Korean brokerage firms sitting on $7 bn in overseas properties yet to sell down

By Oct 06, 2020 (Gmt+09:00)

Samsung steps up AR race with advanced microdisplay for smart glasses

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Seoul-backed K-beauty brands set to make global mark

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

They made the bulk of the investments through mezzanine and equity tranches, signaling a higher risk of principal loss than senior lenders. As vacancy rates in office and commercial spaces rose sharply following the coronavirus outbreak, declining office building prices have made it more difficult to sell down the properties.

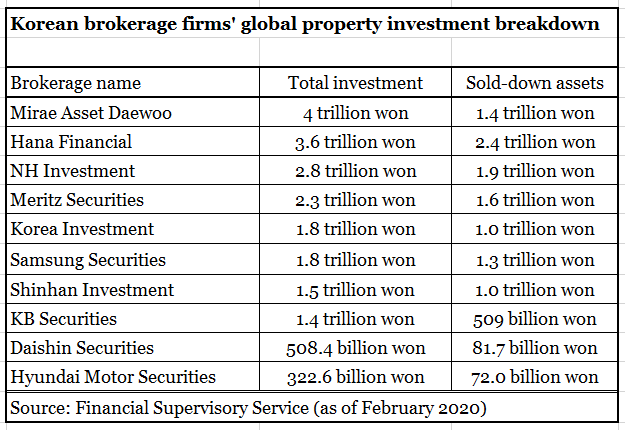

Between January 2017 and February 2020, a total of 20 Korean brokerage firms invested in 418 overseas property deals worth a combined 23.1 trillion won ($20 billion), according to internal documents from the regulatory Financial Supervisory Service (FSS) obtained by Chun Jae-soo of the ruling Democratic Party.

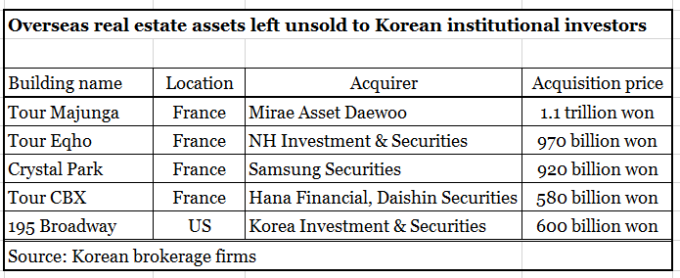

Of these, 9 trillion won ($7.8 billion) worth of investments have not yet to be sold down to institutional investors. The brokerage houses are estimated to have booked 1 trillion-2 trillion won as equity investments, or put part of them into real estate investment trusts available for retail investors.

The remaining 7 trillion-8 trillion won of real estate assets are now classified as unsold assets, about six times the amount previously projected by credit rating agencies and the brokerage sector.

The FSS began compiling data on brokerage firms' global property investments in May of this year, and this marks the first time the results are published.

Meanwhile, brokerage firms, including Samsung Securities and Meritz Securities, dismissed such concerns. They saw little difficulty in completing the resale of the properties, which they said were prime assets easy to sell back.

Meritz Securities said its overseas property investments were focused on senior secured loans that rank ahead of junior debt and equity tranches when they seek to recover money.

In the case of Mirae Asset Daewoo, of the 2.5 trillion won worth of assets it has yet to sell down, some 1.5 trillion won of investments were classified as its own equity investments, which it does not need to sell down in the short term.

NH Investment said that of the 900 billion won worth of assets left unsold, it booked 500 billion won as long-term equity investments. Further, the brokerage unit of the national agricultural cooperative had tried to include part of the unsold investments -- 30 billion won in Tour Eqho, 20 billion won in 195 Broadway and 20 billion won in the OP Financial Group headquarters in Helsinki, Finland -- to NH Prime REIT. But it withdrew the plan due to opposition from REIT shareholders.

Write to Eui-Myung Park at uimyung@hankyung.com

-

Mergers & AcquisitionsMubadala, Goldman Sachs to invest $700 mn in Kakao Mobility

Mergers & AcquisitionsMubadala, Goldman Sachs to invest $700 mn in Kakao MobilityMay 09, 2025 (Gmt+09:00)

-

Debt financingKorea Securities Finance eyes its 1st foreign bond sale in 2026

Debt financingKorea Securities Finance eyes its 1st foreign bond sale in 2026May 09, 2025 (Gmt+09:00)

-

Mergers & AcquisitionsKorea’s top cinema chains seek merger to counter box office slump

Mergers & AcquisitionsKorea’s top cinema chains seek merger to counter box office slumpMay 08, 2025 (Gmt+09:00)

-

Mergers & AcquisitionsSoon for sale: Altos Ventures-backed Cafe Knotted operator

Mergers & AcquisitionsSoon for sale: Altos Ventures-backed Cafe Knotted operatorMay 07, 2025 (Gmt+09:00)

-

Mergers & AcquisitionsHarman acquires Masimo’s audio arm in Samsung’s car audio push

Mergers & AcquisitionsHarman acquires Masimo’s audio arm in Samsung’s car audio pushMay 07, 2025 (Gmt+09:00)