Fund inflows

Global funds flow into S.Korea as investors look to life after COVID-19

By Nov 25, 2020 (Gmt+09:00)

2

Min read

Most Read

Samsung shifts to emergency mode with 6-day work week for executives

Alibaba eyes 1st investment in Korean e-commerce platform

Blackstone signs over $1 bn deal with MBK for 1st exit in Korea

NPS loses $1.2 bn in local stocks in Q1 on weak battery shares

OCI to invest up to $1.5 bn in MalaysiaŌĆÖs polysilicon plant

An increasing amount of global funds are flowing into South Korea as advances in COVID-19 vaccine development and a weaker dollar boost investorsŌĆÖ risk appetite.

Analysts say a record amount of funds flowed into emerging markets, including Korea, in recent weeks as money managers look to life after the pandemic, betting on a big rebound in emerging economies.

The iShares MSCI South Korea ETF, operated by BlackRock Investment Institute, has seen a total of $162 million flow into Korean equities for four straight days since Nov. 18. The accumulated amount so far this year has reached $219 million.

The ETF tracks the performance of the MSCI Korea 25-50 USD Index. The fund holds companies of all market caps, which are primarily traded on the Korea Exchange.

Such foreign passive funds tracking the major players on the Korean bourse have pushed the benchmark Kospi index to record-high levels. On Wednesday, Korean stocks ended a five-day winning streak after hitting an all-time high of 2,617.76 the previous day.

Foreign investors bought Korean shares for the 15 consecutive days before selling a net 135 billion won on Wednesday.

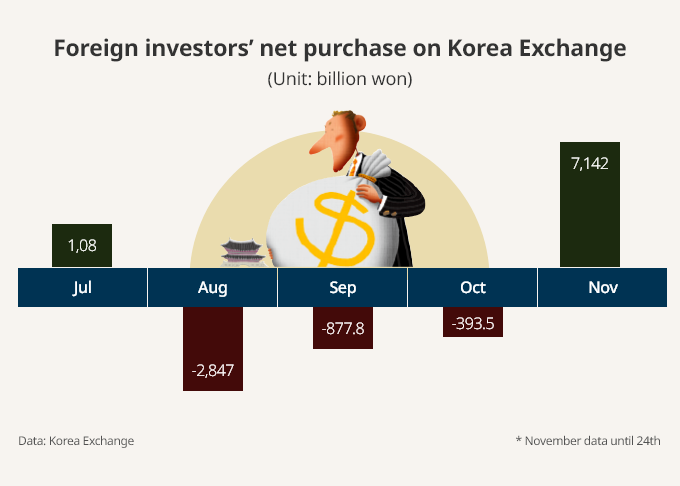

Foreigners bought a net 7.14 trillion won in shares on the Korean market so far this month, and if this trend continues the amount of foreign net purchases should hit a record monthly high in November, surpassing the previous record-high of 7.64 trillion won in September 2013.

Positive developments for vaccines in recent weeks have investors preparing for life after the pandemic, boosting their risk appetite even amid signs of rising coronavirus infections across the world.

OVERWEIGHT FOR EMERGING MARKETS EX-JAPAN

Earlier this month, BlackRock raised its investment ratings on emerging markets, excluding Japan, to overweight from neutral.

The Wall Street Journal reported on Monday that global investors channeled $10.8 billion into funds that invest in emerging-market stocks and bonds, according to research from Bank of America and EPFR data, a sum the bank said was the highest ever.

The largest net purchases by foreign investors included Indian and South Korean equities, as well as Mexican government debt, according to data from Capital Economics.

The downward trend of the dollar versus emerging market currencies, including the Korean won, is also behind the heavy fund inflow into Korea and other Asian markets.

The greenback has been falling for several weeks, as the Federal Reserve is expected to continue to flood the market with dollars to support the US economy.

The iShares Core MSCI Emerging Markets ETF has attracted $817 million this month, indicating more equity investments lined up for Asian markets.

ŌĆ£ThatŌĆÖs a significant net fund inflow for the first time in 10 months,ŌĆØ said SK Securities analyst Kim Soo-jung.

Write to Ji-Yeon Sul at sjy@hankyung.com

In-Soo Nam edited this article.

More to Read

-

-

Korean stock marketHD Hyundai Electric likely to join MSCI Korea: Samsung Securities

Korean stock marketHD Hyundai Electric likely to join MSCI Korea: Samsung SecuritiesApr 19, 2024 (Gmt+09:00)

-

EconomyIn Korean food prices, everythingŌĆÖs up: Now itŌĆÖs dried seaweed's turn

EconomyIn Korean food prices, everythingŌĆÖs up: Now itŌĆÖs dried seaweed's turnApr 18, 2024 (Gmt+09:00)

-

Foreign exchangeKorean won at 17-month low on Middle East woes, Fed rate view

Foreign exchangeKorean won at 17-month low on Middle East woes, Fed rate viewApr 16, 2024 (Gmt+09:00)

-

Comment 0

LOG IN