earnings. CEO Lee promised to reconsider its bonus scheme next year.

On Wednesday, he said the bonus could rise to as high as 1,000% if the company meets this year's profit goal of 13 trillion won.

Write to Jeong-Soo Hwang at hjs@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Foundry expansionSK Hynix mulls foundry expansion, advances capex to ease chip shortage

Foundry expansionSK Hynix mulls foundry expansion, advances capex to ease chip shortageApr 28, 2021 (Gmt+09:00)

3 Min read -

DRAM supercycleSigns of upcoming DRAM boom cycle loom large amid price uptrend

DRAM supercycleSigns of upcoming DRAM boom cycle loom large amid price uptrendFeb 25, 2021 (Gmt+09:00)

3 Min read -

CEO profileSK Hynix CEO Lee Seok-hee: Star engineer, bookworm, soju connoisseur

CEO profileSK Hynix CEO Lee Seok-hee: Star engineer, bookworm, soju connoisseurJan 12, 2021 (Gmt+09:00)

3 Min read -

EarningsSK Hynix vows to triple NAND sales in 5 years after strong Q3

EarningsSK Hynix vows to triple NAND sales in 5 years after strong Q3Nov 04, 2020 (Gmt+09:00)

3 Min read

Comment 0

LOG IN