Economic growth

BOK raises growth view as it holds rate, warns against V-shaped recovery

By Nov 26, 2020 (Gmt+09:00)

2

Min read

Most Read

Samsung shifts to emergency mode with 6-day work week for executives

CJ CheilJedang to sell feed, livestock unit for $1.4 bn

Samsung Electronics' key M&A man returns; big deals in the offing

Affinity to buy SK Rent-a-Car at $572 mn, more deals expected

Keppel REIT to sell Seoul-based prime office T Tower

The Bank of Korea has raised its growth forecast for this year and next, citing advances in vaccine development and a rebound in exports, after keeping its policy rate unchanged at a record low 0.5%.

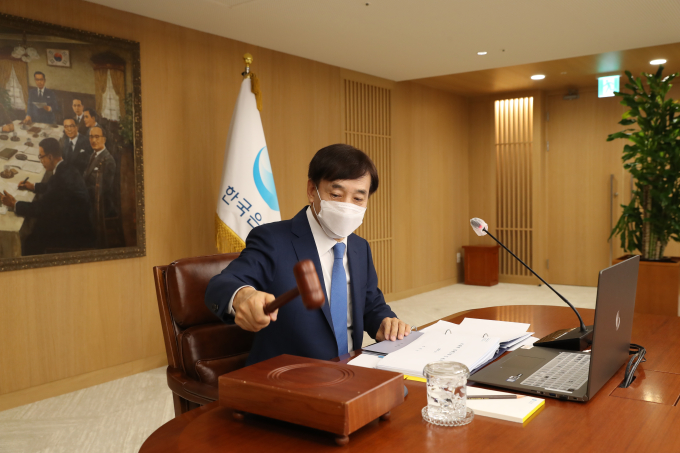

Following the unanimous decision to keep the benchmark rate steady at this yearŌĆÖs final rate review on Nov. 26, BOK Gov. Lee Ju-yeol said there will be no change in the central bankŌĆÖs monetary stance for the time being.

ŌĆ£The worst is over with the local economy hitting the bottom in the second quarter. But given the rapid respread of the coronavirus, itŌĆÖs hard to say the economy has entered a phase of significant growth,ŌĆØ the governor said during an online press briefing.

The Korean economy, AsiaŌĆÖs fourth largest, showed some signs of a recovery in exports and consumer spending, but there are concerns about rising household debt fueled by lower borrowing costs, he said.

Following ThursdayŌĆÖs rate decision, the BOK said it now expects the countryŌĆÖs gross domestic product to shrink at a less severe rate of 1.1% this year. In August, it projected a 1.3% contraction, citing the COVID-19 pandemic.

The central bank has also raised its 2021 growth outlook to 3% from its August estimate of 2.8%. For 2022, the bank expects the economy to grow 2.5%.

NO LIGHT AT END OF TUNNEL YET

The local economy recently gained traction with exports returning to growth for the first time in seven months in September.

In its economic outlook unveiled on Thursday, the BOK forecast the countryŌĆÖs exports will shrink 1.6% this year ŌĆō a milder decline compared to its August projection of a 4.5% fall.

The central bank expects export growth to return in 2021, with an estimated increase of 5.3%, compared with its August forecast of a 4.8% rise, on the back of robust sales of semiconductors and IT products. If realized, that will mark the fastest growth since 2011.

But the BOK said local consumption will shrink at a faster pace of 4.3% this year before rising 3.1% in 2021. In August, it predicted a 3.9% fall in domestic consumption this year and an increase of 3.8% in 2021.

CORONAVIRUS RESURGENCE┬Ā

The latest rate decision and revised growth forecast came amid concerns over the resurgence of the pandemic as new infection cases are rising at a faster-than-expected pace. On Thursday, the country reported 583 new coronavirus cases, the highest since early March, when the nation was grappling with the first wave of virus infections.

ŌĆ£The economic impact of the third wave of infections now will be greater than it was in August,ŌĆØ Lee said.

Analysts expect the BOK to stand pat on its policy rate throughout 2021 to balance growth with financial stability risks rising from household debt and higher property prices.

KoreaŌĆÖs┬Āhousehold debt to GDP ratio reached 100.6%, exceeding the 100% mark for the first time, according to the Institute of International Finance.

Industry experts say that Korea's soaring household debt is owing to increasing demand for housing loans, mortgages and business loans.

Write to Ik-Hwan Kim at lovepen@hankyung.com

In-Soo Nam edited this article.

More to Read

-

-

-

Foreign exchangeKorean won at 17-month low on Middle East woes, Fed rate view

Foreign exchangeKorean won at 17-month low on Middle East woes, Fed rate viewApr 16, 2024 (Gmt+09:00)

-

-

Comment 0

LOG IN