Kakao Japan seeks $446 million from Anchor Equity

By Apr 06, 2021 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

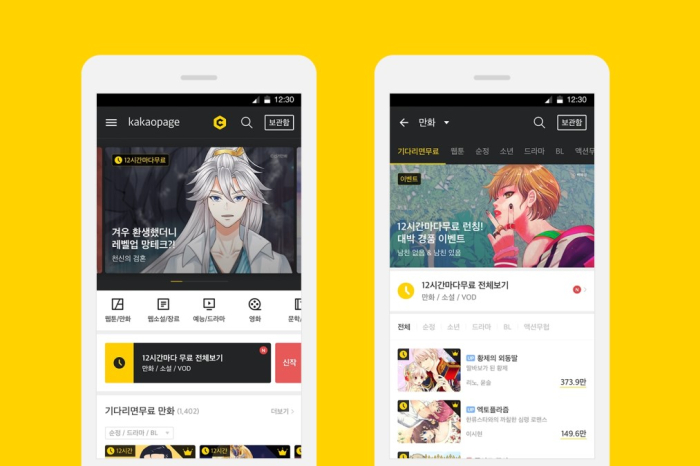

Kakao Corp.’s Japanese unit, which operates Japan’s largest webtoon platform Piccoma, is in talks to attract as much as 500 billion won ($446 million) from Seoul-based private equity firm Anchor Equity Partners.

According to the investment banking industry on Apr. 6, Kakao Japan is seeking investment from Anchor Equity, presenting its enterprise value at between 7 trillion won and 8 trillion won.

Kakao Japan is 78.4% owned by Kakao Corp., one of South Korea’s top content and mobile app operators. Kakao Page Corp. owns the remaining 21.6% of Kakao Japan.

As webtoons gain increasing popularity worldwide, competition has been growing among Korean firms vying for bigger market share in the global digital comics market, particularly the Japanese market, which is second only to the US.

Last month, Kakao’s webtoon app Piccoma and Naver Corp.’s Line Manga topped the list of highest-grossing comic apps in Japan.

LATECOMER BUT TOP PLAYER IN JAPAN

Piccoma entered the Japanese webtoon market in 2016, later than its industry peers, but caught up with Naver's manga service last year to claim the top place.

Piccoma’s payment transactions steadily increased from 63 billion won in 2018 to 144 billion won in 2019 and over 400 billion won in 2020.

Piccoma’s success is owing to its ability to target new digital consumption behavior by uploading new episodes on a weekly basis, or even more frequently. Traditionally Japanese comics apps tended to update their comics offerings once a month as they are generally scanned versions of monthly comics.

According to the National IT Industry Promotion Agency, the global digital comics market is expected to grow from around $2.4 billion in 2018 to $3.3 billion in 2023.

Industry watchers said Kakao Japan’s corporate value of 7 trillion to 8 trillion won may be overestimated, given that its rival Naver Webtoon Ltd.’s value is estimated at 5 trillion to 6 trillion won.

Anchor Equity Partners is a private equity firm specializing in middle-market and consolidation investments. It targets growth opportunities in Korea.

In 2020, the private equity firm invested 210 billion won in Kakao M, which merged with KakaoPage this year to form Kakao Entertainment. Anchor Equity also invested 250 billion won in Kakao Mobility Corp. last year.

Write to Jun-ho Cha at chacha@hankyung.com

In-Soo Nam edited this article.

More to Read

-

[Exclusive] Digital contentsKakao in talks to buy US fiction app in heated IP rivalry

[Exclusive] Digital contentsKakao in talks to buy US fiction app in heated IP rivalryApr 04, 2021 (Gmt+09:00)

4 Min read -

2020 earningsKakao’s private affiliates post record growth in 2020

2020 earningsKakao’s private affiliates post record growth in 2020Mar 19, 2021 (Gmt+09:00)

3 Min read

Comment 0

LOG IN