Two Europe-focused REITs seek $600 mn IPOs in Seoul

Mar 12, 2020 (Gmt+09:00)

S.Korea's LS Materials set to boost earnings ahead of IPO process

CarlyleŌĆÖs Rubenstein sees commercial real estate undervalued

Samsung Electronics' key M&A man returns; big deals in the offing

Money pours in for technology to reshape Korean restaurants

CJ CheilJedang to sell feed, livestock unit for $1.4 bn

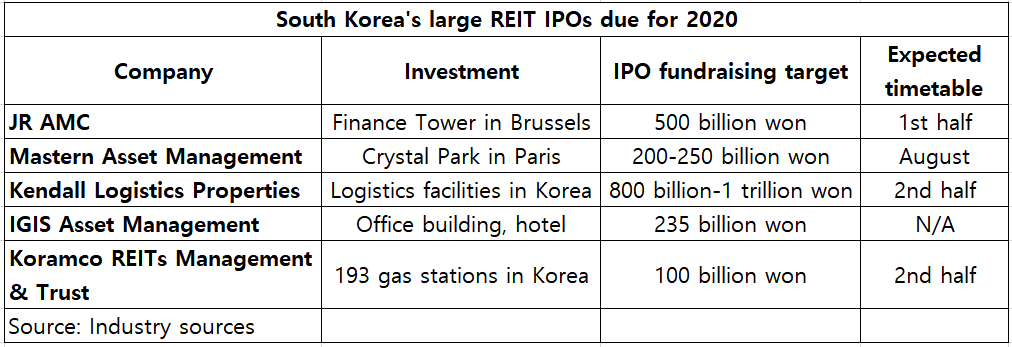

Two real estate investment trusts (REITs) backed by office buildings in Belgium and France are planning to raise a combined $600 million through initial public offerings in Seoul this year, following a record $14 billion investment by South Korean funds in Europe's commercial property market in 2019.

JR AMC Co. Ltd. received a final regulatory approval in February to list JR Global REIT, the parent of the sub REIT that had acquired the Finance Tower in Brussels for $1.6 billion in December.

It is aiming to raise about 500 billion ($415 million) from the offering on the Korea Stock Exchange, which will be the countryŌĆÖs first listed REIT backed by a foreign asset.

JR Global REIT is expecting to offer an annual yield of 8%, with additions of new investments in Belgium, Germany and the Netherlands in the future.

A REIT of Mastern Investment Management Co. Ltd. is planning to go public to raise between 200 billion and 250 billion won ($166 million-$200 million) to fund the purchase of Crystal Park in France and other investments in Germany, Luxemburg and the Netherlands.

With the planned two IPOs, the countryŌĆÖs listed REIT market is poised to top 2 trillion won this year, four times bigger than in 2019 and 10 times more than in 2018.

South KoreaŌĆÖs REIT market has been growing substantially since 2018, luring individual investors with rare investment opportunities for office buildings, hotels and retail outlets, along with high yields and expectations for share price gains.

The upcoming REIT IPOs are expected to offer 5-8% annual yields, compared with 1-2% interest rates on savings accounts.

VARIOUS ASSETS, TAX BENEFITS

Domestic REITs are drawing attention of investors with various underlying assets.

Seoul-based Kendall Square Logistics Properties has recently applied for a REIT IPO backed by logistics facilities in Korea. It plans to raise 800 billion to 1 trillion won from the listing as early as the second half of this year.

If listed, it will become the first listed REIT backed by logistics assets and the largest REIT on the Korean stock market.

Koramco REITs Management & Trust Co. Ltd. is planning to launch the countryŌĆÖs first REIT backed by gas stations.

To encourage retail investment in indirect real estate funds away from the household property market, the land ministry announced tax benefits for dividend incomes from listed REITs and retail property funds in September 2019.

Additionally, it has relaxed regulations for the management of listed REITs and retail property funds and their developments.

But the tumbling stock markets since the coronavirus outbreak is raising doubts about whether the new REITs can receive as much enthusiastic welcome as those listed on the Seoul bourse just a half year ago.

Shares in large domestic REITs, including Lotte REIT and NH Prime REIT, have plunged by around 25% since hitting record highs on their first trading day last year.

Further, doubts arise about their fundamental attractiveness, given that the two Europe-focused REITs were formed after their investment companies failed to sell down the underlying assets to institutional investors.

Most of retail property funds launched last year were backed by single foreign assets that had not been resold to institutional investors. Korean pension funds and insurance firms have turned cool on sell-down assets and increasingly opted for direct deal sourcing since last year.

NEW REGULATORY HURDLE?

Contrary to the government effort to shore up the listed REIT market, the regulatory Financial Services Commission (FSC) signaled in January that brokerage companiesŌĆÖ business practices of underwriting an investment and reselling it to a designated real estate fund could be in violation of the capital market act. The act bans the sale of investment companies' funds managed in accordance with instructions of the fundŌĆÖs seller such as banks and brokerage companies.

Last month an FSC official hinted that the rule could apply to global alternative investments.

But Meritz Securities and JR AMC officials argued that REITs were exempt from the rules from the beginning and were not directed by outside companies as well, because their investment decisions need to gain board and shareholder approval.

Meanwhile, Kiwoom Securities said in a research note last week that the dividend yield ratio of listed dometic REITs, or dividend payouts divided by their current share prices, has climbed to 6% from 3-4% last year, even higher than the base rate of 1.25% that is expected to be cut further within the year.

ŌĆ£Because of lingering uncertainties about their underlying assets and anchors of domestic REITs, we need to approach them from the dividend yield point of views. Given this, the current price range with a 6% dividend yield is unlikely to last long and now is the right time to invest in listed domestic REITs,ŌĆØ Kiwoom analyst Jinsung Rah said in the note.

Yeonhee Kim edited this article

-

-

-

-

EconomyAs many as one in 10 residents in South Korea likely to be foreign by 2042

EconomyAs many as one in 10 residents in South Korea likely to be foreign by 2042Apr 11, 2024 (Gmt+09:00)

-