TPG, online portal Naver eyeing Korean drama producer’s pre-IPO share sale

By Aug 07, 2020 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

The US private equity firm TPG Capital and South Korea’s top Internet portal Naver Corp. have participated in preliminary bidding for a pre-IPO placement by the country’s leading TV drama producer amid soaring viewership of Korean TV series and movies on online platforms, according to investment banking sources on August 7.

The pre-IPO share sale by JTBC Studios Co. Ltd. has drawn eight to nine preliminary bidders including global private equity houses and domestic and foreign strategic investors by the August 7 deadline, the sources said, declining to identify other bidders.

The size of the stake up for sale would be somewhere between 20% and 40% of its outstanding shares, depending on proposals by the bidders. Based on the valuation estimated by the selling side, or 20 times its trailing EBITDA of 20 billion won, the stake on offer would be 80 billion won to 160 billion won ($67 million-$135 million).

JTBC Studios, the producer of the hit TV series The World of the Married, Itaewon Class and Sky Castle, will complete the pre-IPO placement by year’s end to fund its content and streaming service expansion.

Previously, about 20 potential investors, including Blackstone, the Carlyle Group, KKR and TPG, as well as Naver had shown interest in a possible investment in the drama producer and received investment memoranda from the underwriter Morgan Stanley.

Some of the prospective bidders had shown strong determination to take part in the placement which may provide a rare investment opportunity in a content production company with strong track records.

Among prospective investors, Naver emergd as a strong candidate given its financing capacity and synergy effects from a business tie-up.

HIGHLY-VIEWED TV SERIES ON NETFLIX

The pre-IPO share sale comes after streaming giant Netflix Inc. acquired a 4.99% stake in Kosdaq-listed Studio Dragon in November last year for an undisclosed sum. Morgan Stanley had advised on Netflix’s investment in Studio Dragon Corp., another Korean TV drama producer.

The selling side is understood to demand at least 400 billion won ($337 million) for its enterprise value, applying the same multiple of 20 times 2019 EBITDA as Studio Dragon.

JTBC Studios is a unit of South Korea’s media group the Korea JoongAng Daily. Jcontentree Corp., a listed holding company of the media group, controls 60.5% of JTBC Studios. A combined ownership by the holding firm, its affiliates and family members is 91.5%.

Before completing the pre-IPO placement, Jcontentree will spin off its drama investment operation and combine it with JTBC Studios.

To bulk up the content and online streaming services, the affiliated broadcasting company JTBC has agreed to establish a joint venture of streaming media service with CJ ENM Co. Ltd., the country’s largest entertainment company and the parent firm of Studio Dragon.

Last year, JTBC Studios posted a net profit of 7.8 billion won against revenues of 188.9 billion won, up 32% and 17% year-on-year, respectively.

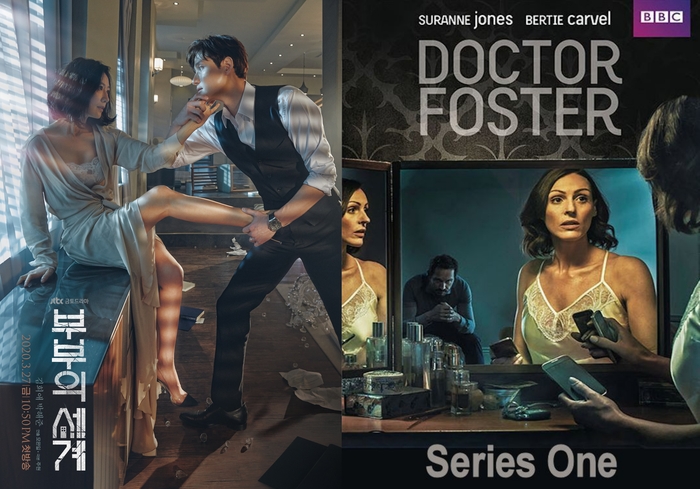

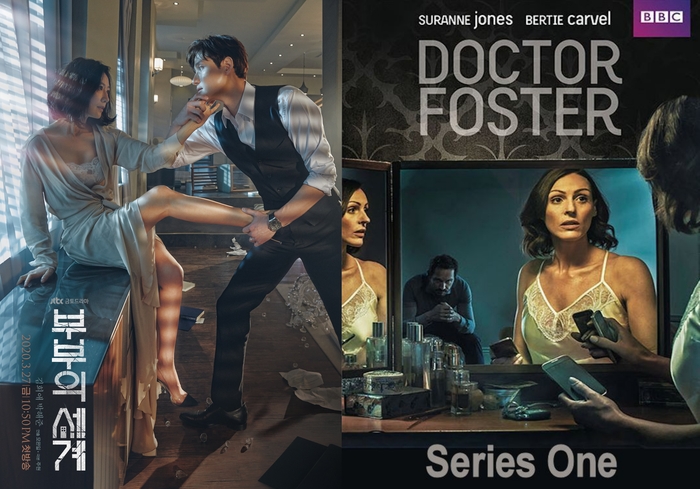

Its recent hit series were among the most highly-viewed series on Netflix. The World of the Married is based upon BBC One's drama series Doctor Foster. Sky Castle is a drama about South Korean tiger moms, and Itaewon Class is based on a popular Korean webtoon novel.

Its bigger rival Studio Dragon, with a market value of 2.45 trillion won, earned 26.4 billion won in net profits against revenues of 468.7 billion won in 2019. CJ ENM controls 66.2% of Studio Dragon, the producer of the recent hit dramas -- The Crash Landing on You, Mr. Sunshine and Guardian: The Lonely and Great God.

A downside risk to an investment in JTBC Studios would be that financial investors may not have a say in management given the content producers’ reluctance to involve outsider investors in their decision-making, the sources added.

Write to Jun Ho Cha at chacha@hankyung.com

The pre-IPO share sale by JTBC Studios Co. Ltd. has drawn eight to nine preliminary bidders including global private equity houses and domestic and foreign strategic investors by the August 7 deadline, the sources said, declining to identify other bidders.

The size of the stake up for sale would be somewhere between 20% and 40% of its outstanding shares, depending on proposals by the bidders. Based on the valuation estimated by the selling side, or 20 times its trailing EBITDA of 20 billion won, the stake on offer would be 80 billion won to 160 billion won ($67 million-$135 million).

JTBC Studios, the producer of the hit TV series The World of the Married, Itaewon Class and Sky Castle, will complete the pre-IPO placement by year’s end to fund its content and streaming service expansion.

Previously, about 20 potential investors, including Blackstone, the Carlyle Group, KKR and TPG, as well as Naver had shown interest in a possible investment in the drama producer and received investment memoranda from the underwriter Morgan Stanley.

Some of the prospective bidders had shown strong determination to take part in the placement which may provide a rare investment opportunity in a content production company with strong track records.

Among prospective investors, Naver emergd as a strong candidate given its financing capacity and synergy effects from a business tie-up.

HIGHLY-VIEWED TV SERIES ON NETFLIX

The pre-IPO share sale comes after streaming giant Netflix Inc. acquired a 4.99% stake in Kosdaq-listed Studio Dragon in November last year for an undisclosed sum. Morgan Stanley had advised on Netflix’s investment in Studio Dragon Corp., another Korean TV drama producer.

The selling side is understood to demand at least 400 billion won ($337 million) for its enterprise value, applying the same multiple of 20 times 2019 EBITDA as Studio Dragon.

JTBC Studios is a unit of South Korea’s media group the Korea JoongAng Daily. Jcontentree Corp., a listed holding company of the media group, controls 60.5% of JTBC Studios. A combined ownership by the holding firm, its affiliates and family members is 91.5%.

Before completing the pre-IPO placement, Jcontentree will spin off its drama investment operation and combine it with JTBC Studios.

To bulk up the content and online streaming services, the affiliated broadcasting company JTBC has agreed to establish a joint venture of streaming media service with CJ ENM Co. Ltd., the country’s largest entertainment company and the parent firm of Studio Dragon.

Last year, JTBC Studios posted a net profit of 7.8 billion won against revenues of 188.9 billion won, up 32% and 17% year-on-year, respectively.

Its recent hit series were among the most highly-viewed series on Netflix. The World of the Married is based upon BBC One's drama series Doctor Foster. Sky Castle is a drama about South Korean tiger moms, and Itaewon Class is based on a popular Korean webtoon novel.

Its bigger rival Studio Dragon, with a market value of 2.45 trillion won, earned 26.4 billion won in net profits against revenues of 468.7 billion won in 2019. CJ ENM controls 66.2% of Studio Dragon, the producer of the recent hit dramas -- The Crash Landing on You, Mr. Sunshine and Guardian: The Lonely and Great God.

A downside risk to an investment in JTBC Studios would be that financial investors may not have a say in management given the content producers’ reluctance to involve outsider investors in their decision-making, the sources added.

Write to Jun Ho Cha at chacha@hankyung.com

Yeonhee Kim edited this article

More to Read

-

Korean dramas push cultural content exports beyond $10 billion

Korean dramas push cultural content exports beyond $10 billionAug 10, 2020 (Gmt+09:00)

4 Min read -

Private equityPEFs zoom in on Korean drama producer as strategic buyers pull back

Private equityPEFs zoom in on Korean drama producer as strategic buyers pull backAug 27, 2020 (Gmt+09:00)

2 Min read

Comment 0

LOG IN