Image sensors

SK Hynix to unveil industryŌĆÖs smallest pixel image sensor, eyes $24.9 bn market

By Mar 04, 2021 (Gmt+09:00)

3

Min read

Most Read

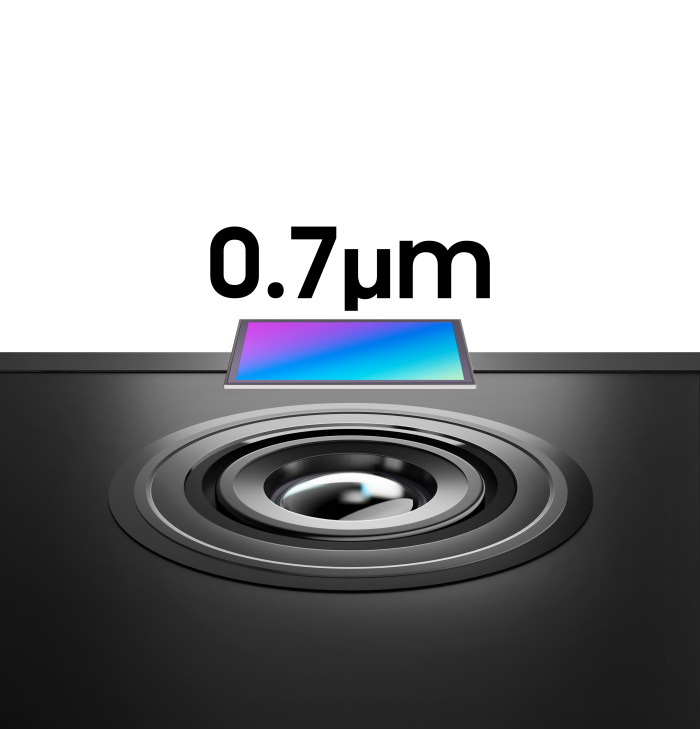

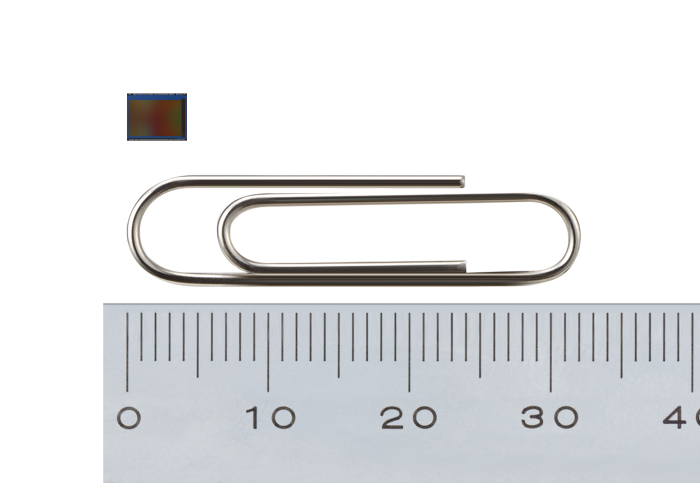

According to the semiconductor industry on Mar. 4, SK Hynix is developing a 0.7-micrometer 64-million-pixel image sensor for smartphones and plans to bring it to market by the end of 2021.

Currently, the 0.7-micrometer image sensor is the industryŌĆÖs smallest. Samsung Electronics Co. launched the product in September 2019.

Hynix also plans to unveil image sensors used in security cameras and bio equipment as the global image sensor market is forecast to grow at an annual average of 10% in the coming years.

ŌĆ£With a variety of products weŌĆÖre considering, our company aims to raise our presence in the global image sensor market,ŌĆØ said an SK Hynix official.

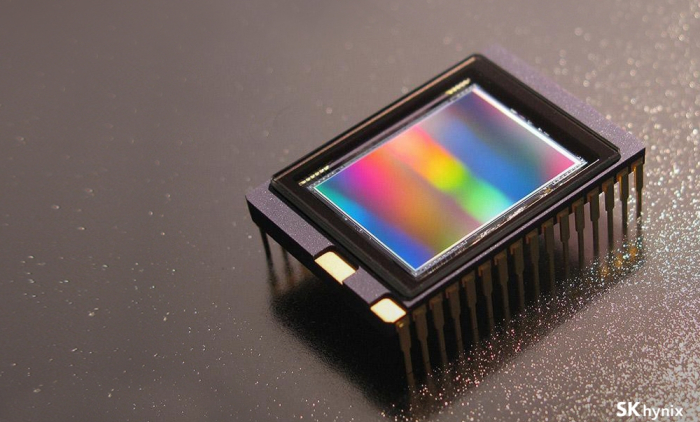

The most common CMOS (complementary metal-oxide-semiconductor) sensor, also known as an active pixel sensor, is an electronic chip that converts photons to electrons for digital processing. CMOS sensors create images in digital cameras of different kinds.

WIDENING APPLICATIONS OF IMAGE SENSORS

Rising demand for improved imaging solutions and increasing penetration of image sensors are driving the overall image sensor market, with its key applications spreading to other areas, including smartphones, self-driving cars and smart factories.

According to market researcher TSR, the CMOS image sensor market is expected to grow to $24.9 billion in 2024, from $17.9 billion in 2020.

Multiple companies have brought cutting-edge image sensors to the market recently, including┬ĀSony, Samsung and Toshiba. Sony is the dominant player with a market share of 45.1% as of 2020, followed by Samsung at 19.8%.

SK Hynix entered the premium image sensor market by unveiling 1.0-micrometer 20-million-pixel products under the Black Pearl brand in the second half of 2019.

Last year, it also developed 0.8-micrometer 48-million-pixel image sensors and began supplies to global smartphone makers.

SK Hynix is making image sensors at two of its semiconductor plants in Icheon, Gyeonggi Province ŌĆō its M10 chip plant, where the company uses 12-inch or 300-millimeter wafters, and its foundry affiliate SK Hynix System IC Inc., which uses 8-inch or 200-millimeter wafters.

HOT MEMORY DEMAND MAY LIMIT RAMP-UP OF IMAGE SENSORS

SK HynixŌĆÖs image sensor market share rose to an estimated 3.2% in 2020 from 2.6% the previous year. Its revenue from the business increased 33.6% to $582.2 million from $435.8 million in the same period.

Industry watchers say it may be difficult for the company to ramp up its image sensor capacity as the chipmaker is already running its facilities at full capacity to meet rising demand for its mainstay products -- DRAM and NAND flash memory.

ŌĆ£It may not be easy for us to switch our DRAM chip fabrication lines to boost production of image sensors. But weŌĆÖll make the right decision in accordance with the market situation,ŌĆØ said an SK Hynix executive.

A worldwide semiconductor shortage, which started with automotive chips, is getting worse, spreading to equipment makers and backend companies that assemble key components amid signs of economic recovery from the COVID-19 pandemic.

Write to Jeong-Soo Hwang at hjs@hankyung.com

In-Soo Nam edited this article.

More to Read

-

DRAM supercycleSigns of upcoming DRAM boom cycle loom large amid price uptrend

DRAM supercycleSigns of upcoming DRAM boom cycle loom large amid price uptrendFeb 25, 2021 (Gmt+09:00)

3 Min read -

Semiconductor shortagesChip shortages spread to backend firms, disrupting supply chains

Semiconductor shortagesChip shortages spread to backend firms, disrupting supply chainsFeb 15, 2021 (Gmt+09:00)

2 Min read -

Image sensorsSamsung Electronics to raise image sensor output to overtake Sony

Image sensorsSamsung Electronics to raise image sensor output to overtake SonyDec 09, 2020 (Gmt+09:00)

3 Min read -

Samsung narrows gaps fast with image sensor market leader Sony

Samsung narrows gaps fast with image sensor market leader SonyAug 04, 2020 (Gmt+09:00)

3 Min read

Comment 0

LOG IN