IPOs

SK IE Tech IPO draws record-high demand; brokerage servers down briefly

By Apr 29, 2021 (Gmt+09:00)

3

Min read

Most Read

Samsung shifts to emergency mode with 6-day work week for executives

CJ CheilJedang to sell feed, livestock unit for $1.4 bn

Samsung Electronics' key M&A man returns; big deals in the offing

Affinity to buy SK Rent-a-Car at $572 mn, more deals expected

Keppel REIT to sell Seoul-based prime office T Tower

SK IE Technology Co. (SKIET), the battery materials subsidiary of SK Innovation Co., has set a new record for initial public offering demand, briefly paralyzing computer servers and operations at some of the brokerages handling the share sale.

The South Korean electric vehicle battery separator maker has attracted a total of 80.9 trillion won ($73 billion) in deposits from retail investors during the two-day public subscription, official data showed on Apr. 29.

That represents the highest-ever amount deposited from individual investors for an IPO on a Seoul bourse to get shares of SKIET, beating the previous record set just last month by SK Bioscience Co., which pulled in 63.62 trillion won in public subscription.

SKIETŌĆÖs shares were oversubscribed by 288 times, attracting 4.74 million subscription accounts, around 12% of all active stock accounts owned by individual investors in Korea. About 5% of short-term funds in the financial market has been mobilized to buy the shares of SKIET, also posting a record amount.

Financial industry officials said some small investors wonŌĆÖt be able to secure a single SKIET share due to the overwhelming demand.

SERVERS DOWN, WORK PARALYZED

Mirae Asset Securities and JPMorgan are managing the IPO with five other co-underwriters ŌĆō Korea Investment & Securities, Credit Suisse, SK Securities, Samsung Securities and NH Investment & Securities.

According to the IPO managers, so many individual investors rushed to secure SKIETŌĆÖs shares online that some of the computer servers at securities companies briefly went down and paralyzed work at the brokeragesŌĆÖ branches.

ŌĆ£It looks like all the Korean people are betting on SKIET as if to win the lotto. The IPO fever in Korea wonŌĆÖt easily go away any time soon,ŌĆØ said a brokerage official.

During the bookbuilding with institutional investors last week, SKIETŌĆÖs IPO price was set at 105,000 won apiece, the top end of the proposed price band, drawing strong interest from large investors, including the National Pension Service (NPS) and BlackRock Inc., the worldŌĆÖs largest asset manager.

The bookbuilding itself was 1,883 times oversubscribed, also posting an all-time high ratio.

EYES ON SHARE MOVEMENT AT DEBUT

Following its┬Āsuccessful bookbuilding and public subscription, investors are now paying close attention to how the share price will move once SK IE Technology goes public on May 11.

Market watchers say if SKIET debuts on the Kospi market with its opening price double the offering price and reaches the daily upper limit of 30%, then it could touch 273,000 won, taking the companyŌĆÖs total market capitalization to close to 19.5 trillion won, similar to its parent SK Innovation.

The company's employees and executives are allowed to subscribe to a total of 4.27 million shares as part of the employee stock ownership scheme ŌĆö thus, on average, each person can hold around 2.06 billion won worth of shares. If the stock opens at double the offering price and hits the daily limit, an employee would see capital gains of 3.3 billion won theoretically.

UNDERWRITING FEE

The underwriting fee, set at 0.8% of the IPO value, will be shared by the lead managers and co-underwriters.

Industry officials said they will be able to receive a combined 17.9 billion won in underwriting fee due to the successful subscription from investors.

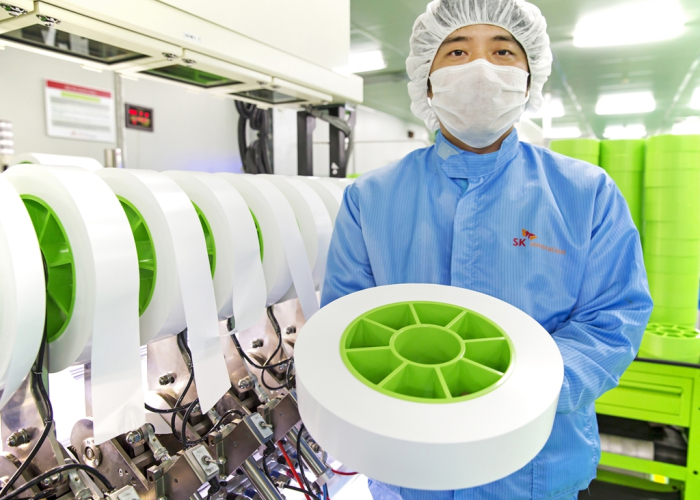

SKIET, which makes lithium-ion battery separators (LiBS), plans to float 21.39 million shares, or 30% of its total outstanding shares, on the main bourse through the IPO.

With the set IPO price, SK will likely raise 2.3 trillion won ($2.1 billion) from the share sale

About 63.2% of the institutional investors, including the NPS, have agreed to a lock-up clause, promising not to sell the stock post-IPO for at least three months. For SKIET employees, the lock-up period is one year.

SK Innovation and SKIET plan to use the proceeds from the IPO to expand their EV battery business.

SKIET has said it will┬Ābuild two additional battery separator plants in Poland┬Āto meet the rising demand for electric car batteries. The project, valued at around 1.2 trillion won, marks SKIETŌĆÖs single largest investment.

SKIET was the first South Korean company to develop lithium-ion battery separators in 2004, and the first in the world to develop the sequential stretching process technology in 2007.

Write to Ye-jin Jun, A-Young Yoon and Jin-Seong Kim at ace@hankyung.com

In-Soo Nam edited this article.

More to Read

-

IPOsSK IE TechnologyŌĆÖs IPO price set at top end; record demand at bookbuilding

IPOsSK IE TechnologyŌĆÖs IPO price set at top end; record demand at bookbuildingApr 26, 2021 (Gmt+09:00)

2 Min read -

IPO valuationsSK IE TechnologyŌĆÖs IPO plan to get boost from ITC ruling

IPO valuationsSK IE TechnologyŌĆÖs IPO plan to get boost from ITC rulingApr 02, 2021 (Gmt+09:00)

3 Min read -

Battery separatorsSKIET to build additional battery separator plants in Poland

Battery separatorsSKIET to build additional battery separator plants in PolandMar 28, 2021 (Gmt+09:00)

2 Min read

Comment 0

LOG IN