k-webtoon

How Korean platform giants disrupted the digital comics market with webtoons

By Aug 20, 2020 (Gmt+09:00)

5

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korean webtoons (mobile and digital comics) are taking over the digital comics markets in Japan and the US. Market watchers claim it is the unique webtoon genre driving Korean digital platforms to global success -- but insiders say otherwise.

“Webtoons, indeed, sync well with digital platforms but their success was more than just getting lucky with the genre. There were tremendous efforts made,” said Kim Jae-yong, head of Kakao Japan.

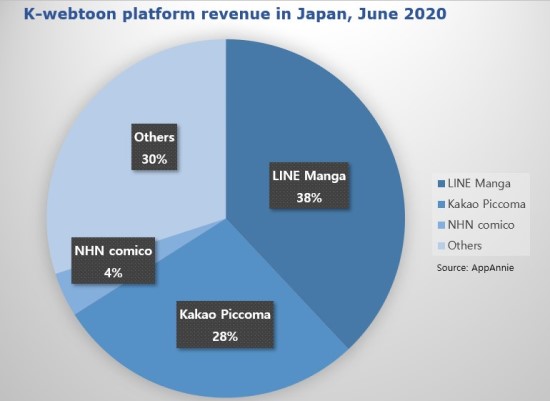

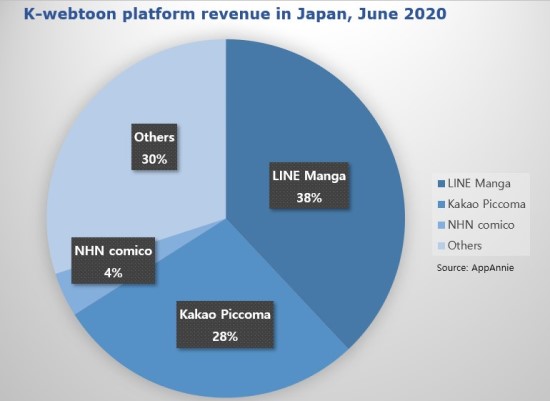

According to mobile data provider AppAnnie, Korean webtoons, or K-webtoons, hold over 70% market share in Japan’s digital comics market, outperforming traditional giants. The top players are Naver Corp’s LINE Manga with 38% share in the Japanese market, Kakao Corp’s Piccoma with 28%, and NHN’s Comico with 4%. In the US, Naver’s LINE Webtoon has reached 70 million monthly active users (MAU).

Naver is Korea's largest internet portal and Kakao is Korea's biggest mobile messaging app operator.

"Japan is considered to be the birthplace of comics, and it's unprecedented to see Korean platforms competing against each other to secure the top place,” said an industry source. “Now Japanese publishers can’t tap into the digital market without going through Korean platforms,” the source explained.

Naver is also enjoying huge success in the US. The Korean IT giant’s LINE Webtoon service launched in the US in 2014, and in six years the platform reached 70 million MAUs as of May 2020. This is a drastic leap from 7 million MAUs posted in April 2019, and 10 million in November 2019. It is also in stark contrast to its Korea-based webtoon platform posting 5.64 million MAUs in Korea in May.

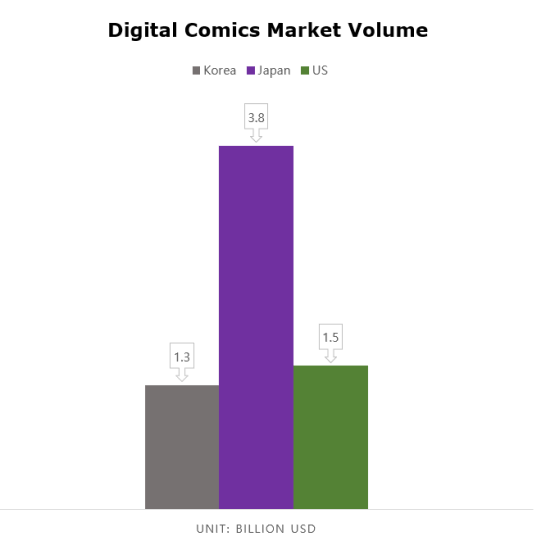

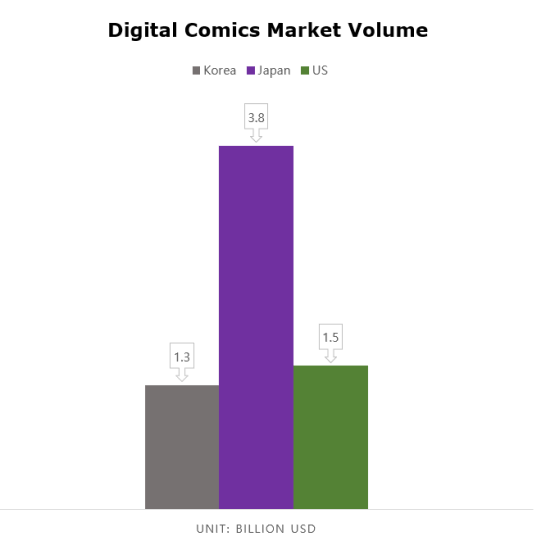

As of 2020, the digital comics market in Japan remains the world’s largest, with an estimated value of approximately 4.5 trillion won ($3.8 billion). Trailing behind is the US with 1.79 trillion won, and Korea with 1.55 trillion won.

GENRE DOESN’T GUARANTEE SUCCESS

K-webtoons disrupted the existing comics market by offering a new drawing technique and a storytelling method best customized for mobile viewing. Readers could comfortably view content by simply scrolling down, and animation effects along with background music were added to enhance the level of immersion.

It was a fresh experience for Japanese and US readers, as before Kakao and Naver digital comics in Japan and the US were mostly scanned print comics from traditional comic publishers such as Shueisha in Japan, and Marvel Comics and DC Comics in the US.

Further, webtoons were in line with the new digital consumption behavior given that a new episode is uploaded every week, sometimes more frequently. This set webtoons apart from traditional print comics, which often released monthly updates.

“The short-term webtoon updates appeal to the younger generation familiar with consuming real-time content through platforms such as Youtube and Instagram,” said a source from the Korea Creative Content Agency.

But insiders say the unique traits of the genre do not guarantee success. Kakao and Naver both suffered in the early stages when they provided webtoons without clear strategies. Piccoma launched its Japanese service in 2016 but did not even appear on the list of the top-200 most-popular apps until early 2017. As for LINE Webtoon, it began its Japanese service in 2014 but it took the platform five years to reach 5 million MAUs.

QUALITY BECOMES PRIORITY

"In the 2000s, the Korean wave (hallyu: global popularity of Korean content) took over Japan but faded away around 2007 and 2008 when Korean dramas and variety shows flooded the scene without quality control," said Kim from Kakao Japan.

"We decided to show only the best of the best to avoid repeating the same mistake," stressed Kim.

Kakao created an exclusive Japan team to select webtoons from the company's platforms KakaoPage and Daum Webtoon. Then Kakao Japan’s global business division selected the best content from the first selection of webtoons, while localizing some if necessary. The company also utilized big data to analyze Japanese users’ culture and consumption patterns.

Only 333 webtoons were selected among 7,000, and the strategy was a huge success. Solo Leveling, a Korean webtoon, was number one on Piccoma in 2019 and has so far recorded 10 billion won in accumulated revenue. Dokgo and Boss in School have earned 6.8 billion won and 3.3 billion won, respectively.

Naver also concentrated on working with local artists to secure quality content. The company partnered with famous Japanese publishers, including Shueisha, Kodansha, and Shogakukan. As a result, LINE Manga grabbed first place for non-game app revenue and downloads in 2019.

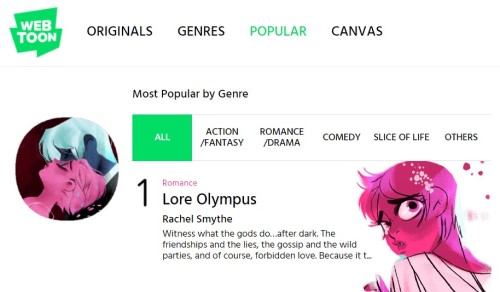

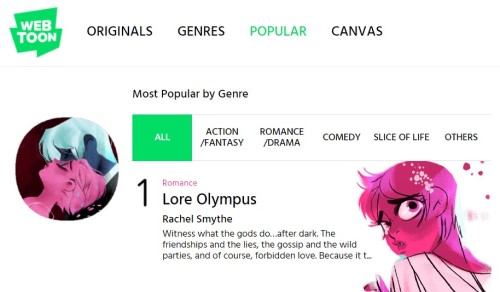

In the US, Naver launched the Canvas platform, where amateur artists could freely upload their work. If a webtoon gained a strong fanbase then it would be recruited to LINE Webtoon services. Canvas became a network of 580,000 amateur creators and 1,600 professional creators. Naver's strategy was a success as Canvas produced a global hit, Lore Olympus, which has over 250 million accumulated views.

BIG DATA, ARTIFICIAL INTELLIGENCE USED AS PROMOTIONAL TOOLS

Big data and artificial intelligence are used as promotional tools for digital giants Naver and Kakao.

Kakao's Piccoma sends users reminders to visit the platform based on their history and offers free coupons to first-time paying users who were previously using the service for free.

“This is a widely used method in games,” said a source from Kakao. “We were the first webtoon platform to offer user-customized promotions,” he added.

Naver's LINE webtoon uses its artificial intelligence AiRS to recommend webtoons based on the users’ history. After LINE Webtoon incorporated AiRS, there was a 30% increase in North America-based Android users’ consumption per person and a 10% increase in revisits.

NEXT STEP: INTELLECTUAL PROPERTY

Kakao and Naver are eyeing the content market given greater intellectual property rights opportunities in sectors such as animation, films and gaming.

“Asian characters still face limitations in the global entertainment market, including the film and music industries,” said an industry source. “But webtoon IPs can overcome those hurdles and have a chance of becoming the superlative in the global content market,” the source added.

As of 2020, the overall content market is valued at 1,091 trillion won in the US and 238 trillion won in Japan.

Write to Min-ki Koo at kook@hankyung.com

“Webtoons, indeed, sync well with digital platforms but their success was more than just getting lucky with the genre. There were tremendous efforts made,” said Kim Jae-yong, head of Kakao Japan.

According to mobile data provider AppAnnie, Korean webtoons, or K-webtoons, hold over 70% market share in Japan’s digital comics market, outperforming traditional giants. The top players are Naver Corp’s LINE Manga with 38% share in the Japanese market, Kakao Corp’s Piccoma with 28%, and NHN’s Comico with 4%. In the US, Naver’s LINE Webtoon has reached 70 million monthly active users (MAU).

Naver is Korea's largest internet portal and Kakao is Korea's biggest mobile messaging app operator.

"Japan is considered to be the birthplace of comics, and it's unprecedented to see Korean platforms competing against each other to secure the top place,” said an industry source. “Now Japanese publishers can’t tap into the digital market without going through Korean platforms,” the source explained.

Naver is also enjoying huge success in the US. The Korean IT giant’s LINE Webtoon service launched in the US in 2014, and in six years the platform reached 70 million MAUs as of May 2020. This is a drastic leap from 7 million MAUs posted in April 2019, and 10 million in November 2019. It is also in stark contrast to its Korea-based webtoon platform posting 5.64 million MAUs in Korea in May.

As of 2020, the digital comics market in Japan remains the world’s largest, with an estimated value of approximately 4.5 trillion won ($3.8 billion). Trailing behind is the US with 1.79 trillion won, and Korea with 1.55 trillion won.

GENRE DOESN’T GUARANTEE SUCCESS

K-webtoons disrupted the existing comics market by offering a new drawing technique and a storytelling method best customized for mobile viewing. Readers could comfortably view content by simply scrolling down, and animation effects along with background music were added to enhance the level of immersion.

It was a fresh experience for Japanese and US readers, as before Kakao and Naver digital comics in Japan and the US were mostly scanned print comics from traditional comic publishers such as Shueisha in Japan, and Marvel Comics and DC Comics in the US.

Further, webtoons were in line with the new digital consumption behavior given that a new episode is uploaded every week, sometimes more frequently. This set webtoons apart from traditional print comics, which often released monthly updates.

“The short-term webtoon updates appeal to the younger generation familiar with consuming real-time content through platforms such as Youtube and Instagram,” said a source from the Korea Creative Content Agency.

But insiders say the unique traits of the genre do not guarantee success. Kakao and Naver both suffered in the early stages when they provided webtoons without clear strategies. Piccoma launched its Japanese service in 2016 but did not even appear on the list of the top-200 most-popular apps until early 2017. As for LINE Webtoon, it began its Japanese service in 2014 but it took the platform five years to reach 5 million MAUs.

QUALITY BECOMES PRIORITY

"In the 2000s, the Korean wave (hallyu: global popularity of Korean content) took over Japan but faded away around 2007 and 2008 when Korean dramas and variety shows flooded the scene without quality control," said Kim from Kakao Japan.

"We decided to show only the best of the best to avoid repeating the same mistake," stressed Kim.

Kakao created an exclusive Japan team to select webtoons from the company's platforms KakaoPage and Daum Webtoon. Then Kakao Japan’s global business division selected the best content from the first selection of webtoons, while localizing some if necessary. The company also utilized big data to analyze Japanese users’ culture and consumption patterns.

Only 333 webtoons were selected among 7,000, and the strategy was a huge success. Solo Leveling, a Korean webtoon, was number one on Piccoma in 2019 and has so far recorded 10 billion won in accumulated revenue. Dokgo and Boss in School have earned 6.8 billion won and 3.3 billion won, respectively.

Naver also concentrated on working with local artists to secure quality content. The company partnered with famous Japanese publishers, including Shueisha, Kodansha, and Shogakukan. As a result, LINE Manga grabbed first place for non-game app revenue and downloads in 2019.

In the US, Naver launched the Canvas platform, where amateur artists could freely upload their work. If a webtoon gained a strong fanbase then it would be recruited to LINE Webtoon services. Canvas became a network of 580,000 amateur creators and 1,600 professional creators. Naver's strategy was a success as Canvas produced a global hit, Lore Olympus, which has over 250 million accumulated views.

BIG DATA, ARTIFICIAL INTELLIGENCE USED AS PROMOTIONAL TOOLS

Big data and artificial intelligence are used as promotional tools for digital giants Naver and Kakao.

Kakao's Piccoma sends users reminders to visit the platform based on their history and offers free coupons to first-time paying users who were previously using the service for free.

“This is a widely used method in games,” said a source from Kakao. “We were the first webtoon platform to offer user-customized promotions,” he added.

Naver's LINE webtoon uses its artificial intelligence AiRS to recommend webtoons based on the users’ history. After LINE Webtoon incorporated AiRS, there was a 30% increase in North America-based Android users’ consumption per person and a 10% increase in revisits.

NEXT STEP: INTELLECTUAL PROPERTY

Kakao and Naver are eyeing the content market given greater intellectual property rights opportunities in sectors such as animation, films and gaming.

“Asian characters still face limitations in the global entertainment market, including the film and music industries,” said an industry source. “But webtoon IPs can overcome those hurdles and have a chance of becoming the superlative in the global content market,” the source added.

As of 2020, the overall content market is valued at 1,091 trillion won in the US and 238 trillion won in Japan.

Write to Min-ki Koo at kook@hankyung.com

Danbee Lee edited this article

More to Read

-

-

Korean chipmakersSamsung in talks to supply customized HBM4 to Nvidia, Broadcom, Google

Korean chipmakersSamsung in talks to supply customized HBM4 to Nvidia, Broadcom, Google23 HOURS AGO

-

EnergyLS Cable breaks ground on $681 mn underwater cable plant in Chesapeake

EnergyLS Cable breaks ground on $681 mn underwater cable plant in ChesapeakeApr 29, 2025 (Gmt+09:00)

-

Business & PoliticsUS tariffs add risk premium to dollar assets: Maurice Obstfeld

Business & PoliticsUS tariffs add risk premium to dollar assets: Maurice ObstfeldApr 29, 2025 (Gmt+09:00)

-

Comment 0

LOG IN