KEPCO unit-German fund buys Sweden’s wind project for $300 mn

Aug 31, 2019 (Gmt+09:00)

Samsung steps up AR race with advanced microdisplay for smart glasses

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

Seoul-backed K-beauty brands set to make global mark

Korea Midland Power Co. Ltd., a unit of South Korea’s utility giant KEPCO, has acquired a wind power project in Sweden in a consortium with a German pension fund and domestic financial investors for 360 billion won ($298 million).

The acquisition of the project’s owner Stavro Vind was recently approved by the European Commission.

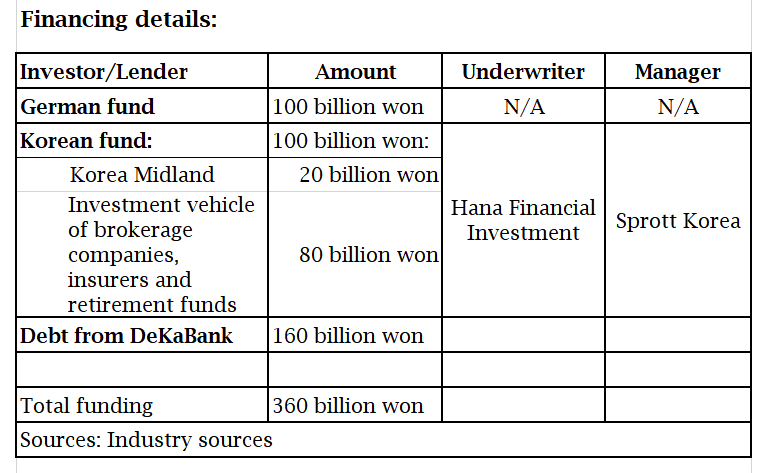

Funding for the deal is composed of 200 billion won in equity financing and 160 billion in a debt, according to investment banking sources on August 29.

Stavro Vind was set up to construct two separate onshore wind farms with a capacity of 254MW in Sweden. They are scheduled to begin commercial operation in October 2021 for 25 years.

The ownership will be split to 50:50 between the Korean investors led by Korea Midland and the German fund.

The German fund reportedly consists of Naev Solventus, a unit of Germany’s Naev Infrastructure Funds and Germany’s Siemens.

Although expected returns from the investment were not disclosed, they are presumed to reach 7-8% per annum, similar to those of previous two investments in Europe's wind power facilities by Korean institutions.

In June, a consortium of Korea Hydro & Nuclear Power Co. Ltd., another KEPCO unit, and Seoul-based Samchully Asset Management Co. Ltd. invested 100 billion won in buying a 14% stake in a Germany’s 400MW offshore wind power company which has been commercially operational since 2016.

Korea Hydro put out 26 billion won for the transaction and Samchully invested 75 billion won for expected annual returns of 7%.

Earlier this year, NH Investment & Securities Co. Ltd. and NH-Amundi Asset Management Co. Ltd. bought a 50% stake in Overturingen wind farm under development in Sweden for 170 billion won.

It is one of Sweden's large onshore wind farms and has a capacity of 235MW.

NH Investment and the affiliate company made the investment in a managed account via CapMan Infra, a Nordic investment firm.

The recent investments in Europe’s renewable energy sector by Korean institutions are in line with the South Korean government’s goal of raising the proportion of renewable energy to 20% by 2030 from 6.2% in 2017.

“Korean strategic investors are showing strong interest in energy infrastructure abroad. They are expanding to greenfield investments, or projects under development which require more expertise,” said one of the investment banking sources.

By Jung-hwan Hwang

jung@hankyung.com

(Photo: Getty Images Bank)

Yeonhee Kim edited this article

-

Pension fundsS.Korea’s GEPS to commit $143 million to foreign mid-cap buyout funds

Pension fundsS.Korea’s GEPS to commit $143 million to foreign mid-cap buyout fundsMay 08, 2025 (Gmt+09:00)

-

Pension fundsNPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

Pension fundsNPS yet to schedule external manager selection; PE firms’ fundraising woes deepenMay 02, 2025 (Gmt+09:00)

-

Real estateMirae Asset to be named Korea Post’s core real estate fund operator

Real estateMirae Asset to be named Korea Post’s core real estate fund operatorApr 29, 2025 (Gmt+09:00)

-

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concern

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concernApr 27, 2025 (Gmt+09:00)

-

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fund

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fundApr 23, 2025 (Gmt+09:00)