Alternative investment

KTCU bumps up global PE investment by 90% since end-2018

By Sep 08, 2020 (Gmt+09:00)

1

Min read

Most Read

Samsung shifts to emergency mode with 6-day work week for executives

CJ CheilJedang to sell feed, livestock unit for $1.4 bn

Samsung Electronics' key M&A man returns; big deals in the offing

Affinity to buy SK Rent-a-Car at $572 mn, more deals expected

Keppel REIT to sell Seoul-based prime office T Tower

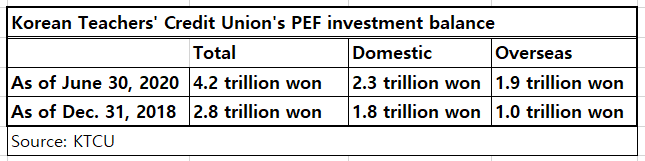

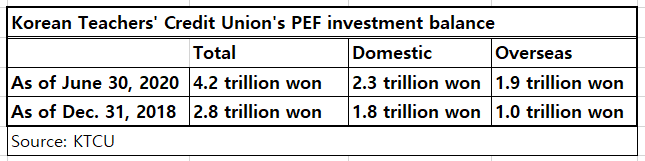

The Korean TeachersŌĆÖ Credit Union (KTCU) has pushed up overseas private equity investments by 90% to 1.9 trillion won ($1.6 billion) over the past one and a half years, at a faster pace than the growth in domestic private equity investment during the same period.

Between the end of 2018 and the end of June 2020, the retirement fund boosted the balance of its PE investments by 1.4 trillion won, of which the global portfolio accounted for 900 billion won, KTCU said on Sept. 8.

It has ramped up┬Āoverseas PE investments since launching the PEF-focused corporate finance division in 2018.

ŌĆ£We have been meeting capital calls from blind-pool funds since 2018, which has sharply boosted the balance of our overseas PE investment,ŌĆØ said an KTCU source. ŌĆ£We have been investing in PEFs focused on developed markets such as North America, Europe and Australia for safe returns.ŌĆØ

In the first half of this year, KTCU posted an average investment return of 5.4%, slightly below the 6.3% a year earlier. But its first-half results still outperformed those of other Korean pension funds, including the National Pension Service's.

ŌĆ£Thanks to diversification into various investment sectors and a larger number of global management companies, we were able to secure solid returns from PEF investments. We will continue to increase investment in PEFs,ŌĆØ said the KTCU source.

Write to Seon-pyo Hong at rickey@hankyung.com

Between the end of 2018 and the end of June 2020, the retirement fund boosted the balance of its PE investments by 1.4 trillion won, of which the global portfolio accounted for 900 billion won, KTCU said on Sept. 8.

It has ramped up┬Āoverseas PE investments since launching the PEF-focused corporate finance division in 2018.

ŌĆ£We have been meeting capital calls from blind-pool funds since 2018, which has sharply boosted the balance of our overseas PE investment,ŌĆØ said an KTCU source. ŌĆ£We have been investing in PEFs focused on developed markets such as North America, Europe and Australia for safe returns.ŌĆØ

In the first half of this year, KTCU posted an average investment return of 5.4%, slightly below the 6.3% a year earlier. But its first-half results still outperformed those of other Korean pension funds, including the National Pension Service's.

ŌĆ£Thanks to diversification into various investment sectors and a larger number of global management companies, we were able to secure solid returns from PEF investments. We will continue to increase investment in PEFs,ŌĆØ said the KTCU source.

Write to Seon-pyo Hong at rickey@hankyung.com

Yeonhee Kim edited this article

More to Read

-

-

-

Private equityPrivate markets open to more high-net-worth individuals: Hamilton Lane

Private equityPrivate markets open to more high-net-worth individuals: Hamilton LaneApr 16, 2024 (Gmt+09:00)

-

InfrastructureInfrastructure secondaries continue to rise amid inflation: Stafford

InfrastructureInfrastructure secondaries continue to rise amid inflation: StaffordApr 09, 2024 (Gmt+09:00)

-

Private equityCarlyleŌĆÖs Rubenstein sees commercial real estate undervalued

Private equityCarlyleŌĆÖs Rubenstein sees commercial real estate undervaluedApr 08, 2024 (Gmt+09:00)

Comment 0

LOG IN