Private equity

S.Korean internet-only bank seeks to raise $540 mn; attracts global PE firms

By Feb 19, 2021 (Gmt+09:00)

2

Min read

Most Read

Samsung shifts to emergency mode with 6-day work week for executives

CJ CheilJedang to sell feed, livestock unit for $1.4 bn

Affinity to buy SK Rent-a-Car at $572 mn, more deals expected

Keppel REIT to sell Seoul-based prime office T Tower

Samsung Electronics' key M&A man returns; big deals in the offing

Potential investors have begun due diligence on K bank. The candidates include global private equity firms based in the US and Hong Kong, according to the investment banking industry on Feb. 19.┬Ā

The Korean internet-only bank is aiming to shortlist bidders as early as this month and wrap up the deal by the end of the first half of this year. Bank of America Merrill Lynch is the advisor.

For its fresh fundraising, K bank's biggest shareholder BC Card and other KT affiliates are likely to commit around a combined 200 billion won. The remaining amount will be raised from about four investors, which will each receive 100 billion won worth of new shares to acquire between a 5% to 10% stake.

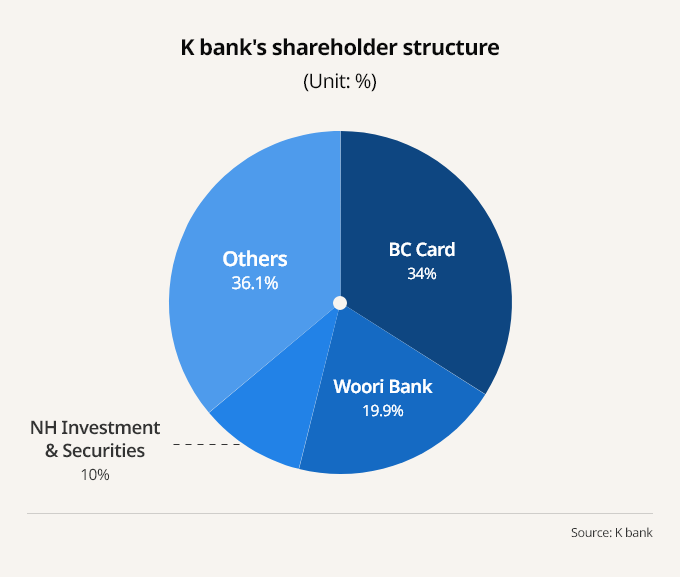

Currently, BC Card is the company's biggest shareholder with a 34% stake, followed by Woori Bank (19.9%) and NH Investment & Securities (10%).┬Ā

K bank's enterprise value is likely to hover around 1.4 trillion won ($1.3 billion), far below its competitor Kakao Bank Corp., which logged a valuation of near 9.3 trillion won and raised $920.5 million via rights offering last year. US-based TPG Capital and Hong Kong-based Anchor Equity Partners participated in Kakao Bank's fundraising.

Potential bidders are anticipating K bankŌĆÖs valuation to be reassessed once Kakao Bank makes a successful trading debut this year.

While K bank's fundraising looks promising on the surface, the bidders have looming concerns. The potential investors are requesting downside protection, such as call option or drag-along rights, but K bank has insisted on them purchasing common shares via a rights offering.

If K bank offers downside protection, the company could face backlash from its previous investors, Woori Bank and IMM Private Equity, which participated in a rights offering without any protection clause.

Bidders are also concerned that the wide gap between K bank and Kakao Bank may not be narrowed. Last year, Kakao Bank posted an earnings surprise with a net gain of 110 billion won ($99 million), posting a higher net interest margin than the country's four leading banks.

Meanwhile, K bank's net loss continues to grow ŌĆō while the company has expressed full confidence in swinging to profit this year, some bidders remain skeptical as a short-term turnaround may not be easy.

Write to Jun-ho Cha at chacha@hankyung.com

Danbee Lee edited this article.

More to Read

-

Banking & FinanceInternet-only K Bank to raise $1.05 bn in rights offering

Banking & FinanceInternet-only K Bank to raise $1.05 bn in rights offeringMay 21, 2021 (Gmt+09:00)

2 Min read

Comment 0

LOG IN