IPOs

Hyundai Engineering seeks Q3 IPO; seen as precursor to group revamp

By Apr 13, 2021 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

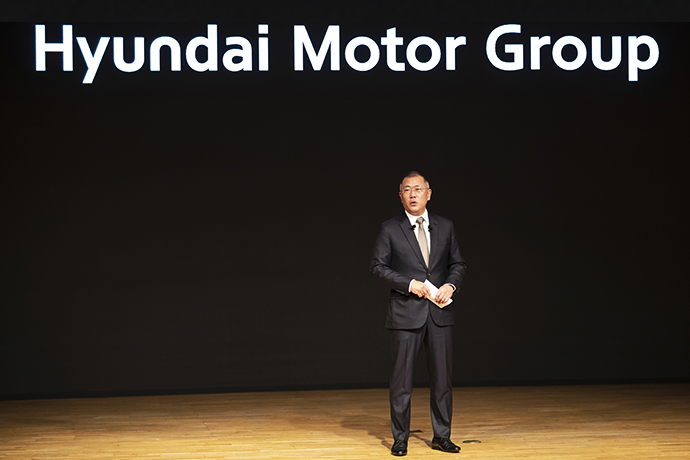

Hyundai Engineering Co., an unlisted construction affiliate of the Hyundai Motor Group, is seeking an initial public offering on the Korean bourse, a move widely seen as a precursor to the automotive group’s ownership revamp.

According to the investment banking industry on Apr. 13, Hyundai Engineering last week sent out a request for proposals (RFPs) to brokerages interested in managing its planned IPO.

Among the prospective IPO managers are Mirae Asset Securities, Korea Investment & Securities, NH Investment & Securities, Shinhan Investment Corp. and Hana Financial Investment. Citigroup Global Markets Korea, Morgan Stanley, JPMorgan and Credit Suisse have also been asked to submit a bid.

The company plans to receive proposals by Apr. 23 and choose lead managers through competition by early May, according to industry sources.

The listing on the main Kospi market of Hyundai Engineering with an estimated corporate value of around 10 trillion won ($8.9 billion) will likely happen in the third quarter at the earliest but could be delayed as other big IPOs, such as those of Krafton Inc. and KakaoBank Corp., are also scheduled for the quarter, they said.

If the IPO goes as planned, it would mark the automotive group's first affiliate listing since the public share sale of Hyundai AutoEver Co., its system integration unit, in 2019.

Analysts said the IPO of Hyundai Engineering appears to be aimed at raising capital needed for Hyundai Motor Group Chairman Chung Euisun to reorganize group affiliates to streamline their weblike cross-shareholdings.

Chung holds an 11.72% stake in Hyundai Engineering as the builder’s second-largest shareholder, following No. 1 stakeholder Hyundai Engineering & Construction Co. with 38.62%. Other major shareholders include Hyundai Glovis Co. (11.67%), Kia Corp. (9.35%) and Hyundai Mobis Co. (9.35%).

The investment banking industry estimates Hyundai Engineering’s enterprise value at around 10 trillion won if the company debuts on the Korea Exchange, given its current market capitalization of about 8 trillion won on the over-the-counter (OTC) market.

Specialized in plant business, building and housing works and infrastructure projects, Hyundai Engineering posted 258.7 billion won in operating profit on revenue of 7.19 trillion won on a consolidated basis in 2020. The results compare with 408.1 billion won in operating profit on revenue of 6.8 trillion won in 2019.

ABORTED REVAMP ATTEMPT

Speculation of an impending ownership revamp resurfaced when Chung took over the helm of the group from his father Chung Mong-koo in October 2020.

The junior Chung has been widely expected to revisit the aborted attempt to reform the group’s ownership structure to tighten his grip on the conglomerate.

Analysts said the chairman is highly likely to place Hyundai Mobis at the center of the automotive group’s ownership overhaul.

In 2018, the junior Chung, then-executive vice chairman of the group, sought to carve out Mobis’ module and after-sales parts divisions and combine them with Glovis. Under the proposed plan, Mobis’ remaining entity was meant to serve as the holding company of Hyundai Motor Co., Kia and Glovis.

But he had to abandon the plan in the face of opposition from institutional investors, including US activist investor Elliot Management. They opposed the spin-off plan on concerns about shareholder value dilution.

Chairman Chung, which currently holds just 0.32% of Hyundai Mobis, needs to increase his stake in the auto parts maker to strengthen his control over the group, analysts said.

He is expected to raise about 1 trillion won from the Hyundai Engineering IPO.

REVISED FAIR TRADE ACT

The ownership structure revamp is also linked to the revision of the Fair Trade Act, set to take effect on Dec. 30, 2021.

Under the revised law, an increased number of big companies will be subject to stricter regulations on inter-affiliate business deals and violators will face heavier penalties.

In the past, the regulation applied to listed companies at least 30% owned by group chiefs and their families and 20% for unlisted firms. But under the new legislation, the threshold is set at 20% for both cases.

Chairman Chung and his father Chung Mong-koo, who own a combined 29.9% stake in Hyundai Glovis, the logistics unit of the group, must sell at least 10% of Glovis by the end of this year. The owner family will be able to raise another 1 trillion won from the stake sale.

Analysts said the automotive group won’t likely rush to embark on group ownership restructuring this year, to avoid the revamp being rejected again by investors.

Write to Byung-Uk Do and Ye-Jin Jun at dodo@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Hyundai Gloivis, Mobis shares jump on ownership revamp hopes

Hyundai Gloivis, Mobis shares jump on ownership revamp hopesOct 20, 2020 (Gmt+09:00)

3 Min read -

New Hyundai Motor Chairman Chung Euisun sets sights on future mobility

New Hyundai Motor Chairman Chung Euisun sets sights on future mobilityOct 14, 2020 (Gmt+09:00)

4 Min read

Comment 0

LOG IN