[Dealmaker] Credit Suisse leads Korea's M&A advisory market

Jan 31, 2020 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

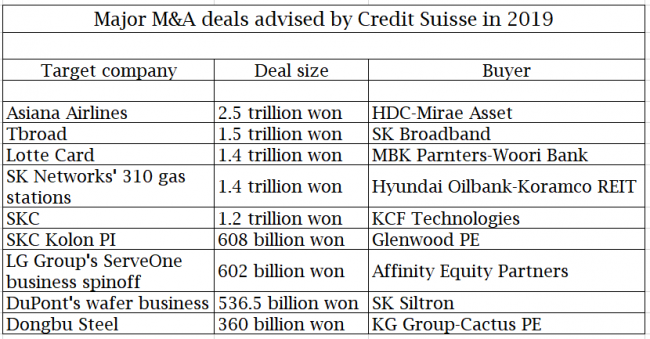

Credit Suisse arranged five buyout deals worth 5.2 trillion won ($4.4 billion) for SK Group’s units in 2019, which represented half of its M&A advisory business secured in South Korea in the year.

In addition, the Switzerland-based bank approached SK Telecom Co. Ltd. and Kakao Corp. last year, South Korea’s top mobile carrier and messaging app operator respectively, suggesting them to swap 300 billion won worth of shares in themselves to build strategic partnerships.

Both companies, competing in mobile navigation and other areas, accepted the proposal and reached the share swap deal to cooperate in a range of businesses last October.

Credit Suisse has been aggressively expanding its presence in South Korea’s M&A advisory market since managing director David Kyungin Lee started leading the 20-strong investment banking team in its Seoul branch in 2017.

“Companies are now under heavy pressure to keep up with the changing trends through generational shifts. Mr. Lee has an exceptional ability to bring new M&A ideas that meet the changing business trends and to create deal structures,” a Korean company source told the Korean Investors.

Credit Suisse worked on 10 buyout deals for a combined 10.6 trillion won ($9 billion) in South Korea last year, topping the league table for corporate M&A advisory service in the country, according to data compiled by the Korea Economic Daily and research company FnGuide.

It was the first time for the bank to join the 10-trillion-won club for M&A arrangements in Korea, narrowly beating out Morgan Stanley which also advised 10 trillion won worth of buyout transactions in the country last year.

Lee, 45, has won clients’ trust with skillful and meticulous work for complex deals and finding suitable buyers for hard-to-sell assets in creative ways.

The bank also puts effort into building long-term relationships with clients to make them return for another work.

In 2017, Lee advised the $1.8 billion acquisition by the SK Hynix Inc. and Bain Capital consortium of Toshiba’s memory chip business and SK Corp.’s 620 billion-won purchase of 51% of the silicon wafer manufacturer LG Siltron from LG Corp.

For LG Group, Credit Suisse worked on the spin-off and sale of the maintenance, repair and operation (MRO) services from the purchase outsourcing unit Serveone to Hong Kong-based Affinity Equity Partners in a 602 billion won transaction last year.

It was the first business restructuring led by LG Group’s fourth-generation chairman Kwang-mo Koo who took office in 2018.

SK NETWORKS, SKC

For the 1.4 trillion-won sale of SK Networks Co. Ltd.’s 310 gas stations in Korea, Credit Suisse proposed that a potential buyer would be a consortium of strategic and financial investors, instead of proceeding with the sale through a sales and leaseback structure.

Hyundai Oilbank Co. Ltd. teamed up with Koramco REITs Management and Trust Co. Ltd. to buy the gas stations. While operating them, they are able to develop the properties as well.

For the spin-off of SKC’s chemical business to a joint venture, Credit Suisse made every effort to bring Kuwait’s Petrochemical Industries Company (PIC) as the JV partner in the complicated 560 billion-won deal, according to investment banking sources.

LOTTE CARD

In the auction for Lotte Card Co. Ltd., Credit Suisse tapped Woori Bank, a leading domestic bank, to join hands with MBK Partners in the final stages of the sale.

MBK had made a bid on its own, while Woori was not in a situation to buy the card company which would lower its capital adequacy ratio.

As proposed, they formed a consortium for the 1.4 trillion-won acquisition and beat the strongest competitor Hana Financial Group.

Teaming up with Woori Bank, MBK tentatively agreed to sell off its 60% stake in the card firm to Woori in a couple of years, according to market sources. Currently, Woori owns 20% of Lotte Card.

Prior to Credit Suisse, Lee had worked at Macquarie, Lehman Brothers and Nomura Securities since joining Samil PwC in 2004.

He was the youngest managing director for a foreign bank in South Korea when he was promoted to the position in 2017.

“Besides his ability, he’s humble and dedicated to clients, unlike a stereotypical foreign investment banker. I think that’s why many people give work to him,” another company source said.

By Sang Eun Lee and Riahn Kim

knra@hankyung.com

Yeonhee Kim edited this article

-

Mergers & AcquisitionsCJ CheilJedang scraps $3.5 bn green bio sale, shifts gears to expansion

Mergers & AcquisitionsCJ CheilJedang scraps $3.5 bn green bio sale, shifts gears to expansion24 HOURS AGO

-

Mergers & AcquisitionsCJ CheilJedang scraps sale of Brazilian unit CJ Selecta to Bunge

Mergers & AcquisitionsCJ CheilJedang scraps sale of Brazilian unit CJ Selecta to BungeApr 29, 2025 (Gmt+09:00)

-

Mergers & AcquisitionsLG Chem to sell water filter business to Glenwood PE for $692 million

Mergers & AcquisitionsLG Chem to sell water filter business to Glenwood PE for $692 millionApr 28, 2025 (Gmt+09:00)

-

Mergers & AcquisitionsKyobo Life poised to buy Japan’s SBI Group-owned savings bank

Mergers & AcquisitionsKyobo Life poised to buy Japan’s SBI Group-owned savings bankApr 24, 2025 (Gmt+09:00)

-