Global chip crisis

Quest for semicon autonomy pushes countries to brink of chip cold war

By Apr 14, 2021 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

The ongoing global race for semiconductors, largely driven by the aggressive measures taken by both China and the US, has entered a more serious phase with the European Union joining the emerging chip cold war as the third bloc.

German Chancellor Angela Merkel said on Apr. 12 at Hannover Messe, one of the world’s largest industrial fairs, that Germany will “invest a total sum of 3.6 billion euros ($4.3 billion) on non-memory semiconductors together with 27 European companies.”

Her announcement is a detailed follow-up from her 2019 statement, also made at Hannover Messe, calling for the EU’s semiconductor self-sufficiency. Experts interpret Merkel’s investment announcement at this time as Germany’s strategic, timely move to secure the continent’s chip autonomy.

She also said that Europe should be “flexible in handling the global chip shortage crisis” and that she wants to “see an independent Europe in terms of raw materials, products and technology within the semiconductor infrastructure.”

On the very same day across the Atlantic, US president Joe Biden also underscored his country’s clear stance on the issue during the virtual CEO Summit on Semiconductor and Supply Chain Resilience.

He was straightforward in asking global companies for more investment in the US and did not hide his administration’s strong will to constrain China.

“China and the rest of the world are not waiting. There is no reason why America should wait. Our (country’s) competitiveness depends on where you invest and how you invest,” said the president.

Biden also noted his bipartisan support from the US Congress: “In fact, today, I received a letter from 23 Senators, bipartisanly, and 42 House members, Republicans and Democrats, supporting the CHIPS for America program.”

He quoted the congressional letter at the CEO summit: “It says, the Chinese Communist Party ‘aggressively plans to reorient and dominate the semiconductor supply chain …’ — and it goes into how much money they’re pouring in to be able to do that.”

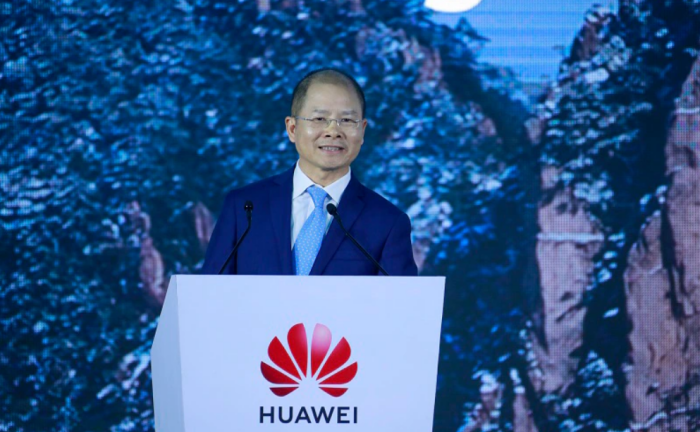

Also on Apr. 12, on the other side of the globe in Shenzhen, China, Huawei Chairman Eric Xu criticized the US at the company’s Global Analysts Summit 2021.

“The sanctions imposed by the US on China’s tech companies are hurting the global semiconductor industry. They have disrupted the trusted relationships in the industry,” said the chairman.

Xu also said that the global chip shortage was caused by the US, as companies around the world started to pile up large inventories of chips on concerns over US sanctions.

RISING PRESSURE ON SAMSUNG

Samsung Electronics Co., the only South Korean company invited to present at the US summit, refrained from sharing an official stance.

Analysts say this illustrates Samsung’s dilemma, facing pressure to invest more in the US, while continuing to serve its Chinese and European clients.

Samsung will reportedly soon unfold its investment plan to expand its foundry business and facilities in the US.

In February the company said it seeks to build a leading-edge semiconductor manufacturing facility in the US with a $17 billion investment. Austin, Texas, is a strong candidate for the investment as it already houses the company’s existing foundry facilities.

But Samsung said that the “US federal government’s amount of cash and tax support must be finalized before we can make a decision.”

The company’s longtime partner and competitor Intel added extra pressure to Samsung, with Intel's March decision to invest $20 billion to build two new foundry plants in Arizona.

Others highlight that American companies’ recent focus on increasing investment in application processor (AP) chips used in future vehicles will further burden Samsung, one of the leading global AP chip manufacturers.

“AP chips for future vehicles require a more advanced level of technology than the chips used in mobile phones. Only the leading foundry companies, like Samsung and Taiwan’s TSMC, can manufacture those AP chips,” said an industry expert.

Write to Su-bin Lee, Dong-hyun Kim, Shin-young Park and Jin-won Kim at lsb@hankyung.com

Daniel Cho edited this article.

More to Read

-

Semiconductor shortagesMemory chip shortage may drive SSD price hike in Q2

Semiconductor shortagesMemory chip shortage may drive SSD price hike in Q2Mar 10, 2021 (Gmt+09:00)

2 Min read -

Semiconductor shortagesQualcomm chip shortage may squeeze global smartphone production

Semiconductor shortagesQualcomm chip shortage may squeeze global smartphone productionMar 08, 2021 (Gmt+09:00)

3 Min read -

Semiconductor shortagesChip shortages spread to backend firms, disrupting supply chains

Semiconductor shortagesChip shortages spread to backend firms, disrupting supply chainsFeb 15, 2021 (Gmt+09:00)

2 Min read

Comment 0

LOG IN