Fund manager survey

Outlook for Korean battery shares evenly split amid weak performance

By Mar 29, 2021 (Gmt+09:00)

1

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korea’s major battery makers, which have underperformed the broader stock market since the start of the year, remain opaque as fund managers are evenly divided over the sector's share price outlook.

According to a recent survey of local fund managers by The Korea Economic Daily, about 22.6% of the respondents said battery shares will face a correction in the 10-20% range in the coming months.

Nearly the same percentage of the fund managers polled said they expect the shares to rise by 10-20%, indicating that some investors remain hopeful in the wake of a series of negative news.

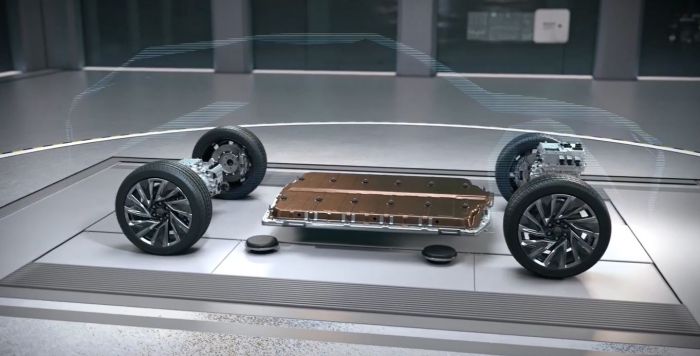

Korea’s three major battery players – LG Chem Ltd., Samsung SDI Co. and SK Innovation Co. – led the main Kospi market’s rally throughout 2020, but faced downward pressure alongside the weak performance of US electric car giant Tesla Inc.'s shares in the first couple of months of the year.

The Korean battery manufacturers were further hit by Volkswagen AG’s announcement in mid-March that it will make batteries in-house for its electric cars and switch its battery type in favor of Chinese manufacturers.

LG Chem, which owns Korea’s largest battery company LG Energy Solution Ltd., has shed 15% since Feb. 1, while Samsung SDI has dropped 12%. SK Innovation has fallen 35% in the same period.

BATTERY MATERIALS MAKERS EMERGE AS ALTERNATIVES

The pessimists said the Korean companies’ valuations will likely be lowered as they face an increasingly uphill battle with automakers entering the EV battery-making business.

But those who hold an optimistic view say the shares of the battery makers will likely stage a rebound from the second quarter on the back of improving profits.

Some fund managers recommended investors adjust their investment portfolios to include battery materials makers given fierce competition between conventional battery makers and EV automakers to secure battery materials.

Write to Bum-Jin Chun at forward@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Battery stocksMarket jitters grow over Korean battery shares after VW’s decision

Battery stocksMarket jitters grow over Korean battery shares after VW’s decisionMar 18, 2021 (Gmt+09:00)

3 Min read -

EV batteriesKorean battery shares tumble as VW gears up for in-house production

EV batteriesKorean battery shares tumble as VW gears up for in-house productionMar 16, 2021 (Gmt+09:00)

4 Min read -

EV battery plantsLG Energy to invest over $4.5 bn to expand US battery facilities

EV battery plantsLG Energy to invest over $4.5 bn to expand US battery facilitiesMar 12, 2021 (Gmt+09:00)

3 Min read -

EV battery plantsLG Energy, GM in talks to build 2nd EV battery plant in Tennessee

EV battery plantsLG Energy, GM in talks to build 2nd EV battery plant in TennesseeMar 05, 2021 (Gmt+09:00)

3 Min read -

EV battery salesSK Innovation’s Q4 EV battery business revenue hits record high

EV battery salesSK Innovation’s Q4 EV battery business revenue hits record highJan 29, 2021 (Gmt+09:00)

3 Min read

Comment 0

LOG IN