K-content

K-content companies set to rule 2021 stock market after breakneck growth

By Dec 14, 2020 (Gmt+09:00)

3

Min read

Most Read

Samsung shifts to emergency mode with 6-day work week for executives

CJ CheilJedang to sell feed, livestock unit for $1.4 bn

Samsung Electronics' key M&A man returns; big deals in the offing

Affinity to buy SK Rent-a-Car at $572 mn, more deals expected

Keppel REIT to sell Seoul-based prime office T Tower

Once considered just one of many Asian entertainment products, Korean dramas, games, music and webtoons ŌĆō collectively known as K-content ŌĆō have risen to prominence on the global stage.

Among the standout titles are Oscar-winning film Parasite, K-drama Crash Landing on You, boyband sensation BTS, girl group Blackpink and action role-playing game Dungeon Fighter, to name just a few.

On the back of the global popularity of K-content amid the COVID-19 lockdown, KoreaŌĆÖs entertainment companies saw their shares surge this year. Still, they havenŌĆÖt come close to peaking, as analysts say they are set to rule the stock market again in 2021 after a year of breakneck growth.

According to brokerages, KoreaŌĆÖs 21 major content providers listed on the Kospi and Kosdaq markets posted a combined market capitalization of 60.57 trillion won ($55.42 billion) as of Dec. 11. ThatŌĆÖs up 70% from the end of 2019.

Their total share prices are just behind the 63 trillion won in combined market cap of shipbuilders and steelmakers, KoreaŌĆÖs two mainstay industries.

The content providersŌĆÖ stellar performance this year was led by the countryŌĆÖs three entertainment giants ŌĆō SM Entertainment Co., YG Entertainment Inc. and JYP Entertainment Inc. ŌĆō as well as the initial public offerings of Kakao Games Corp. and Big Hit Entertainment Co., the label behind global sensation BTS.

JYPŌĆÖs shares surged 60% after the agency formed rookie Japanese girl group NiziU, who topped JapanŌĆÖs Oricon music chart with their debut album, "Step and a step."

The gaming industry also strengthened, with shares of NCSoft Corp., a Korean video game developer, rising 65% and other game companies posting similar gains.

MORE K-CONTENT PROVIDERS SET TO GO PUBLIC

Stock market analysts expect K-content companiesŌĆÖ combined market cap to top 100 trillion won with sales hovering around 30 trillion won as early as 2021, when Krafton Inc., the label behind the international hit game PlayerUnknownŌĆÖs Battlegrounds (PUBG), and video game developer Smilegate Co. are set to go public.

Other companies expected to list their shares on the Korean bourses include Kakao Page, MOBIRIX, RaemongRaein, COPUS Korea and GIANTSTEP.

ŌĆ£The Korean content industry has proven its global competitiveness in the pandemic era. K-content companies will continue to lead growth in the local stock market into next year,ŌĆØ said DS Asset Management Co. Chief Executive Wi Yoon-duk.

According to market consensus, the combined operating profit of the 21 content providers is forecast to reach 2.62 trillion won this year, up 37% from 1.91 trillion won in 2019. The companies are projected to post a combined operating profit of 3 trillion won on sales of 20 trillion won in 2021.

Among K-content, Korean dramas have enjoyed global popularity for years on the back of the Korean wave, or Hallyu, with the rise of over-the-top (OTT) services such as Netflix.

Thanks to the phenomenal growth of K-dramas and K-pop music, the boom in K-content has expanded into a fusion of traditional and modern music genres.

Analysts say K-content companies' stocks will be among the most favored in Korea next year, given their strong platforms and competitive intellectual property portfolios.

K-CONTENT TOP PICKS

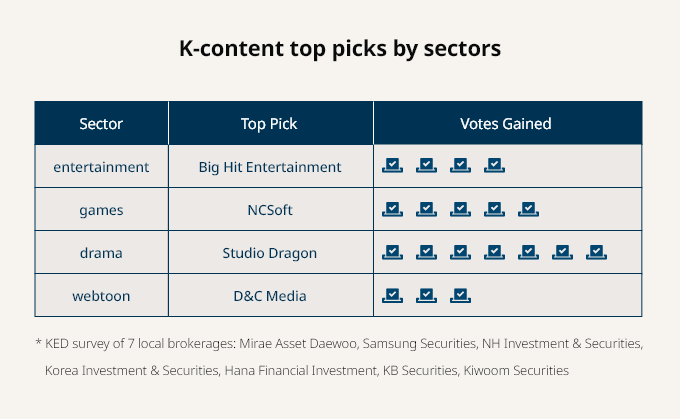

According to a recent survey of seven local brokerages by The Korea Economic Daily, Big Hit Entertainment, NCSoft Corp., Studio Dragon Corp., and D&C Media Co. were chosen as the top picks in their respective sectors.

Analysts, however, say that some Korean content providers are overvalued.

According to market tracker FnGuide, game software companies listed on the junior Kosdaq market, on average, have a price-to-earnings ratio (PER) of 52 times.

ŌĆ£K-content companies are expected to benefit from eased regulations in the Chinese market. But from an investor perspective, itŌĆÖs best to buy shares of companies that have a solid footing in the US market,ŌĆØ said Shinhan Investment Corp. analyst Hong Se-jong.

Write to Bum-Jin Chun at forward@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Mobile gamesS.Korean games, entertainment eye China return after 3-year ban

Mobile gamesS.Korean games, entertainment eye China return after 3-year banDec 04, 2020 (Gmt+09:00)

2 Min read

Comment 0

LOG IN