Fintech platforms

KoreaŌĆÖs InfoPLUS sees growth potential in VietnamŌĆÖs fintech platform

By Feb 17, 2021 (Gmt+09:00)

2

Min read

Most Read

Mirroring the other fast-growing economies in Southeast Asia, Vietnam is rapidly transitioning into a cashless society, with financial transactions being done digitally rather than with physical banknotes or coins.

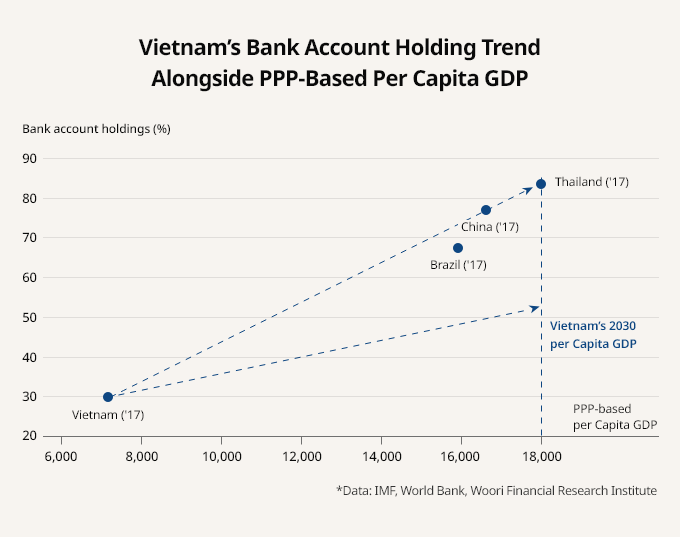

With the Vietnamese government vowing to slash the use of cash in transactions to 10% by 2025, nine out of every ten Vietnamese are forecast to have at least one personal bank account in 2030, signaling greater demand for online financial services.

For financial technology firms such as InfoPLUS Co. that provide digital services, the Southeast Asian country is a land of opportunity.

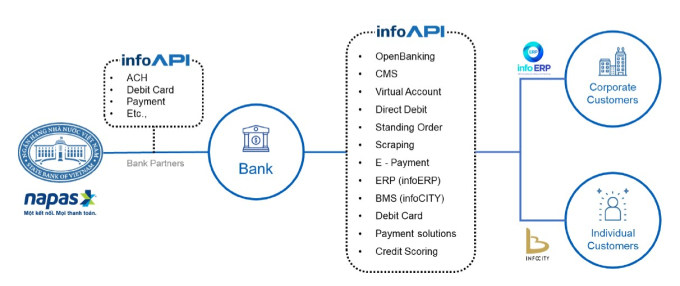

InfoPLUS, a South Korean fintech startup, began services in Vietnam in 2018, providing application programming interfaces (APIs) that financial companies use as building blocks for their digital services.

The Korean companyŌĆÖs APIs handle tasks such as scraping, extracting and collecting an individualŌĆÖs financial information scattered across different accounts, processing money transfers and other banking activities.

In Vietnam, InfoPLUS counts the country's state oil firm PetroVietnam and local branches of Korean banks including Woori Bank, Shinhan Bank and NongHyup Bank as its clients. Its largest source of revenue is the fees from the API services.

ŌĆ£We see some 2.4 million enterprises in Vietnam as our potential clients that can use our financial services,ŌĆØ said Chief Executive Kim Min-ho.

VERSED IN VIETNAM'S FINANCIAL INDUSTRY

Before launching the API services in 2018, CEO Kim and the companyŌĆÖs Chief Technology Officer Kim Jong-woo, who also serves as its co-head, worked at Woori BankŌĆÖs Vietnamese office for years with deep knowledge of the Asian countryŌĆÖs financial industry. Will Choi, who had experience of running a fintech business in Vietnam and Cambodia, later joined InfoPLUS as its chief strategy officer.

With 12 Korean employees and 44 local hires in Vietnam, InfoPLUS provides enterprise customers with a variety of fintech solutions already proven in the Korean financial market.

InfoPLUS said it aims to follow the successful trajectory of Galileo Financial Technologies Inc., a US fintech service operator that provides APIs to more than 20 US banks and financial organizations.

Fintech unicorn Social Finance Inc., better known as SoFi, acquired business partner Galileo Financial for $1.2 billion last year.

In January, InfoPLUS won the highest score during a startup pitching competition at D.Day, a venture firm demonstration event hosted by D.CAMP, KoreaŌĆÖs largest non-profit foundation for startups. The company won the top prize among the final five contenders chosen from 100 participating startups.

InfoPLUS is currently seeking investment through a pre-series A funding round to expand its fintech services in Vietnam beyond enterprises to peer-to-peer (P2P) lending that matches lenders with borrowers through online services.

Write to Ga-Yung Chu at gychu@hankyung.com

In-Soo Nam edited this article.

More to Read

-

-

Startup IPOsNaver-invested startups line up for IPOs; market seems welcome

Startup IPOsNaver-invested startups line up for IPOs; market seems welcomeJan 25, 2021 (Gmt+09:00)

2 Min read -

CES 2021K-startup products sweep CES 2021 innovation awards honors

CES 2021K-startup products sweep CES 2021 innovation awards honorsJan 11, 2021 (Gmt+09:00)

2 Min read -

-

StartupsStartup foundation D.CAMP generates $6 bn in economic value

StartupsStartup foundation D.CAMP generates $6 bn in economic valueJan 29, 2021 (Gmt+09:00)

2 Min read -

Urban mobilityAutonomous driving startup 42dot plans Level 4 self-driving in Seoul

Urban mobilityAutonomous driving startup 42dot plans Level 4 self-driving in SeoulDec 21, 2020 (Gmt+09:00)

1 Min read

Comment 0

LOG IN