Foreign stock sale

Shares of Samsung, Hynix subdued amid foreign selling spree

By Mar 11, 2021 (Gmt+09:00)

2

Min read

Most Read

CarlyleŌĆÖs Rubenstein sees commercial real estate undervalued

Infrastructure secondaries continue to rise amid inflation: Stafford

Goldman Sachs names Choi Seoul office chief

Golf equipment maker Taylormade to refinance $222 mn of debt

NPS' former key players move to law firms as its voting power increases

Foreign investors, the dominant players on the Korean bourse, are dumping leading chipmakers such Samsung Electronics Co. and SK Hynix Inc., keeping the main Kospi index from barely rising above the psychologically important 3,000 points.

They turned net sellers of the chipmakers this month, unloading shares of Samsung and Hynix for the 10th straight session. Foreigners sold a net 870.8 billion won ($768 million) in Samsung shares in the first 10 days of March and sold a combined 572.5 billion won of Hynix shares in the same period.

But chip analysts say their selling spree is temporary and they are expected to return as buyers in coming months, given the upcoming boom cycle of the global semiconductor market.

ŌĆ£Their selling is nothing but a haircut, meaning that they are booking profits from recent gains as foreigners are temporarily withdrawing money from emerging markets due to the strength of the dollar,ŌĆØ said Chung Myoung-ji, a senior analyst at Samsung Securities.

ŌĆ£Korea has been one of the best performers among the emerging equities markets. ItŌĆÖs no wonder foreigners want to take profit from their investments in Korea.ŌĆØ

Shares of Samsung Electronics have shed 11% from this yearŌĆÖs highs, while SK Hynix has fallen about 10%.

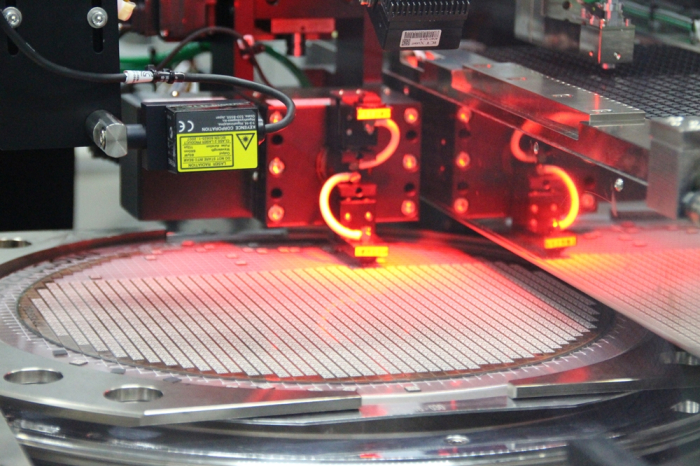

SAMSUNG STANDS TO BENEFIT FROM CHIP SHORTAGE

Stock traders said foreigners are also concerned about the supply and demand situation of major chips, especially after the brief business suspension of SamsungŌĆÖs chip plant in Austin, Texas, and the dire shortage of non-memory chips, which could disrupt the tech giantŌĆÖs smartphone shipments.

However, NH Investment & Securities analyst Doh Hyun-woo said Samsung has more to gain from industry shortages than it has to lose.

ŌĆ£Mobile chip shortages will prompt smartphone makers to compete for depleting supplies, pushing up chip prices. As a result of the short supply of late, foundry service prices have risen more than 15% while the price of power management integrated circuit (PMIC) chips has gained about 20%. Samsung stands to benefit from the situation,ŌĆØ he said.

Park You-ak, a Kiwoom Securities Co. analyst, said contract chip prices, which are currently lower than spot prices, will soon catch up in the second quarter, boding well for chipmakers.

Signs that the global DRAM market is entering a boom cycle are looming large with chip prices on an ascending trendline and major chipmakers spending generously to ramp up facilities.

Industry leaders such as┬ĀSamsung and┬ĀSK Hynix┬Āare┬Āalready running their plants at full capacity, but a shortage is increasingly becoming an issue as makers of cars, smartphones and electronic devices compete for chips amid depleting supplies.

ŌĆ£Software companies did well in terms of share price movements in 2020. This year, hardware companies will outperform as the chip industry has just entered an upcycle,ŌĆØ said Samsung SecuritiesŌĆÖ Chung.

Write to Jae-Yeon Ko at yeon@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Semiconductor shortagesMemory chip shortage may drive SSD price hike in Q2

Semiconductor shortagesMemory chip shortage may drive SSD price hike in Q2Mar 10, 2021 (Gmt+09:00)

2 Min read -

Semiconductor shortagesChip shortages spread to backend firms, disrupting supply chains

Semiconductor shortagesChip shortages spread to backend firms, disrupting supply chainsFeb 15, 2021 (Gmt+09:00)

2 Min read -

Foundry expansionSamsung mulls $17 billion Austin chip plant, seeks tax breaks

Foundry expansionSamsung mulls $17 billion Austin chip plant, seeks tax breaksFeb 05, 2021 (Gmt+09:00)

2 Min read -

Chip talent hiringSamsung hunts for top talent amid chip industry hiring war

Chip talent hiringSamsung hunts for top talent amid chip industry hiring warFeb 03, 2021 (Gmt+09:00)

3 Min read -

DRAM chip plantSK Hynix completes construction of its largest $3.14 bn chip plant

DRAM chip plantSK Hynix completes construction of its largest $3.14 bn chip plantFeb 01, 2021 (Gmt+09:00)

2 Min read

Comment 0

LOG IN