Battery materials

POSCO Chem eyes No.1 spot in battery materials sector

By Dec 15, 2020 (Gmt+09:00)

3

Min read

Most Read

Samsung shifts to emergency mode with 6-day work week for executives

CJ CheilJedang to sell feed, livestock unit for $1.4 bn

Samsung Electronics' key M&A man returns; big deals in the offing

Affinity to buy SK Rent-a-Car at $572 mn, more deals expected

Keppel REIT to sell Seoul-based prime office T Tower

South Korean steelmaker POSCO launched in 1968 with a mission to aid the country's economic growth through its steel business. True to its intent, the company is credited for contributing to the rise in Korea's exports, becoming the world's fifth-largest steelmaker.

The company's focus on steel took a turn in 2017 when Choi Jeong-woo was appointed as the new chairman. He zeroed in on fresh growth drivers such as the battery materials business to accommodate Korean companies' shifting demand for materials.

As Korean companies emerged as prominent players in the electric vehicle battery market, POSCO stepped up as a supplier for battery materials. The steelmaker unveiled its goal of becoming the worldŌĆÖs top player in the global EV battery materials market by 2030 by establishing a value chain from raw material procurement to battery materials production.

At the center of this evolution stands POSCO's battery materials provider POSCO Chemical Co.

ŌĆ£Over the next 10 years, we are determined to claim the global No. 1 spot in the battery materials sector,ŌĆØ said Min Kyungzoon, the chief executive of POSCO Chemical, in an interview with The Korea Economic Daily on Dec. 14.

According to Min, POSCO Chemical aims to gain a 20% share of the global market by posting 23 trillion won ($21 billion) in sales by that time.

Min's confidence stems from knowing there is no clear leader yet in the battery materials sector.

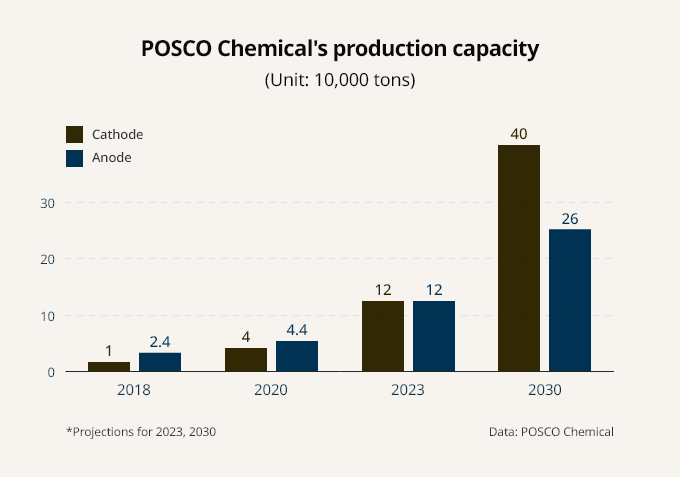

ŌĆ£We kicked off the battery materials operation just a few years ago, but weŌĆÖve already secured an annual cathode production capacity of 40,000 tons,ŌĆØ Min said, adding that it accounts for about 3% of the global market share.

POSCO Chemical plans to boost its cathode production capacity to 120,000 tons by 2023 and 400,000 tons by 2030.

Min says there is a solid lineup of buyers who will purchase materials as soon as they are available.

ŌĆ£ChinaŌĆÖs battery companies are competing for the lead with LG Energy Solution, but they are considerably behind in terms of technology,ŌĆØ he said.

He expects Korean companies to eventually dominate the global EV battery market, similar to the semiconductor industry. POSCO Chemical is a supplier of battery materials for LG Energy Solution.

ŌĆ£The manufacturing processes for battery materials and steel are quite similar,ŌĆØ said Min, noting the that the years of expertise and knowledge gained in the steelmaking business were put to good use.

ŌĆ£We have many metal materials experts in the company, and our intensive research and manufacturing experience give our battery materials business a huge advantageŌĆØ Min said.

POSCO BOOSTS MINE INVESTMENTS TO SECURE RAW MATERIALS

POSCO has been investing in mines worldwide to secure raw materials essential for rechargeable batteries.

CEO Min says that the mine developments will help boost POSCO ChemicalŌĆÖs competitiveness, procuring┬Āa stable volume of raw materials such as lithium, nickel and graphite.

Recently it was reported that Argentina-based Hombre Muerto Salt Lake, in which POSCO owns 22,800 hectares, holds lithium reserves of around 13.5 million tons, more than the initial estimate of 2.2 million tons. The latest estimate is enough for 370 million electric vehicles.

It will allow POSCO to mine 25,000 tons of lithium annually over the next 50 years instead of the presumed 20 years.

The company also plans to foray into developing graphite mines in Africa and Australia to diversify import sources of graphite, a key material used to make anodes.

The steelmaker, which currently imports 100% of its graphite needs from China, intends to lower its dependence on China to less than 50% over the medium to long term.

POSCO will also roll out a battery recycling business to extract raw materials such as nickel, lithium and cobalt from waste batteries.┬Ā

Backed by aggressive investments made to acquire raw materials, POSCO aims to secure 220,000 tons of lithium and 100,000 tons of nickel annually by 2030, Min said.

CEO Min also shared the company's long-term plans to cultivate experts in the battery materials industry and support them to become key leaders in KoreaŌĆÖs battery business.

According to Min, many companies are jumping into the battery business because of its lucrative future. "But it's not just about making money. We are driven by our mission to support KoreaŌĆÖs industrial ecosystem.ŌĆØ

Write to Jae-kwang Ahn and Man-su Choe at ahnjk@hankyung.com

Danbee Lee edited this article.

More to Read

-

EV battery materialsPOSCO Chem becomes supplier for GM-LG Energy Solution JV

EV battery materialsPOSCO Chem becomes supplier for GM-LG Energy Solution JVDec 09, 2020 (Gmt+09:00)

2 Min read -

Battery materialsPOSCO aims for top spot in EV battery materials market

Battery materialsPOSCO aims for top spot in EV battery materials marketDec 03, 2020 (Gmt+09:00)

2 Min read -

POSCO swings to Q3 operating profit vs Q2; steel demand on rise

POSCO swings to Q3 operating profit vs Q2; steel demand on riseOct 23, 2020 (Gmt+09:00)

2 Min read -

POSCO partners with ExxonMobil to target LNG storage tank materials market

POSCO partners with ExxonMobil to target LNG storage tank materials marketOct 07, 2020 (Gmt+09:00)

1 Min read

Comment 0

LOG IN