Hyosung Group

Hyosung GroupŌĆÖs year-to-date valuation almost doubles

By Apr 22, 2021 (Gmt+09:00)

4

Min read

Most Read

S.Korea's LS Materials set to boost earnings ahead of IPO process

CarlyleŌĆÖs Rubenstein sees commercial real estate undervalued

Samsung Electronics' key M&A man returns; big deals in the offing

Money pours in for technology to reshape Korean restaurants

CJ CheilJedang to sell feed, livestock unit for $1.4 bn

Hyosung Group, founded in 1966, is a textile and chemicals conglomerate that currently stands as the 26th-largest business group in South Korea.

Until and including last year, the group received not-so-stellar attention from investors in the stock market as its core business segments -- petrochemical, textile and heavy industries ŌĆō were regarded as unattractive compared to future-looking sectors such as AI or EV batteries. ┬Ā┬Ā

The group was also hard-hit by the pandemic last year, when many of its clients had shut down their manufacturing plants. Among the group affiliates, only Hyosung Heavy Industries could fend off a serious downturn by repositioning itself as a hydrogen maker.

Nonetheless, with a fast rate of recovery in the global manufacturing segment so far this year, Hyosung Group is enjoying a renewed level of market attention.

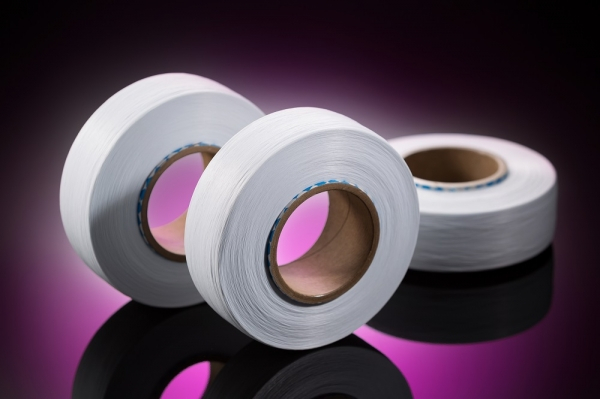

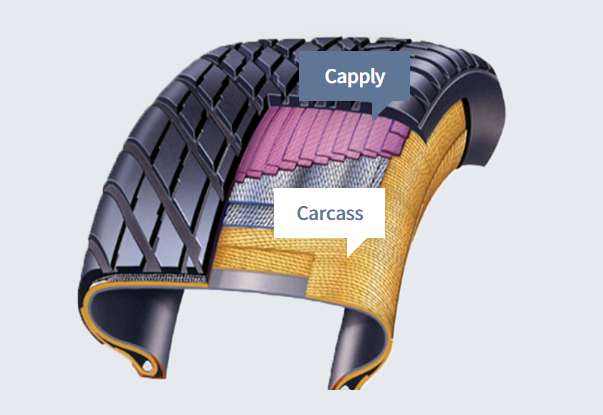

Many of the groupŌĆÖs core products from spandex, a textile used for a wide range of garments such as yoga pants, to tire cords are facing a skyrocketing demand from global clients, pushing financial analysts to raise earnings forecast figures of the groupŌĆÖs key affiliates: Hyosung TNC Corp., Hyosung Advanced Materials and Hyosung Chemical.

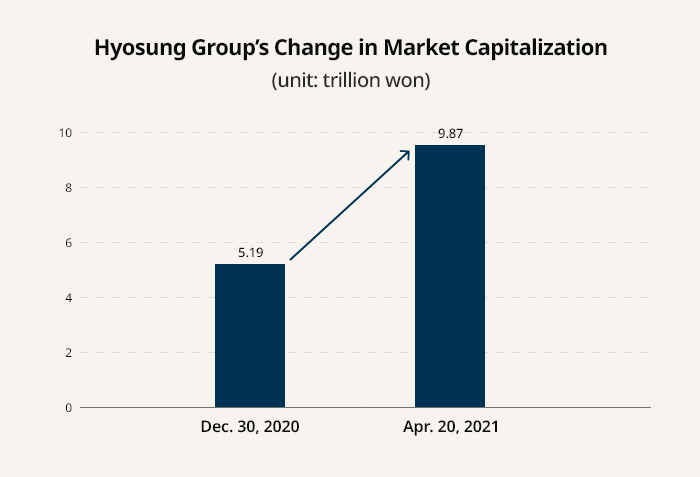

As a result, the groupŌĆÖs market capitalization has almost doubled as of Apr. 20 at almost 10 trillion won ($8.96 billion) from 5.19 trillion won ($4.65 billion) at the 2020 year-end.

THREE KEY SUBSIDIARIES SPEARHEADING GROWTH

Hyosung TNCŌĆÖs year-to-date share price growth as of Apr. 20 recorded a drastic 239% increase. During the same period, the stock prices of Hyosung Applied Materials and Hyosung Chemicals also increased by 183% and 121%, respectively.

According to the market data provider FnGuide Inc., Hyosung TNCŌĆÖs estimated operating profit for 2021 saw a sharp growth, from 338.7 billion won ($303 million) to 706.6 billion won ($633 million).

At the same time, Hyosung Applied MaterialsŌĆÖ profit estimate also saw a similar growth from 151 billion won ($135 million) to 235.6 billion won ($211 million), and Hyosung ChemicalŌĆÖs estimate went up from 194.1 billion won ($174 million) to 230.7 billion won ($207 million).

The figures mark big increases from last yearŌĆÖs actual earnings, with Hyosung TNCŌĆÖs operating profit at 266.6 billion won ($239 million) and those of Hyosung Applied Materials and Hyosung Chemical at 34.2 billion won ($30.6 million) and 60.9 billion ($54.5 million), respectively.

HyosungŌĆÖs rosy outlook by the financial analysts has largely to do with the rapidly growing demand for its core products, spandex and tire cords. ┬Ā

The business areas of HyosungŌĆÖs three key affiliates are interconnected to quite some degree, as Hyosung ChemicalŌĆÖs chemical materials are used to produce Hyosung TNCŌĆÖs spandex yarn and tire cord yarn. Hyosung Applied Material makes tire cord fabric using its sister company Hyosung TNCŌĆÖs tire cord yarn. ┬Ā

Hyosung TNC is the leading player in the global textile industry, holding the largest market shares in both the spandex segment as well as the tire cord segment.

ChinaŌĆÖs factories that use spandex yarns to make fabric and garments have resumed operation this year, driving demand for Hyosung TNCŌĆÖs products. In addition, the rising popularity of home gyms are driving sales of yoga pants and leggings that use spandex.

Despite the growing demand, spandex supply cannot be increased drastically as the expansion of spandex production facilities requires at least a year for construction.

While Hyosung TNC is operating all its factories -- located in Brazil, China, South Korea, Turkey and Vietnam -- at 100% capacity, its clients are still facing a big shortage.

To address client needs for more volume, the company is currently building a plant in ChinaŌĆÖs Ningxia Province, with operation expected from the end of this year.

ŌĆ£The ongoing spandex shortage will fuel Hyosung TNCŌĆÖs extraordinary rate of growth until the third quarter of this year,ŌĆØ said NH Investment & Securities Co. Analyst Hwang Yoo-sik.

Kiwoom Securities also raised the target price of Hyosung TNC stocks to 1 million won ($895) a share. Hyosung TNCŌĆÖs share price closed at 737,000 won ($660) on Apr. 22.

Likewise, the expected recovery of the global tire cord industry has fueled Hyosung Applied MaterialsŌĆÖ share price growth.

Analysts say that the current stock price range of Hyosung Applied Materials reflects investorsŌĆÖ high hopes for the companyŌĆÖs new materials including carbon fibers and aramid fibers. The carbon fibers are key materials used in fuel tanks of hydrogen-powered vehicles. ┬Ā

Others note that the future value of Hyosung Applied MaterialsŌĆÖ next generation fibers are already fully reflected in the companyŌĆÖs current share price.

ŌĆ£While Hyosung Applied MaterialsŌĆÖ plan to expand carbon and aramid fibers manufacturing facilities is an upside, such factors have already been counted to its current share price level,ŌĆØ said KB Securities Analyst Baek Young-chan last month after adjusting his rating from a buy to a hold.

Write to Jae-Yeon Ko at yeon@hankyung.com

Daniel Cho edited this article.

More to Read

-

AirbagsHyosung to equip airbags on AmazonŌĆÖs self-driving cars

AirbagsHyosung to equip airbags on AmazonŌĆÖs self-driving carsMar 17, 2021 (Gmt+09:00)

1 Min read -

Eco-friendly garmentsHyosung TNCŌĆÖs Love Seoul made of recycled PET bottles

Eco-friendly garmentsHyosung TNCŌĆÖs Love Seoul made of recycled PET bottlesMar 10, 2021 (Gmt+09:00)

1 Min read -

Fashion brand launchHyosung TNC: Shifting from yarn maker to eco-fashion trendsetter

Fashion brand launchHyosung TNC: Shifting from yarn maker to eco-fashion trendsetterFeb 09, 2021 (Gmt+09:00)

2 Min read -

Hydrogen energyHyosung, Linde to create world's largest liquid hydrogen plant

Hydrogen energyHyosung, Linde to create world's largest liquid hydrogen plantFeb 05, 2021 (Gmt+09:00)

1 Min read -

Elastic textilesHyosung to expand spandex capacity on home clothing demand

Elastic textilesHyosung to expand spandex capacity on home clothing demandDec 03, 2020 (Gmt+09:00)

2 Min read

Comment 0

LOG IN