Hyundai Heavy tapped for Doosan Infracore purchase

Dec 10, 2020 (Gmt+09:00)

Samsung shifts to emergency mode with 6-day work week for executives

CJ CheilJedang to sell feed, livestock unit for $1.4 bn

Samsung Electronics' key M&A man returns; big deals in the offing

Affinity to buy SK Rent-a-Car at $572 mn, more deals expected

Keppel REIT to sell Seoul-based prime office T Tower

A few months after announcing plans to sell a 36.07% controlling stake, Doosan Infracore Co. has found its new home in the world's largest shipbuilder Hyundai Heavy Industries Holdings Co., according to Doosan officials on Dec. 10.

Doosan Group selected Hyundai Heavy as the preferred bidder and informed respective parties including creditors on Thursday morning. The deal is expected to wrap up by year-end after finalizing details, sources say.

The union between Hyundai Heavy's affiliate Hyundai Construction Equipment Co. and Doosan Infracore is set to create the worldŌĆÖs fifth-largest construction equipment player, pushing it to the No. 1 spot in South Korea.

Hyundai Heavy and its competitor, construction materials maker Eugene Group, were both strong contenders having each proposed near 800 billion won ($738 million) in the bid, according to sources familiar with the situation.

However, Hyundai Heavy was chosen for its fundraising ability, thanks to its consortium with the state-run Korea Development Bank (KDB) alongside its anticipated synergy with Doosan Infracore's construction equipment operations.

Doosan InfracoreŌĆÖs market cap stands at around 1.7 trillion won ($1.6 billion), putting the selling stake's value at around 600 billion won. Market watchers predicted the companyŌĆÖs price tag to be in the 800 billion to 1 trillion won range including a premium for management control. The actual selling price has not been disclosed, but it is estimated to be between 700 billion and 800 billion won.

Once the acquisition is finalized, Hyundai Heavy will secure Doosan InfracoreŌĆÖs manpower, research & development capabilities and patents alongside its global network. In particular, Hyundai Heavy is expected to speed up its market expansion backed by Doosan InfracoreŌĆÖs strong presence in the Chinese market.

Also, Doosan Infracore's robust excavator operations will enhance the competitiveness of Hyundai's excavator engine business, seen as a weak point for Hyundai Construction.

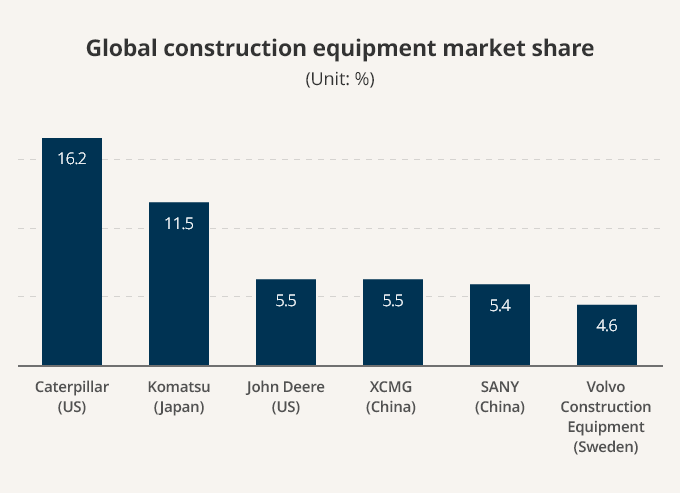

Hyundai Heavy has been eyeing Doosan Infracore from the beginning ŌĆö if it merges with the group's affiliate Hyundai Construction, it could become one of the five leading companies in the global construction equipment market with a combined 4.5% market share.

Currently, the global construction machinery market is led by US-based Caterpillar and Japan-based Komatsu, which account for 16.2% and 11.5%, alongside US-based John Deere (5.5%), China-based XCMG (5.5%), and SANY (5.4%), and Sweden-based Volvo Construction Equipment (4.6%).

The final hurdle will be receiving merger approval from the Korea Fair Trade Commission. Under the country's Monopoly Regulation and Fair Trade Act, a company is considered to have a market-dominant position if its market share exceeds 50%.

If Hyundai Heavy is selected as the preferred bidder, the combined market shares of Hyundai and Doosan Infracore are likely to exceed 60% in the domestic excavator market.

There is also uneasiness over a possible restructuring of the company as it is a union between the same industry peers.

Yet, concerns over potential monopoly have been dismissed by a Hyundai Heavy official who said that the construction equipment industry is a pure competition market in which prices are set by consumers.

ŌĆ£If the two companies merge and have a price competitiveness then itŌĆÖd be able to boost its footing in the global market alongside global players,ŌĆØ the official said.

The stake sale in Doosan Infracore is part of Doosan Group's efforts to keep the debt-laden Doosan Heavy Industries & Construction Co. afloat. The group pledged to raise 3 trillion won through the sale of core assets and paid-in capital increases in return for a 3.6 trillion won bailout from creditors.

By Jun-ho Cha and Sang-eun Lucia Lee┬Ā

chacha@hankyung.com

Danbee Lee edited this article.

-

-

Private equityAffinity to buy SK Rent-a-Car at $572 mn, more deals expected

Private equityAffinity to buy SK Rent-a-Car at $572 mn, more deals expectedApr 16, 2024 (Gmt+09:00)

-

-

Mergers & AcquisitionsSamsung Electronics' key M&A man returns; big deals in the offing

Mergers & AcquisitionsSamsung Electronics' key M&A man returns; big deals in the offingApr 12, 2024 (Gmt+09:00)

-

Mergers & AcquisitionsKorea's M&A market poised to bounce back after bleak Q1

Mergers & AcquisitionsKorea's M&A market poised to bounce back after bleak Q1Apr 11, 2024 (Gmt+09:00)