M&As

Yogiyo sale gains steam as Baemin investors set for Q1 exit

By Jan 14, 2021 (Gmt+09:00)

3

Min read

Most Read

Samsung shifts to emergency mode with 6-day work week for executives

CJ CheilJedang to sell feed, livestock unit for $1.4 bn

Samsung Electronics' key M&A man returns; big deals in the offing

Affinity to buy SK Rent-a-Car at $572 mn, more deals expected

Keppel REIT to sell Seoul-based prime office T Tower

In December 2019, Germany-based online food delivery service Delivery Hero SE announced that it would acquire an 87% stake in Woowa Brothers Corp., the operator of Baemin, for $4 billion.

Delivery Hero recently informed Woowa's financial investors, including Hillhouse Capital Group, Altos Ventures, Goldman Sachs PIA and Naver, that the remaining payments and procedures will be completed within the first quarter, according to investment banking sources on Jan. 14.

Under the 2019 deal agreement, the Germany-based company will issue 40.1 million new shares of Delivery Hero and 1.7 billion euros in cash to the existing financial investors and the Woowa management, including Woowa Founder and Chief Executive Kim Bong-jin.┬Ā

At the time of the agreement, the share price of Delivery Hero stood at 47 euros ($57) apiece, but soared to 134 euros apiece as of Jan. 13, which puts Baemin's value at around 9.5 trillion won ($8.6 billion).

Financial investors that hold an 87% stake in Woowa will receive 1.7 billion euros in cash and 31.2 million in new shares from Delivery Hero. The share value will touch around 5.6 trillion won ($5.1 billion) based on the current exchange rate.

FINANCIAL INVESTORS NEED TO WAIT TO CASH OUT

But, key shareholders such as Hillhouse Capital, Altos, and Naver are under a lock-up agreement where they canŌĆÖt offload Delivery Hero shares from six months to a year, preventing them from cashing out. Some financial investors have expressed regret for not increasing their portion of new shares against the cash portion.

The 13% stake in Woowa held by its management, including CEO Kim, will be converted into Delivery Hero shares over the next four years. The management is expected to hold around a 3% to 4% stake in Delivery Hero, valued at around 1.1 trillion won ($1 billion) based on the two companies' enterprise value as of the end of 2019.┬Ā

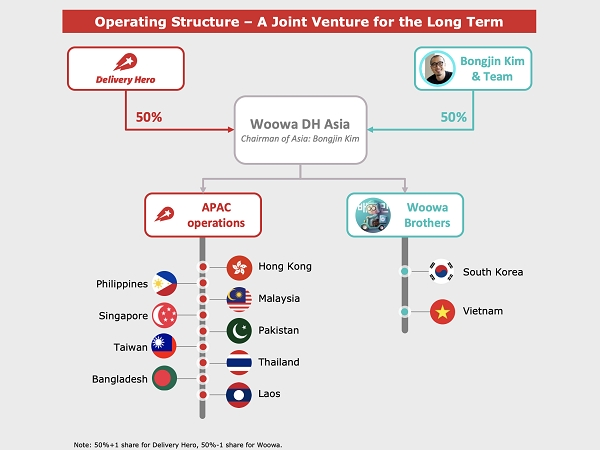

Woowa CEO Kim and the management will be subject to a four-year lock-up period wherein they cannot sell the allotted shares. Delivery Hero will also be able to confiscate management rights for the Southeast Asia-based joint venture, Woowa DH Asia, if CEO Kim resigns during this period. Kim will serve as the chairman of the board and the executive director of the JV.

Delivery Hero's share value is expected to fluctuate depending on its growth over the next three to four years.

Meanwhile, investment banks are eyeing the sale process of Yogiyo as Delivery Hero is in the final stage of discussions with the Korea Fair Trade Commission (KFTC) to discuss the scope of the sale and its conditions.

Last month, the KFTC issued conditional approval for┬ĀDelivery Hero's proposed acquisition of Baemin, requiring the Germany-based company to offload a 100% stake in Delivery Hero Korea, the operator of Yogiyo, by next June. Despite initial pushback, Delivery Hero has accepted the antitrust regulator's decision.

Once the discussions are finalized, Delivery Hero will begin sending out teaser letters to potential buyers for Yogiyo. It is understood that the company has already begun the process of mandating sale managers from a pool of investment banks.

Food industry players expect YogiyoŌĆÖs price tag to be around 2 trillion won ($1.8 billion), roughly half of BaeminŌĆÖs value. Much attention will be placed on who becomes Yogiyo's new owner.┬Ā

Write to Jun-ho Cha at chacha@hankyung.com

Danbee Lee edited this article.

More to Read

-

Fried chickensKoreaŌĆÖs fried chicken brands fly high on food delivery boom

Fried chickensKoreaŌĆÖs fried chicken brands fly high on food delivery boomDec 30, 2020 (Gmt+09:00)

3 Min read -

-

Merger reviewsDelivery Hero, Woowa $4 bn merger faces hiccup due to KFTC

Merger reviewsDelivery Hero, Woowa $4 bn merger faces hiccup due to KFTCNov 16, 2020 (Gmt+09:00)

3 Min read -

Goldman, GIC, Sequoia to exit from Korean food delivery app in $4 bn deal

Goldman, GIC, Sequoia to exit from Korean food delivery app in $4 bn dealDec 14, 2019 (Gmt+09:00)

2 Min read

Comment 0

LOG IN