Top court rules in favor of Doosan Infracore; sale to Hyundai to proceed

By Jan 14, 2021 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

The sale process for Doosan Infracore Co. is gaining traction after it won a legal dispute with financial investors over a case involving the top South Korean construction equipment maker’s Chinese subsidiary.

Korea’s Supreme Court on Jan. 14 ruled in favor of Doosan, saying the company does not have to return as much as 800 billion won ($728 million) in investment and accrued interest to financial investors, including Mirae Asset Private Equity, IMM PE and Hana Financial Investment PE.

In 2011, the excavator maker raised 380 billion won from financial investors through Doosan Infracore China Co. (DICC) based on a commitment to go public by April 2014. However, the company was unable to get listed due to poor market conditions.

The financial investors filed suit in a Korean court after they failed to exercise their drag-along rights to sell their stake in the company. The investors lost the case in a lower court but won the second ruling in a higher court.

Thursday’s ruling by the top court will clear the way for Doosan Group to sell its controlling stake in Doosan Infracore to Hyundai Heavy Industries Holdings Co.

In mid-December of 2020, a consortium led by Hyundai Heavy was named the preferred negotiator to buy a 36.07% stake in Doosan Infracore held by Doosan Heavy Industries & Construction Co.

If Doosan lost the legal case at the top court, it would have complicated Doosan’s planned sale to Hyundai Heavy as the group, struggling under growing debt, has promised to take care of all contingent liabilities arising from the litigation.

DOOSAN, HYUNDAI VOW TO FINALIZE DEAL

Now that the legal hurdle is removed, Doosan Group said it will proceed with its sale of Doosan Infracore as planned. A Hyundai Heavy official also said it will “do its best to work toward reaching a final deal.”

Analysts said financial investors who lost the case to Doosan Infracore may try to exercise their drag-along rights to sell their stake in the company, regardless of the top court’s final decision.

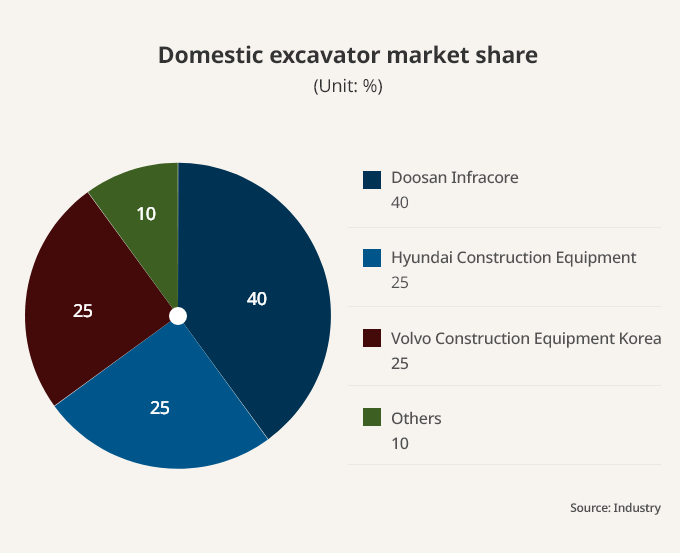

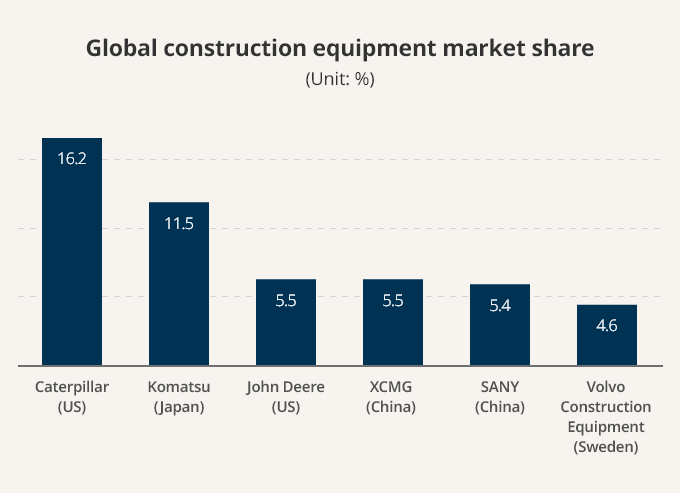

Hyundai Heavy, the world’s largest shipbuilder, has been eyeing Doosan Infracore from the beginning. If it acquires the company and merges with its affiliate Hyundai Construction, it would become one of the five leading companies in the global construction equipment market with a combined 4.5% market share.

Market watchers expect Doosan Infracore’s price tag to be in the 800 billion to 1 trillion won range, including a premium for management control.

Currently, the global construction machinery market is led by US-based Caterpillar and Japan-based Komatsu, which account for 16.2% and 11.5%, respectively, alongside US-based John Deere (5.5%), China-based XCMG (5.5%), and SANY (5.4%), and Sweden-based Volvo Construction Equipment (4.6%).

The stake sale in Doosan Infracore is part of Doosan Group's efforts to keep the debt-laden Doosan Heavy Industries afloat. The group pledged to raise 3 trillion won through the sale of core assets and capital increases in return for a 3.6 trillion won bailout from creditors.

Write to Man-Su Choe and Jeong Min Nam at bebop@hankyung.com

In-Soo Nam edited this article.

-

EarningsHD Hyundai’s machinery units post profits despite slump in China

EarningsHD Hyundai’s machinery units post profits despite slump in ChinaOct 30, 2022 (Gmt+09:00)

2 Min read -

Shipping & ShipbuildingHD Hyundai files complaint against EU's veto of DSME merger

Shipping & ShipbuildingHD Hyundai files complaint against EU's veto of DSME mergerMar 28, 2022 (Gmt+09:00)

4 Min read -

Shipping & ShipbuildingHyundai Heavy’s holding firm changes name to HD Hyundai

Shipping & ShipbuildingHyundai Heavy’s holding firm changes name to HD HyundaiFeb 24, 2022 (Gmt+09:00)

3 Min read -

MachineryDoosan Infracore to build 15,000 forklift engines for China’s Linde

MachineryDoosan Infracore to build 15,000 forklift engines for China’s LindeApr 19, 2021 (Gmt+09:00)

1 Min read -

Shipping & ShipbuildingKorean shipbuilders kick off 2021 with $1 bn container ship, LNG carrier orders

Shipping & ShipbuildingKorean shipbuilders kick off 2021 with $1 bn container ship, LNG carrier ordersJan 05, 2021 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsHyundai-Daewoo shipbuilding merger wins China approval, awaiting EU

Mergers & AcquisitionsHyundai-Daewoo shipbuilding merger wins China approval, awaiting EUDec 28, 2020 (Gmt+09:00)

3 Min read -

Shipping & ShipbuildingS.Korea maintains global lead in shipbuilding industry

Shipping & ShipbuildingS.Korea maintains global lead in shipbuilding industryDec 27, 2020 (Gmt+09:00)

3 Min read -

-

Mergers & AcquisitionsHyundai Heavy tapped for Doosan Infracore purchase

Mergers & AcquisitionsHyundai Heavy tapped for Doosan Infracore purchaseDec 10, 2020 (Gmt+09:00)

3 Min read