IPOs

Controversy surrounds SK BioscienceŌĆÖs $1 bn IPO valuation ┬Ā

By Feb 09, 2021 (Gmt+09:00)

4

Min read

Most Read

S.Korea's LS Materials set to boost earnings ahead of IPO process

CarlyleŌĆÖs Rubenstein sees commercial real estate undervalued

Samsung Electronics' key M&A man returns; big deals in the offing

Money pours in for technology to reshape Korean restaurants

CJ CheilJedang to sell feed, livestock unit for $1.4 bn

The SK Group unit will price its shares in a band of 49,000 and 65,000 won ($44 and $58.3) apiece, valuing its entire company at up to 5 trillion won. In an initial public offering, it will float 22.95 million shares, including 15.3 million new issues, according to the company's regulatory filing on Feb. 5.

Its price band is higher than the affiliate SK Biopharmaceuticals Co.ŌĆÖs price range provided for its IPO that took place in July 2020, reflecting an almost 50% surge in the broader Kospi market during the period. SK Chemical owns 98% of the vaccine unit, founded in 2018.

The Korean vaccine company is expected to capitalize on investor enthusiasm for the bio industry, with retail investors flocking in droves to stock markets, pushing the benchmark index above the historically-important 3,000 point level.

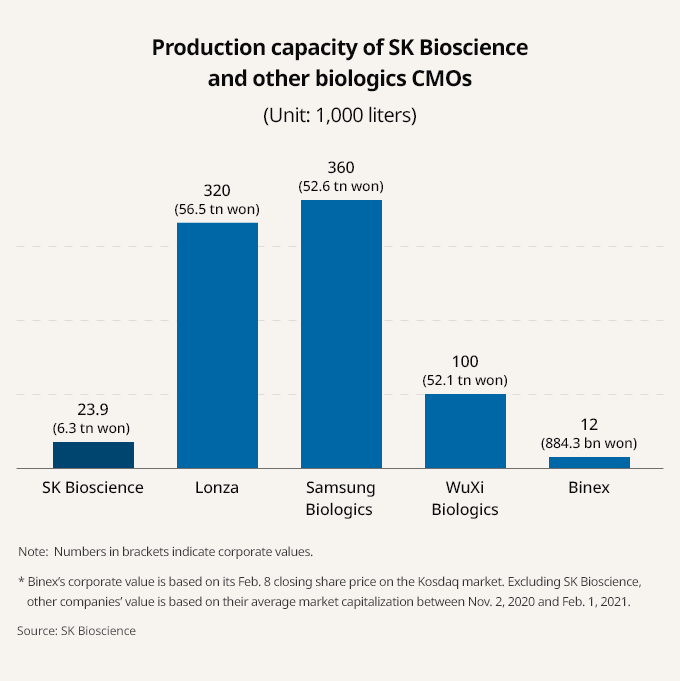

But its IPO valuation seems controversial. It compared its enterprise value (EV) only with antibody-based biologics contract manufacturing organizations (CMOs), including Switzerland-based Lonza.

SK Bioscience derived 64% of sales from vaccines, including its flagship product SKY Cellflu influenza vaccine in the first nine months of last year. Distribution of multinational companiesŌĆÖ vaccines, including Merck & Co.ŌĆÖs (MSD) RotaTeq vaccine, accounted for an additional 25% of its sales. RotaTeq is one of the few two rotavirus vaccines licensed for use in children.

ŌĆ£Antibody-based biologics CMOs have much higher operating profit margins that vaccine CMOs,ŌĆØ a CMO company head told The Korea Economic Daily. ŌĆ£The vaccine CMO business should be separated from the antibody-based biologics CMO industry.ŌĆØ

Some defend SK BioscienceŌĆÖs valuation, saying that the company has been producing AstraZenecaŌĆÖs COVID-19 vaccine since September 2020. SK Bioscience also inked a contract development and manufacturing (CDMO) order for a COVID-19 vaccine candidate developed by US-based Novavax Inc. last year.

ŌĆ£ItŌĆÖs been less than six months since it started the CMO business in full swing, but it compared its business only with CMO companies. ItŌĆÖs unprecedented,ŌĆØ said a pharmaceutical industry source.

The CMO orders for pandemic-related vaccines could be a one-off boost to the Korean company, he warned.

VALUATION BASED ON CAPACITY

Further, its EV is based on the reactor capacity used to culture cells, instead of sales and orders received. To get the EVs of the companies to which it was compared, SK Bioscience's IPO managers subtracted net borrowings from their three-month average market capitalization between Nov, 2, 2020 and Feb. 1, 2021. As for Lonza, its average market cap was multiplied by the proportion of its CMO business, or 72.3%, to calculate its EV.

Based on the capacity-based valuation method, Lonza was valued at 1.27; Samsung Biologics at 1.44; and ChinaŌĆÖs WuXi Biologics at 5.21. The three companiesŌĆÖ average multiple of 2.64 was multiplied by SK BioscienceŌĆÖs capacity of 23,924 liters to get the latterŌĆÖs EV of 6.32 trillion won.

To set the IPO price range, SK Bioscience applied the discount rate of 20.99% to 40.44% to the estimated EV, after subtracting its net borrowings.

If WuXi Biologics had been excluded from the sample companies, SK BioscienceŌĆÖs EV would have been cut to 1.9 trillion to 2.6 trillion won.

ŌĆ£WuXi Biologics has a dominant market share of 78.6% in China and has strength in CDMO. ItŌĆÖs strange to include the Chinese company in the list of the companies to compare with,ŌĆØ said another pharmaceutical industry source. ŌĆ£It may be because they wanted to add a high-value company.ŌĆØ

Back in 2016 when Samsung Biologics went public, the worldŌĆÖs largest CMO compared its business only with Lonza for its valuation.

Based on SKŌĆÖs valuation method, the market capitalization of Kosdaq-listed Binex Co. should have exceeded 3 trillion won, more than three times its current market cap of 884.3 billion won. Binex, a South Korean-based CMO company, holds around 12,000 liters of reactor capacity, about half of SK Bioscience's.

"The argument that sales will increase in proportion of the reactor capacity seems illogical,ŌĆØ said another CMO industry source. ŌĆ£The sales gap between the companies with a 1,000 liter reactor and a 5,000 liter reactor, for example, is not simply five times, but two to three times."

In response, SK said its valuation is based on comparisons with the three most influential CMO companies, excluding highly-valued ones.

"Lonza is running various businesses, so it has something in common with us,ŌĆØ said an SK Bioscience official.

In the first nine months of last year, SK Bioscience earned 23 billion won in net profit, up from 14.7 billion won for the whole year of 2019. Sales came to 158.6 billion won in the January-September period, compared with 183.9 billion won for all of 2019.

NH Investment & Securities is the IPO's lead manager.

Write to Woo-Sub Kim at duter@hankyung.com

Yeonhee Kim edited this article.

More to Read

-

IPOsSK Bioscience aims for March listing; enterprise value may reach $4.5 bn

IPOsSK Bioscience aims for March listing; enterprise value may reach $4.5 bnFeb 08, 2021 (Gmt+09:00)

3 Min read -

IPOsSK Bioscience begins listing process; enterprise value near $3 bn

IPOsSK Bioscience begins listing process; enterprise value near $3 bnDec 03, 2020 (Gmt+09:00)

2 Min read -

SK Bioscience wins COVID-19 vaccine manufacturing order from US firm

SK Bioscience wins COVID-19 vaccine manufacturing order from US firmAug 14, 2020 (Gmt+09:00)

2 Min read

Comment 0

LOG IN