Entertainment

K-content shares rise as OTTs bask in success of dramatized webtoons

By Jan 20, 2021 (Gmt+09:00)

3

Min read

Most Read

Samsung shifts to emergency mode with 6-day work week for executives

CJ CheilJedang to sell feed, livestock unit for $1.4 bn

Samsung Electronics' key M&A man returns; big deals in the offing

Affinity to buy SK Rent-a-Car at $572 mn, more deals expected

Keppel REIT to sell Seoul-based prime office T Tower

Korean content providers' shares are emerging as some of the best to buy as competition heats up among global over-the-top (OTT) services such as Netflix Inc. to release popular webtoon-turned Korean dramas on their platforms.

On the back of the growing popularity of K-content amid the COVID-19 lockdown, shares of content providers are posting decent gains as investors bet on industry expectations that they will generate a steady stream of revenue.

AStory Co., the Kosdaq-listed drama producer behind blockbuster zombie series Kingdom sponsored by Netflix, has risen more than 80% in the past month to trade at a record high level of 48,000 won on Jan. 20. Its market capitalization has risen beyond 400 billion won ($364 million).

Analysts say hopes of another blockbuster are boosting its shares, with the release of its next series Jirisan, starring Korean superstars Jeon Ji-hyun and Joo Ji-hoon, in the second half of 2021.

ŌĆ£Jirisan will be another tentpole drama for AStory; a major earner for the company as the video was sold to overseas OTTs other than Netflix with a cost recovery ratio of more than 70%,ŌĆØ said NH Investment & Securities analyst Lee Hwa-jung. ŌĆ£The sale proves AStoryŌĆÖs capability as a sales agent as well as a good content maker.ŌĆØ

According to market tracker FnGuide, market consensus for AStoryŌĆÖs 2021 operating profit has risen to 17.4 billion won from about 10 billion won three months earlier, as the company is expected to release at least one megahit series a year.

Shares of NEW, formerly known as Next Entertainment World, which produced the film Peninsula and webtoon-based supernatural drama Moving, have risen 27% so far this year.

In financial terms, the company is emerging from ŌĆ£a dark ageŌĆØ after posting an operating loss for three straight years since 2017 amid a lack of popular content and ChinaŌĆÖs ban on Korean dramas and music, according to Lee Byung-wha, a KB Securities analyst.

Among K-content, Korean drama series have enjoyed global popularity┬Āfor years on the back of the Korean wave, or hallyu, supported by the rise of OTT services.

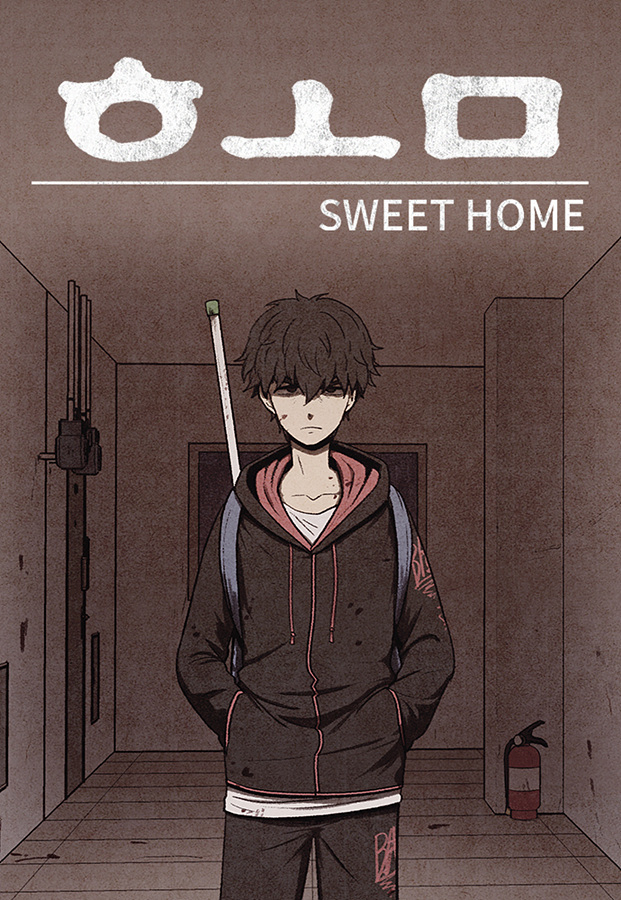

More recently, webtoon-based Korean TV series dramas like Sweet Home, The Uncanny Counter, and Itaewon Class are capturing the hearts of global K-drama fans.

Studio Dragon Corp., the drama-making wing of South Korean entertainment giant CJ ENM, has risen 15% so far this year from the end of 2020.

Its apocalyptic horror series Sweet Home, based on the webtoon of the same name, has been one of the most successful Netflix originals created in South Korea.

Shares of KidariStudio Inc. are trading up 3.8% at 15,200 won on late Wednesday after surging more than 20% the previous day. The stock has gained more than 55% this year.

DRAMATIZED WEBTOONS ON UPTREND

Analysts say the trend of dramatizing popular webtoons is growing as content providers are eager to get their hands on one-source multi-use (OSMU) content, which reduces spending while assuring profit by adapting successful webtoons into dramas.

In its bid to widen its presence in the global streaming video market, the company in November 2020 acquired Lezhin Entertainment, a Korean startup that features Lezhin Comics, an online comics service for mature readers.

ŌĆ£With the takeover, KidariStudio will be able to produce dramas based on webtoons that have already proven their popularity in overseas markets such as the US and Japan,ŌĆØ said Shinhan Investment Corp. analyst Cho Min-seo.

Shares of D&C Media Co. and Daewon Media Co. have risen 11% and 5.2%, respectively, on a rosy business outlook.

Daewon Media, whose Nintendo video game distribution business accounts for more than 70% of its revenue, is also involved in publishing webtoons through online platforms such as KakaoPage and Naver.

ŌĆ£DaewonŌĆÖs online business will be responsible for half of its total revenue this year, up from 25% in 2017. It should be rerated as an online content provider,ŌĆØ said Shinhan Investment Corp. analyst Yoon Chang-min.

According to Shinhan, DaewonŌĆÖs 12-month forward price-to-earnings ratio (PER) is 20 times, lower than the peer average of 38 times.

Write to Kyeong-je Han at hankyung@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Mergers & AcquisitionsNaver vs Kakao: Intense rivalry to extend beyond Asia

Mergers & AcquisitionsNaver vs Kakao: Intense rivalry to extend beyond AsiaMay 11, 2021 (Gmt+09:00)

3 Min read -

-

EntertainmentK-content companies set to rule 2021 stock market after breakneck growth

EntertainmentK-content companies set to rule 2021 stock market after breakneck growthDec 14, 2020 (Gmt+09:00)

3 Min read -

EntertainmentK-contentŌĆÖs ŌĆśunfamiliar familiarityŌĆÖ theme goes viral on global stage

EntertainmentK-contentŌĆÖs ŌĆśunfamiliar familiarityŌĆÖ theme goes viral on global stageNov 29, 2020 (Gmt+09:00)

5 Min read -

Naver, CJ ink $531 mn deal on entertainment content, logistics

Naver, CJ ink $531 mn deal on entertainment content, logisticsOct 27, 2020 (Gmt+09:00)

2 Min read -

Naver Webtoon becomes industry's first to post over $2.5 mn for daily paid-content

Naver Webtoon becomes industry's first to post over $2.5 mn for daily paid-contentAug 07, 2020 (Gmt+09:00)

2 Min read

Comment 0

LOG IN