ESG

BOK to stop investing in low ESG scorers

By Apr 01, 2021 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korea’s central bank will exclude companies with low ESG ratings from its portfolio of foreign currency assets.

The Bank of Korea has decided to adopt negative screening, a practice in ESG investing that excludes companies that do not comply with specific ESG criteria, according to bank sources on Apr. 1.

The decision will directly impact the composition of the portfolio managed by the Bank of Korea’s Reserve Management Group, responsible for research, risk management, investment management as well as overseas operations of all foreign currency assets held by the bank.

The Reserve Management Group invests the bank’s foreign reserves in overseas stocks and bonds, with $430.1 billion worth of assets under management (AUM) excluding an IMF reserve position, gold reserves and special drawing rights.

The size of the Bank of Korea’s AUM ranks ninth among central banks worldwide.

The bank is currently devising internal principles and standards in line with its strategic direction of negative screening, said an industry source.

MORGAN STANLEY INDEX AS BENCHMARK

South Korea’s central bank will be using the ESG index of Morgan Stanley Capital International (MSCI) as a selection criterion.

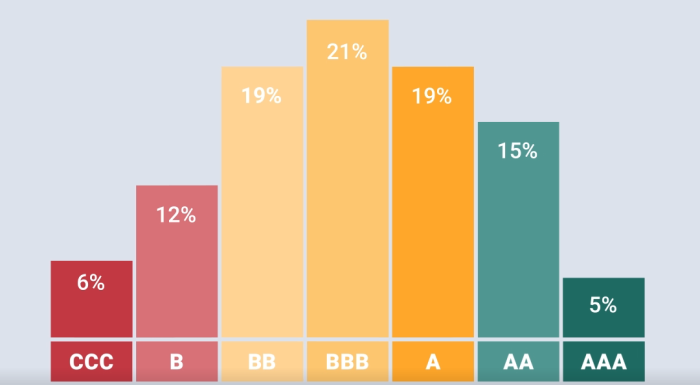

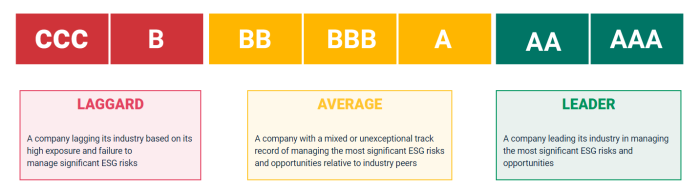

MSCI evaluates ESG activities of global companies and publishes ESG ratings every year in seven grades: AAA, AA, A, BBB, BB, B and CCC.

The bank will begin excluding companies with CCC ratings from its portfolio after it completes drafting the negative screening principles and standards.

The world’s first central bank to adopt negative screening was Sweden’s Sveriges Riksbank last November. The Bank of Korea is the second central bank to follow the practice.

A TWO-WAY STRATEGY WITH POSITIVE SCREENING

At the same time, the Bank of Korea will introduce the practice of positive screening, buying more stocks and bonds of companies with AAA ratings on the MSCI ESG index.

It will also purchase so-called “green bonds” issued by international organizations, bonds that are used for eco-friendly investment purposes only.

The recent series of actions taken by the bank is interpreted as preparation for a possible “green swan.”

The green swan, a term coined by the Bank for International Settlements (BIS) in a January 2020 report, warns that rapid climate change may cause an unexpected financial crisis.

The BIS report had suggested central banks analyze and manage the green swan properly. Many central banks have been conducting research on ESG since the BIS report, including the Bank of Korea.

The central bank said that it will continue to expand the amount and portion of its ESG investment; the bank’s ESG-focused investment totaled $5.45 billion at the end of 2020.

Write to Ik-Hwan Kim at lovepen@hankyung.com

Daniel Cho edited this article.

More to Read

-

ESG InvestmentBOK tells institutions to cut exposure in high carbon sectors

ESG InvestmentBOK tells institutions to cut exposure in high carbon sectorsMar 25, 2021 (Gmt+09:00)

3 Min read -

BOK net profitBOK posts record 2020 net income on higher foreign asset gains

BOK net profitBOK posts record 2020 net income on higher foreign asset gainsMar 12, 2021 (Gmt+09:00)

1 Min read

Comment 0

LOG IN