Narrative and valuation

Corporate storytelling: S.Korean firms' next growth key

By Apr 27, 2021 (Gmt+09:00)

5

Min read

Most Read

Samsung shifts to emergency mode with 6-day work week for executives

CJ CheilJedang to sell feed, livestock unit for $1.4 bn

Samsung Electronics' key M&A man returns; big deals in the offing

Affinity to buy SK Rent-a-Car at $572 mn, more deals expected

Keppel REIT to sell Seoul-based prime office T Tower

South KoreaŌĆÖs major companies are increasingly adopting corporate storytelling as a means of rebranding their identities.

As the companies enjoy a strong bull market, more-than-adequate liquidity and ultra-low interest rates, it has become easier for them to raise multiple billions of dollars in investment simply by delivering their new long-term visions to the market.┬Ā

Experts say that the way the companies tell their new growth stories, with a focus on company-wide transformation and future areas of diversification rather than existing strengths, has become as important as -- if not more important than -- devising management-level strategies.

ŌĆ£The companies can no longer depend on labor or equipment alone to generate wealth. Only those with unique business models or technological advantages can thrive,ŌĆØ said a director of corporate financing at a major securities firm.

ŌĆ£As investors are funneling their money into such rising stars, the companies are now putting effort into writing new growth stories that can replace their old images in the investment community,ŌĆØ he added. ┬Ā

STORIES BACKED BY PERFORMANCE

SK IE Technology (SKIET) Co.ŌĆÖs recent success in setting its IPO price at the top end of the proposed band is considered a good example of successful storytelling.

SKIET, the battery materials subsidiary of SK Innovation Co., received scant market attention when it became a separate entity in Apr. 2019.

Not only was its parent company SK Innovation a latecomer in the EV battery market, trailing LG Chem Ltd. and Samsung SDI Co., but SKIET's own business segment was little known among investors.

Even in recent months, SKIETŌĆÖs IPO prospects didn't look good, as SK Innovation was fighting an unfavorable legal battle against LG Chem.

But such negative perceptions were turned around when stories, backed by facts and data, spread that SKIET was among the top three global makers of battery separators, core components in EV batteries. The investors were particularly interested by the fact that SKIETŌĆÖs battery separators are even used by SK InnovationŌĆÖs main rival LG Chem.

As a result of such storytelling, SKIET has reached a valuation of 8.8 trillion won ($7.9 billion) and is set to raise 898.3 billion won ($809 million) from its IPO.

Likewise, Hanwha Systems, listed on the Kospi in Nov. 2019, had been seen as a somewhat stagnant company as its main business area, defense, was in decline. But it has succeeded in writing a renewed corporate narrative by highlighting its focus on the fast-growing aerospace segment.

As Hanwha GroupŌĆÖs aerospace business is led by the groupŌĆÖs heir apparent Kim Dong-kwan, investors have high hopes for Hanwha Systems. Not only has the companyŌĆÖs stock price more than doubled in the past 12 months, but it also plans a rights offering to raise 1.24 trillion won ($1.12 billion), more than three times the 402.5 billion won ($363 million) it raised from the IPO. ┬Ā

HYBE Co., formerly known as Big Hit Entertainment, has also made a big move to change its image from just the label behind BTS. Its recent announcement to acquire Ithaca Holdings, the company representing Justin Bieber and Ariana Grande, and its planned rights offering to fund the acquisition have been widely welcomed by the market.

More traditional manufacturers like Hanwha Solutions, previously known only as a chemical company, and POSCO Chemical, which formerly made bricks used in steel plants, are transforming into future-oriented companies.

Hanwha Solutions is now positioning itself as a solar cell maker and a hydrogen producer, while POSCO Chemical has rebranded itself as a battery materials company. Both companies raised more than 1 trillion won ($900 million) through rights offerings in the first quarter of 2021.

Financial analysts stress that now the success and failure of a companyŌĆÖs financing plan depends primarily on how well structured and attractive is its story and the rationale behind the financing.

IDENTITY SHIFT BEYOND INDUSTRY BOUNDARIES

In other words, companies that fail to provide new growth narratives to investors are destined to see sharp drops in their share prices.

Mid-sized shipping company SM Korealine Co., saw a 15% drop in stock price within 11 trading days after its announcement on Mar. 31 to conduct a rights offering worth 194 billion won ($175 million), which disappointed investors who saw it as a move to pay back its debt.

South KoreaŌĆÖs largest multiplex cinema chain CJ CGV is also facing a similar drop in its share price, after sharing plans on Apr. 16 to raise 300 billlion won ($269 million) in convertible bond sales. CJ CGV is considered one of the hardest-hit companies by the pandemic.

At the same time, the countryŌĆÖs leading conglomerates like SK Group and Hyundai Motor Group are writing corporate narratives that aim to shift their identities beyond the boundaries defined by the current industry landscape.

For instance, Hyundai Motor Group, the largest automaker in Korea, is working to throw off its identity as solely an auto manufacturing company. The group has been making aggressive investments not only in future mobility segments including electric vehicles (EV), hydrogen fuel cells, autonomous driving and urban air mobility (UAM), but also in robotics and mobility platforms.

Kia Corp., a part of Hyundai Motor Group, also dropped Motors from its company name to reposition itself as an innovative mobility service provider.

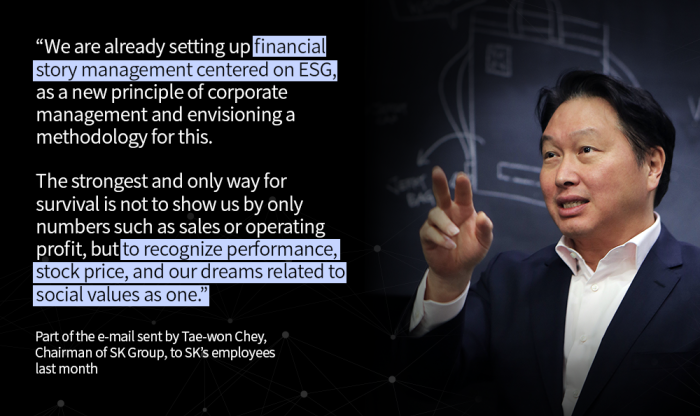

SK Group is another Korean conglomerate that is shifting its identity as a business with a ŌĆ£financial story.ŌĆØ

The financial story is a business keyword coined by the groupŌĆÖs chairman Chey Tae-won, and emphasizes that corporate value is raised when ŌĆ£financial stories, equipped with attractive goals and detailed action plans, win trust from the market.ŌĆØ

Under the chairmanŌĆÖs guidance to write a new corporate narrative, SK Group has recently made bold moves to expand its presence outside its traditional turf such as the telecom segment.

ŌĆ£Nowadays, a companyŌĆÖs storytelling and narrative building skills are the keys in determining its corporate value and success of financing plans. Many companies, especially those that have been undervalued for a long time, will likely put more effort in delivering fresh new stories to investors,ŌĆØ said an investment banking official.

Write to Jin-seong Kim at jskim1028@hankyung.com

Daniel Cho edited this article.

More to Read

-

Future mobilityHyundai Motor invests in Clearpath Robotics in push for future mobility

Future mobilityHyundai Motor invests in Clearpath Robotics in push for future mobilityMar 17, 2021 (Gmt+09:00)

2 Min read

Comment 0

LOG IN