Joblessness rate

KoreaŌĆÖs July jobless claims hit $1 bn; insurance fundsŌĆÖ deficit to widen

By Aug 10, 2020 (Gmt+09:00)

1

Min read

Most Read

Samsung shifts to emergency mode with 6-day work week for executives

Alibaba eyes 1st investment in Korean e-commerce platform

Blackstone signs over $1 bn deal with MBK for 1st exit in Korea

NPS loses $1.2 bn in local stocks in Q1 on weak battery shares

OCI to invest up to $1.5 bn in MalaysiaŌĆÖs polysilicon plant

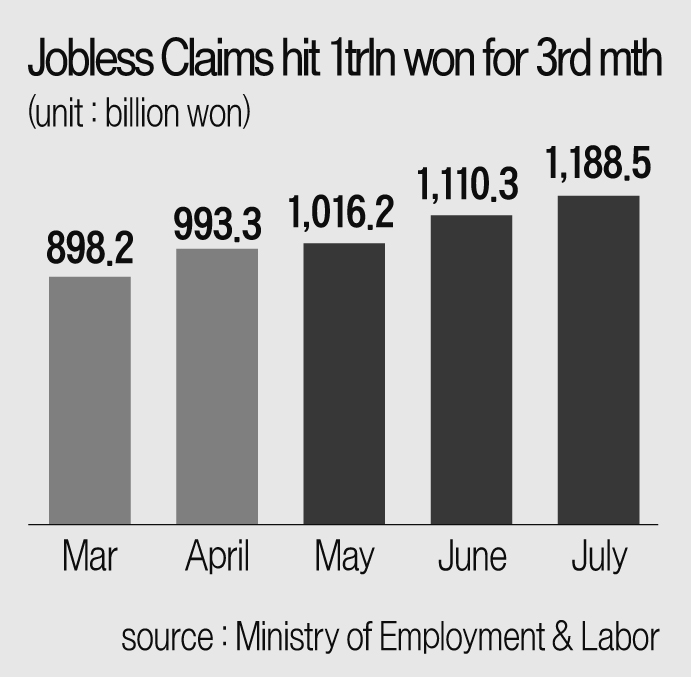

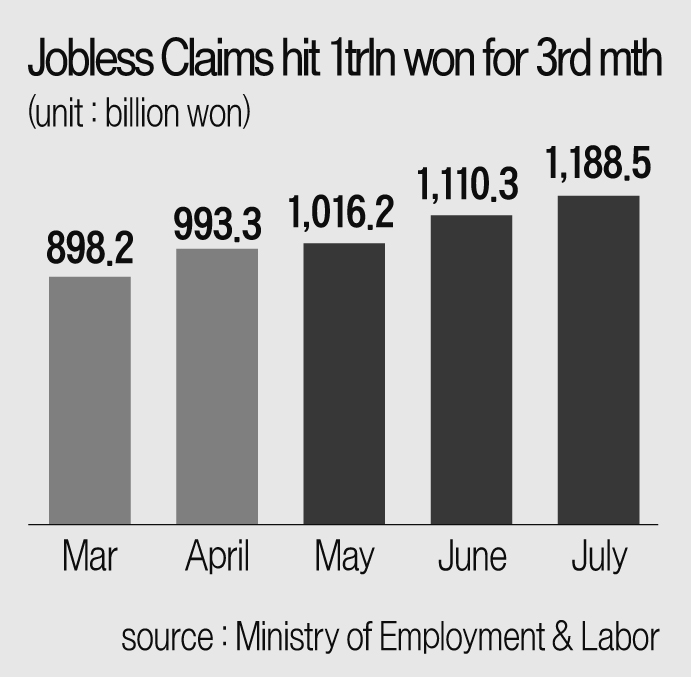

South Korea's jobless claims payments topped 1 trillion won ($842 million) for the third consecutive month in July, threatening to widen the shortfalls of the governmentŌĆÖs employment insurance funds to as much as 3.3 trillion won by yearŌĆÖs end.

Jobless benefit payments came in at 1.19 trillion won ($1 billion) in July, marking the biggest amount for a single month, according to the Ministry of Employment and Labor on August 10. The number of recipients hit a record high of 833,000.

In the first seven months to July of the year, a total of 6.7 trillion won were paid in benefits to the unemployed or job seekers, accounting for 70% of the governmentŌĆÖs original budget of 9.5 trillion won in allowances for all of 2020.

Despite a fresh┬Āinjection of 3.4 trillion won into the employment insurance funds in a third supplementary budget, the shortfalls at the state funds are projected to increase by 57% to 3.3 trillion won by the end of this year, compared with last yearŌĆÖs 2.1 trillion won.

As a result, the accumulated reserves set aside for jobless claims at the government funds are expected to halve to 4.1 trillion won by the end of the year, compared with 10.3 trillion won in 2017.

Unemployment claims have been on the rise since March when the spread of the coronavirus began taking a heavy toll on the jobs market. The payment of unemployment benefits exceeded 1 trillion won for the first time in May.

The number of employment insurance subscribers edged up last month supported by the job creation in the public sector for the aged. But the number of subscribers in their 20s and 30s continued to decline, with manufacturing jobs taking a heavy hit.

ŌĆ£The drop in the number of young insurance subscribers was basically due to the demographic change,ŌĆØ said a labor ministry official. ŌĆ£But the fact that companies focused on maintaining employment instead of making new hires in response to Covid-19 weighed on the jobs numbers, as well.ŌĆØ

Write to Jin-kyu Kang at josep@hankyung.com

Jobless benefit payments came in at 1.19 trillion won ($1 billion) in July, marking the biggest amount for a single month, according to the Ministry of Employment and Labor on August 10. The number of recipients hit a record high of 833,000.

In the first seven months to July of the year, a total of 6.7 trillion won were paid in benefits to the unemployed or job seekers, accounting for 70% of the governmentŌĆÖs original budget of 9.5 trillion won in allowances for all of 2020.

Despite a fresh┬Āinjection of 3.4 trillion won into the employment insurance funds in a third supplementary budget, the shortfalls at the state funds are projected to increase by 57% to 3.3 trillion won by the end of this year, compared with last yearŌĆÖs 2.1 trillion won.

As a result, the accumulated reserves set aside for jobless claims at the government funds are expected to halve to 4.1 trillion won by the end of the year, compared with 10.3 trillion won in 2017.

Unemployment claims have been on the rise since March when the spread of the coronavirus began taking a heavy toll on the jobs market. The payment of unemployment benefits exceeded 1 trillion won for the first time in May.

The number of employment insurance subscribers edged up last month supported by the job creation in the public sector for the aged. But the number of subscribers in their 20s and 30s continued to decline, with manufacturing jobs taking a heavy hit.

ŌĆ£The drop in the number of young insurance subscribers was basically due to the demographic change,ŌĆØ said a labor ministry official. ŌĆ£But the fact that companies focused on maintaining employment instead of making new hires in response to Covid-19 weighed on the jobs numbers, as well.ŌĆØ

Write to Jin-kyu Kang at josep@hankyung.com

Yeonhee Kim edited this article

More to Read

-

-

-

Korean stock marketHD Hyundai Electric likely to join MSCI Korea: Samsung Securities

Korean stock marketHD Hyundai Electric likely to join MSCI Korea: Samsung SecuritiesApr 19, 2024 (Gmt+09:00)

-

EconomyIn Korean food prices, everythingŌĆÖs up: Now itŌĆÖs dried seaweed's turn

EconomyIn Korean food prices, everythingŌĆÖs up: Now itŌĆÖs dried seaweed's turnApr 18, 2024 (Gmt+09:00)

-

Foreign exchangeKorean won at 17-month low on Middle East woes, Fed rate view

Foreign exchangeKorean won at 17-month low on Middle East woes, Fed rate viewApr 16, 2024 (Gmt+09:00)

Comment 0

LOG IN