Stake sale

SK Hynix ponders fate of Kioxia stake after bids by Micron, WDC

By Apr 02, 2021 (Gmt+09:00)

2

Min read

Most Read

Samsung shifts to emergency mode with 6-day work week for executives

CJ CheilJedang to sell feed, livestock unit for $1.4 bn

Samsung Electronics' key M&A man returns; big deals in the offing

Affinity to buy SK Rent-a-Car at $572 mn, more deals expected

Keppel REIT to sell Seoul-based prime office T Tower

The reported bids to buy Japanese chipmaker Kioxia Holdings Corp. by Micron Technology Inc. and Western Digital Corp. is raising market chatter over the fate of the Kioxia stake held by South KoreaŌĆÖs SK Hynix Inc.

According to the investment banking industry on Apr. 2, SK Hynix doesnŌĆÖt have any right to buy additional Kioxia shares ahead of other bidders if the Japanese company is up for sale, which means SK HynixŌĆÖs invested firm may end up in the hands of its competitors.

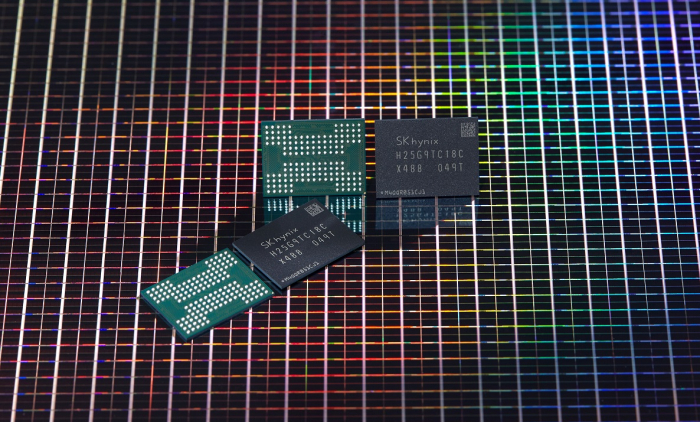

Back in 2018, SK Hynix, the semiconductor arm of SK Group, invested about 4 trillion won ($3.55 billion) in the Japanese chipmaker┬Āthrough a consortium led by US private equity firm Bain Capital. Of the investment, 1.3 trillion won was used to buy convertible bonds worth a 15% stake in┬ĀKioxia.

Industry officials said SK Hynix joined the consortium as a financial investor, meaning it didnŌĆÖt secure the right of first refusal (ROFR), a contractual right that gives its holder the option to buy the shares of the entity before the owner is entitled to enter into a transaction with a third party.

MAY CONVERT CB INTO STOCK TO UNLOAD STAKE

Market analysts say SK Hynix may choose to convert its CB into shares of Kioxia, and exercise its tag-along rights, also known as co-sale rights, to divest of its stake.

The Korean chipmaker may also try to acquire Kioxia in competition with Micron and Western Digital, but analysts said such a chance is low given that SK Hynix already spent heavily to buy Intel Corp.ŌĆÖs NAND memory business.

In October 2020, SK Hynix signed a 10.3 trillion won ($9 billion) all-cash deal to buy IntelŌĆÖs NAND business┬Āthat will propel the Korean chipmaker to second place in the sectorŌĆÖs global rankings.

SK Hynix Chief Executive Lee Seok-hee said at the time he had no intention to sell its stake in Kioxia to raise the money needed for the Intel deal.

After the US market close on Wednesday, The Wall Street Journal reported that both Western Digital and Micron Technology are considering an acquisition of Kioxia Holdings, currently the worldŌĆÖs No. 2 NAND player, for about $30 billion.

Kioxia, which originally was ToshibaŌĆÖs memory-chip business, is controlled by a group of investors that includes Bain Capital, SK Hynix and Toshiba. The WSJ said a deal could be completed later this spring.

Last year, Kioxia had planned to go public but withdrew the plan amid volatile market conditions.

Write to Ri-Ahn Kim at knra@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Memory competitionSamsung, SK Hynix at crossroads, challenged by underdogs

Memory competitionSamsung, SK Hynix at crossroads, challenged by underdogsMar 14, 2021 (Gmt+09:00)

4 Min read -

M&AsSK Hynix's Intel NAND chip deal wins US regulatory approval

M&AsSK Hynix's Intel NAND chip deal wins US regulatory approvalMar 12, 2021 (Gmt+09:00)

1 Min read -

Mobile DRAMsSK Hynix produces mobile DRAM with industryŌĆÖs largest capacity

Mobile DRAMsSK Hynix produces mobile DRAM with industryŌĆÖs largest capacityMar 08, 2021 (Gmt+09:00)

1 Min read -

DRAM chip plantSK Hynix completes construction of its largest $3.14 bn chip plant

DRAM chip plantSK Hynix completes construction of its largest $3.14 bn chip plantFeb 01, 2021 (Gmt+09:00)

2 Min read -

CEO profileSK Hynix CEO Lee Seok-hee: Star engineer, bookworm, soju connoisseur

CEO profileSK Hynix CEO Lee Seok-hee: Star engineer, bookworm, soju connoisseurJan 12, 2021 (Gmt+09:00)

3 Min read

Comment 0

LOG IN