Inflation

Inflation fears spread in S.Korea amid wage hikes

By Mar 29, 2021 (Gmt+09:00)

4

Min read

Most Read

CarlyleŌĆÖs Rubenstein sees commercial real estate undervalued

Infrastructure secondaries continue to rise amid inflation: Stafford

Goldman Sachs names Choi Seoul office chief

Golf equipment maker Taylormade to refinance $222 mn of debt

NPS' former key players move to law firms as its voting power increases

Inflation figures have entered a rising trend in South Korea amid ongoing competition across industries for higher wages.

The countryŌĆÖs expected inflation rate for the next 12 months came in at 2.1% in March, up 0.1 percentage point from the February number, according to Bank of Korea statistics on Mar. 28.

The expected rate of inflation remained under the two percent mark in January this year at 1.8% but rose to 2.0% in February before reaching March's 2.1%, the highest point since July 2019.

The actual consumer inflation rate is also rising fast, having marked 0.5% in December last year but 0.6% in January and 1.1% in February of this year.

Economists project an even higher rate of inflation moving forward this year, as the January and February figures failed to take sharp salary growth in key industries into account.

This year, the countryŌĆÖs major players in the tech and gaming industries, such as NCSoft Corp., Netmarble Co., Nexon, Webzen Inc. and Vespa Inc., have increased their average annual salaries by 8 million to 20 million won ($7,000 to $17,700).

Samsung Electronics Co. and LG Electronics Co. followed suit with 7.5% and 9.0% average wage hikes, respectively, for their employees this year.

Corporations' recent salary hike one-upmanship is largely driven by competition for talent in the software and data mining segments. Another factor pushing up wages is the spread of anonymous work-gossip social media platform Blind, on which users post real-time information about their workplaces.

The millennials and Gen Zers have been very frank on Blind in exchanging data on wage increases and incentives, further driving calls for changes. ┬Ā

ŌĆ£Congrats to those at Samsung Electronics on their successful wage talks. We definitely need a big pay rise here too at our company,ŌĆØ posted an anonymous Blind user.

POTENTIAL MACRO-LEVEL IMPACT

The Bank of Korea estimated the wage level forecast index for each month of this yearŌĆÖs first quarter at 112, the highest level since the 116 seen in the pre-pandemic month of February 2020.

If the index is above 100, it means more people expect wage levels to increase in the future than those who don't.┬Ā

Experts worry that the industry-wide call for higher pay may further drive up inflation, without strengthening companies' competitiveness.

ŌĆ£If wages keep rising, employees in the same or related industries will ask for similar raises. If companies increase wages without a rigorous standard or a logical base, it will have a negative impact on their competitiveness,ŌĆØ said Hansung University Professor of Economics Park Young-bum.

Corporations are increasingly facing a burden from labor costs. The labor income portion of national income reached 65.5% in 2019, the highest in history and up 2.0 percentage points from 63.5% in 2018. The labor income increase was driven by a 3.4% rise in wages and a 6.9% decrease in corporate profit in the same period.

Others are concerned about the rise of unemployment and potential reduction in real income in case of wage hikes without an actual improvement in corporate productivity.

Macroeconomic figures support such concerns on unemployment.

According to Korea Statistics, 240,000 jobs were lost in 2018 in the self-employed segment and companies with fewer than five employees. The current administration raised the national minimum wage at an unprecedented rate in 2018 and again in 2019, by 16.4% and 10.9%, respectively.

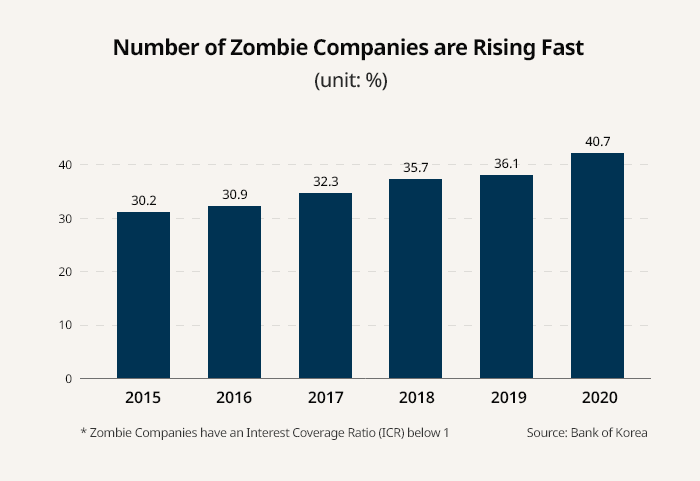

Voices calling for an expulsion of so-called ŌĆ£zombie companiesŌĆØ from the market to secure labor productivity are thus getting louder.

Zombie companies are those with an interest coverage ratio below one.

The ratio is calculated by dividing the companyŌĆÖs operating profit by its cost of interest. A ratio under one means that the company cannot even afford to pay back its interest.

These companies have much lower rates of labor productivity, only around 48% that of other companies, thus dragging down national labor productivity figures.

The Bank of Korea forecasted a 1.01% rise in productivity if the number of zombie companies remains at current levels. ┬Ā

According to the central bankŌĆÖs latest statistics in March, the portion of zombie companies in the country among the 2,175 listed and non-listed companies is at 40.7%, up 4.6 percentage points from the previous year.

The ratio has been on a constant increase from 30.9% in 2016, to 32.3% in 2017 and 35.7% in 2018.

Write to Ik-hwan Kim and Seung-hyun Baik at lovepen@hankyung.com

Daniel Cho edited this article.

More to Read

-

Pay raisePandemic polarizes pay between tech and non-tech firms

Pay raisePandemic polarizes pay between tech and non-tech firmsMar 21, 2021 (Gmt+09:00)

5 Min read

Comment 0

LOG IN