Korean value stocks outshine growth names in flat market

By Mar 24, 2021 (Gmt+09:00)

Samsung shifts to emergency mode with 6-day work week for executives

Alibaba eyes 1st investment in Korean e-commerce platform

Blackstone signs over $1 bn deal with MBK for 1st exit in Korea

NPS loses $1.2 bn in local stocks in Q1 on weak battery shares

MBK eyes stake in Korean software developer Tmaxsoft

Over the past three months, domestic value stock funds in South Korea saw net outflows of 921.4 billion won ($814 million), with the benchmark Kospi index entering a downward correction after hitting a record high above 3,000 points in late January.

But Korean value stocks, mostly in traditional businesses such as telecommunications and banking, are staging a strong comeback in the rangebound markets, outstripping growth stocks that appear to have run their course.

Increased market concerns about inflationary pressure and interest rate hikes have taken the shine off growth names, with investors switching to value stocks such as telecom giant KT Corp., steelmaker POSCO Co. and retailer Shinsegae Inc.

Fund managers see further upside potential for sector leaders in traditional industries, seen less vulnerable to rising interest rates.

"Last year, companies with a strong sales growth rate received higher valuations. This year, market focus has been shifting toward companies with solid operating profits and net profits," said Korea Value Asset Management's fund manager Yoon Jung-hwan.

Domestic value stocks have outperformed domestic equity funds managed in the country year to date, with returns from some value stock funds exceeding 20%. That compares with a mere 4% advance in the Kospi index since the start of the year, wiping out most of its gains made earlier this year.

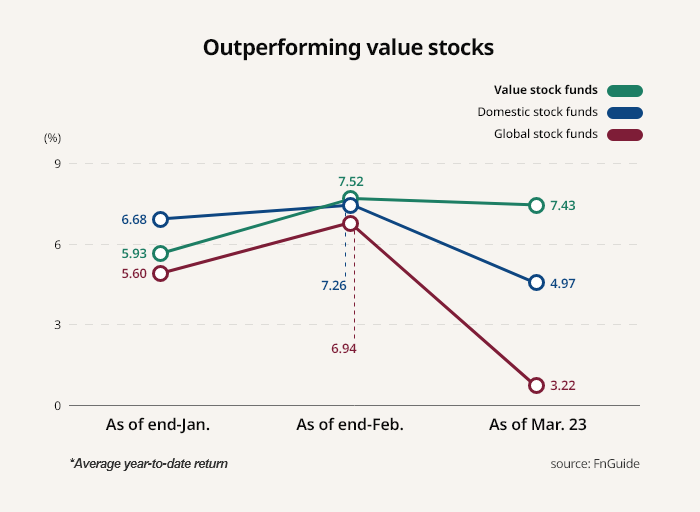

The average return from domestic value funds with over 1 billion won under management came to 7.43% year to date, according to stock market tracker FnGuide on Mar. 23. That outstripped the 3.22% gain for overseas equity funds sold in South Korea and the average 4.97% for equity funds managed in the country as a whole.

| ┬ĀKorean value stock funds vs. stock funds in general (average return: %) | ||

| ┬ĀValue stock funds | ┬ĀStock funds | |

| One-year as of early Mar. | ┬Ā82.28% | ┬Ā106.76% |

| Year-to-date as of early Feb. | ┬Ā5.93% | ┬Ā6.68% |

| Year-to-date as of early Mar. | ┬Ā7.52% | ┬Ā7.26% |

| ┬Ā(Source: FnGuide) |

||

With the 10-year US Treasury yield creeping up toward 2%, market expectations for interest rate hikes boosted the relative allure of value stocks, which have better short-term earnings visibility than growth companies.┬Ā

High valuations of the broader markets also renewed interest in value stocks. The Kospi index spiked to a record high of 3,266.23 in January, around 14 times the projected earnings of listed companies.┬Ā

Last year, South Korean stock markets closed at their highest levels of the year, rising the most among major equity markets and beating bigger rivals such as the S&P 500 and the Nasdaq.┬Ā

On Wednesday, the benchmark stock index dipped below the 3,000 level for the first time in two weeks.

Write to Byeong-hun Yang at hun@hankyung.com

Yeonhee Kim edited this article.

-

-

Kospi market capS.Korea's stock market cap tops nominal GDP for the first time

Kospi market capS.Korea's stock market cap tops nominal GDP for the first timeJan 03, 2021 (Gmt+09:00)

2 Min read -

Market snapshotKoreaŌĆÖs stock markets rise most among majors; beat S&P 500, Nasdaq gains

Market snapshotKoreaŌĆÖs stock markets rise most among majors; beat S&P 500, Nasdaq gainsDec 30, 2020 (Gmt+09:00)

2 Min read