Exporters' currency woes

Korea Inc. braces for tough year as strong KRW kicks in

By Dec 07, 2020 (Gmt+09:00)

3

Min read

Most Read

Samsung shifts to emergency mode with 6-day work week for executives

CJ CheilJedang to sell feed, livestock unit for $1.4 bn

Samsung Electronics' key M&A man returns; big deals in the offing

Affinity to buy SK Rent-a-Car at $572 mn, more deals expected

Keppel REIT to sell Seoul-based prime office T Tower

South Korean exporters are bracing for a tough year with their profits poised to languish, hit by the strong won, amid expectations for a rebound in the global economy.

The countryŌĆÖs flagship manufacturers, including Samsung Electronics Co. and Hyundai Motor Co., are moving to adjust their forecasts for the wonŌĆÖs levels against the dollar and their export strategies accordingly, following the local currencyŌĆÖs advance in recent weeks.

If the wonŌĆÖs uptrend continues, analysts say it will deal a crushing blow to smaller firms, in particular, which account for a fifth of the countryŌĆÖs exports.

The won is currently hovering around a two-and-a-half year high versus the greenback on hopes for COVID-19 vaccines and US stimulus measures.

Many currency dealers expect the won to appreciate further to the immediate resistance level of 1,050 early next year, despite efforts by foreign exchange authorities to slow its gains.

KoreaŌĆÖs exports are widely expected to perform decently in 2021, due to a low base of comparison in 2020 and helped by a rebounding global economy, but a stronger won will prompt a swath of Korean firms to take belt-tightening steps to compensate for rising costs.

ŌĆ£Over the past three months, the local currency has gained 100 won per dollar, which could be likened to a 10% increase in product prices (in overseas markets),ŌĆØ said Bae Min-geun, a researcher at the┬ĀLG Economic Research Institute.

According to a survey of 967 exporters by the Korea International Trade Association on Sunday, the export business survey index (EBSI) for the first quarter of 2021 came in at 121.1, the highest level since the third quarter of 2017. The index reflects exporters' business outlook, with a reading above 100 meaning they expect improvement.

The Korea Institute for Industrial Economics & Trade (KIET) forecasts KoreaŌĆÖ exports to grow 11.2% in 2021 from this year.

ŌĆ£With the diminishing negative impact of the coronavirus, ChinaŌĆÖs economic recovery and stimulus measures by advanced countries will provide a tailwind for Korean exporters,ŌĆØ said the state-run research firm.

DIZZYING HEIGHTS

The strength of the won not only erodes Korean companiesŌĆÖ overseas earnings but lowers exporters' price-competitiveness. Given that exports account for half of KoreaŌĆÖs gross domestic product, its economy ŌĆō AsiaŌĆÖs fourth-largest ŌĆō is vulnerable to shifts in global exchange rates.

The wonŌĆÖs gains have accelerated even further since Joe BidenŌĆÖs US presidential election victory as his economic team is expected to push for a bolder stimulus package.

Hyundai Motor, KoreaŌĆÖs largest automaker, expects the wonŌĆÖs 5% appreciation against the dollar to slash its quarterly net profit by 44 billion won ($406 million).

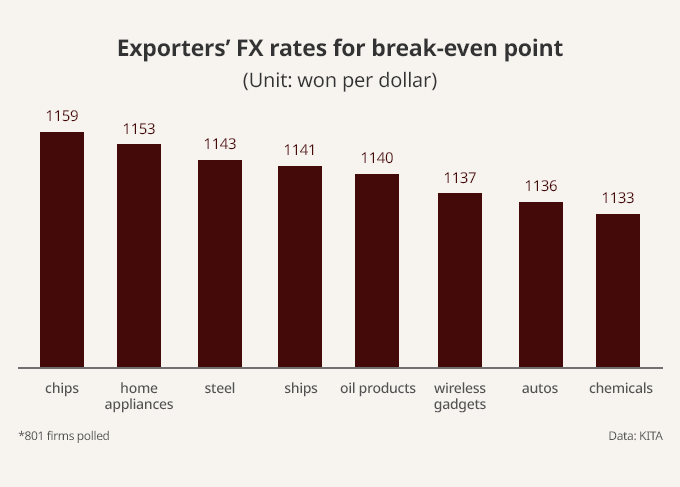

Many Korean exporters look at 1,167 won to the dollar as the ŌĆ£appropriateŌĆØ exchange rate to maintain their price competitiveness and 1,133 won as the breakeven point.

CONTINGENCY PLANS UNDERWAY

Local companies are working out contingency plans under scenarios of different foreign exchange levels.

Samsung Electronics, for example, is known to be paying for transactions with global business partners in the currencies of the corresponding countries to avert conversion losses.

Small and medium-sized companies are especially vulnerable to volatile foreign exchanges.

According to a survey of 308 smaller firms by the Korea Federation of SMEs in November, more than half the respondents said a 10% increase in the value of the won results in a 7 percentage-point decline in their profits.

The federation views 1,181 won per dollar as the appropriate level for SMEs and 1,118 won as their breakeven point.

ŌĆ£The pace of the wonŌĆÖs gains in recent weeks is too fast for SMEs to adjust themselves. Currency risk is emerging as their biggest uncertainty, following the coronavirus,ŌĆØ said Noh Min-sun, a researcher at the Korea Small Business Institute.

ŌĆ£SMEs account for 20% of KoreaŌĆÖs exports. The government needs to work out comprehensive measures for SMEs to counter the wonŌĆÖs strength and rising oil prices.ŌĆØ

Write to Il-Gue Kim and Dae-Kyu Ahn at black0419@hankyung.com

In-Soo Nam edited this article.

More to Read

Comment 0

LOG IN