Sovereign wealth funds

KIC replaces alternative investment strategy, PE heads

By Dec 29, 2020 (Gmt+09:00)

1

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Korea Investment Corporation has appointed new heads of alternative investment strategy and private equity in a senior management reshuffle carried out last week.

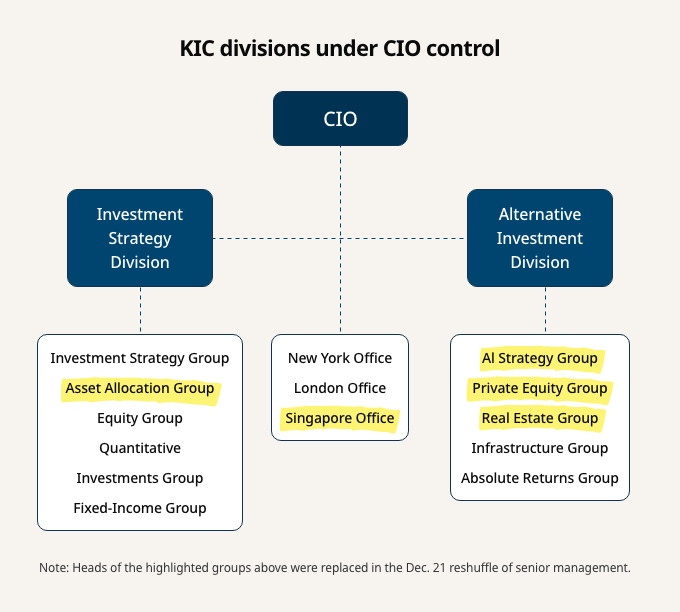

It was KIC’s first senior management shake-up since June, when the sovereign wealth fund reorganized its divisions and enhanced risk management, alongside the appointments of two deputy CIOs – James Jong-ho Kim and Hoon Lee. Kim took charge of the Alternative Investment Division and Lee the Investment Strategy Division.

As part of the reshuffle, the two deputy CIOs handed over their concurrent roles as private equity group head and asset allocation group head to concentrate on their respective jobs as Alternative Investment Division chief and Investment Strategy Division chief.

For the Alternative Investment Division led by James Jong-ho Kim, Park Jin-seong was named as alternative investment strategy group head and concurrently as head of the absolute returns group, KIC said in a statement on Dec. 21.

Huh Jea-young was appointed private equity group head and concurrently head of the real estate group on a temporary basis.

The current acting Singapore office head Lee Seung-kul is set to take over the role of real estate group head in the near future, according to a KIC source.

For the Investment Strategy Division, Lee Gun-ung has taken over the job of asset allocation group head.

“When KIC reshuffled its organization a half year ago, it had major division chiefs take additional roles as heads of some groups under their divisions,” said a financial industry source. “The recent reshuffle shows that its new management has settled in during the past half year.”

The following are other new appointments announced on Dec. 21.

* Singapore office head: Kim Ho-gyun

* Institutional relations group head: Lee Chang-ho

* Knowledge management group head: Kim Myung-jin (under COO)

* Ethics and compliance group head: Kwon Yong-sung

Write to Seon-Pyo Hong at rickey@hankyung.com

Yeonhee Kim edited this article.

More to Read

-

Real estateMirae Asset to be named Korea Post’s core real estate fund operator

Real estateMirae Asset to be named Korea Post’s core real estate fund operatorApr 29, 2025 (Gmt+09:00)

-

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concern

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concernApr 27, 2025 (Gmt+09:00)

-

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fund

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fundApr 23, 2025 (Gmt+09:00)

-

Real estateRitz-Carlton to return to Seoul, tapped by IGIS Asset for landmark project

Real estateRitz-Carlton to return to Seoul, tapped by IGIS Asset for landmark projectApr 22, 2025 (Gmt+09:00)

-

Real estateS.Korean gaming giant Netmarble eyes headquarters building sale

Real estateS.Korean gaming giant Netmarble eyes headquarters building saleApr 18, 2025 (Gmt+09:00)

Comment 0

LOG IN