Memory competition

Samsung, SK Hynix at crossroads, challenged by underdogs

By Mar 14, 2021 (Gmt+09:00)

4

Min read

Most Read

Samsung shifts to emergency mode with 6-day work week for executives

CJ CheilJedang to sell feed, livestock unit for $1.4 bn

Samsung Electronics' key M&A man returns; big deals in the offing

Affinity to buy SK Rent-a-Car at $572 mn, more deals expected

Keppel REIT to sell Seoul-based prime office T Tower

South KoreaŌĆÖs leading chipmakers Samsung Electronics Co. and SK Hynix Inc. are at a crossroads, challenged by smaller rivals such as Micron Technology Inc. that are narrowing the technology gap with the industry leaders.

A sense of urgency to widen the lead with fast followers is even more pronounced in the local industry and among academics, as governments in the US, Europe and China promise to spend heavily to swiftly overtake Korea in technological prowess.

In November of last year, Micron surprised the global semiconductor market by announcing that it developed 176-layer 3D NAND flash memory, the industryŌĆÖs first, and had begun volume shipments of the product to its clients.

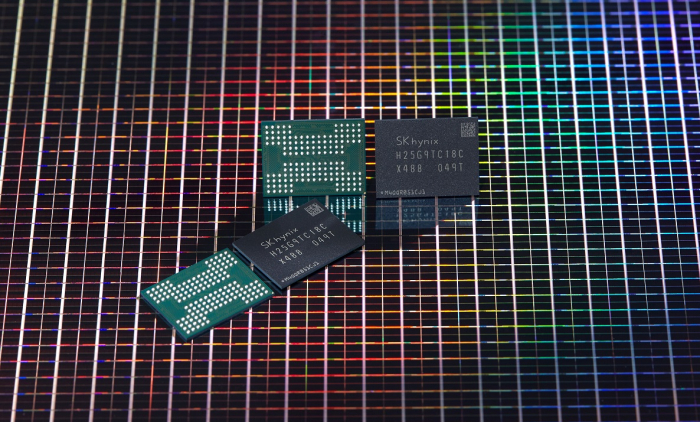

Korean chipmakers have yet to mass produce the highest-density NAND memory, although SK Hynix unveiled samples of its own 176-layer NAND chips in December.

In January of this year, Micron, the worldŌĆÖs fifth-largest NAND player, again embarrassed its bigger rivals by declaring it had begun producing fourth-generation 10-nanometer DRAM chips in large quantity ŌĆō also the worldŌĆÖs first.

Samsung and SK Hynix controlled a combined 71% of the worldŌĆÖs DRAM market and 45% of the NAND market as of the fourth quarter of 2020, but local analysts raised concerns that their grip on the two major types of memory chips could loosen with their technology edge narrowing faster than expected.

KOREAN PLAYERSŌĆÖ LOSING GRIP ON MEMORY LEADERSHIP

Samsung developed and mass produced the 96-layer V NAND chip in July 2018 and SK Hynix began volume production of 128-layer 4D NAND in June 2019. Just one and a half years later, Micron started mass production of 128-layer NAND chips.

Lee Jong-ho, an electrical and computer engineering professor at Seoul National University, said Korean chipmakers face difficulties extending frontiers.

ŌĆ£Being a leader is a blessing and a curse. As an industry leader, you have to keep overcoming new challenges to stay on top, while latecomers just follow in the footsteps of the trailblazers -- and this has become more noticeable of late,ŌĆØ he said.

Korean chipmakers have maintained their lead over rivals in cost competitiveness and facility investments, with Samsung's R&D spending in the trillion won range annually.

But recent data showed they are losing ground in cost competitiveness.

MicronŌĆÖs operating profit margin was hovering around 19.5% in 2019, below SamsungŌĆÖs 21.6%, but much higher than SK HynixŌĆÖs 10.1%.

In 2020, Samsung posted an operating profit margin of 25.8%, higher than most other competitors. SK HynixŌĆÖs profit margin was 15.7%, just 0.5 percentage point higher than that of Micron, signifying that there was hardly any gap in cost competitiveness between the two.

RACE AMONG NATIONS TO FOSTER CHIP INDUSTRY

The competition to stay ahead of rivals has become fiercer, not just among companies but also on the government level, as the US, China and some European countries back their chipmakers with generous subsidies and easier regulations.

According to the final report by the US National Security Commission on Artificial Intelligence (NSCAI) last week, the commission called for the need to invest heavily in the chip sector to win the technology competition with other countries.

Based on the report, the US Senate has been working on a bill to support its chip industry with a $30 billion package.

The European Union has also decided to raise chip production in the region to 20% of the global output by 2030 from the current 10% by injecting some 180 trillion won ($158 billion) until then.

European Commission President Ursula von der Leyen recently unveiled a vision for the EUŌĆÖs ŌĆ£Digital DecadeŌĆØ to transform Europe into a digital society by 2030.

Chinese Premier Li Keqiang has also vowed to raise the countryŌĆÖs semiconductor production significantly from the current 20% of its own supplies. China imported $350 billion worth of chips in 2020.

According to a report in June of 2020 by the Federation of Korean Industries, state subsidies for ChinaŌĆÖs Semiconductor Manufacturing International Corp. (SMIC) accounted for 6.6% of its annual sales between 2014 and 2018, while the comparable percentage for Micron of the US stood at 3.3%. Meanwhile, the Korean governmentŌĆÖs support for Samsung and SK Hynix accounted for a mere 0.8% and 0.5% of their sales, respectively, in the corresponding period.

ŌĆ£The foreign nationsŌĆÖ fostering of the semiconductor industry and major IT companiesŌĆÖ move to make chips for themselves will be a big risk factor for Korean chipmakers,ŌĆØ said Kyung Chong-min, an electrical engineering professor at KAIST, KoreaŌĆÖs national research university.

ŌĆ£The Korean government should also expand its state support for local chipmakers with a focus on creating a favorable chip ecosystem.ŌĆØ

Write to Jeong-Soo Hwang and Hyung-Suk Song at hjs@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Semiconductor shortagesQualcomm chip shortage may squeeze global smartphone production

Semiconductor shortagesQualcomm chip shortage may squeeze global smartphone productionMar 08, 2021 (Gmt+09:00)

3 Min read -

DRAM supercycleSigns of upcoming DRAM boom cycle loom large amid price uptrend

DRAM supercycleSigns of upcoming DRAM boom cycle loom large amid price uptrendFeb 25, 2021 (Gmt+09:00)

3 Min read -

Foundry ramp-upsSamsung Elec may advance start of leading-edge foundry line to July

Foundry ramp-upsSamsung Elec may advance start of leading-edge foundry line to JulyFeb 21, 2021 (Gmt+09:00)

3 Min read

Comment 0

LOG IN