KEPCO unit-German fund buys SwedenŌĆÖs wind project for $300 mn

Aug 31, 2019 (Gmt+09:00)

Samsung shifts to emergency mode with 6-day work week for executives

CJ CheilJedang to sell feed, livestock unit for $1.4 bn

Samsung Electronics' key M&A man returns; big deals in the offing

Affinity to buy SK Rent-a-Car at $572 mn, more deals expected

Keppel REIT to sell Seoul-based prime office T Tower

Korea Midland Power Co. Ltd., a unit of South KoreaŌĆÖs utility giant KEPCO, has acquired a wind power project in Sweden in a consortium with a German pension fund and domestic financial investors for 360 billion won ($298 million).

The acquisition of the projectŌĆÖs owner Stavro Vind was recently approved by the European Commission.

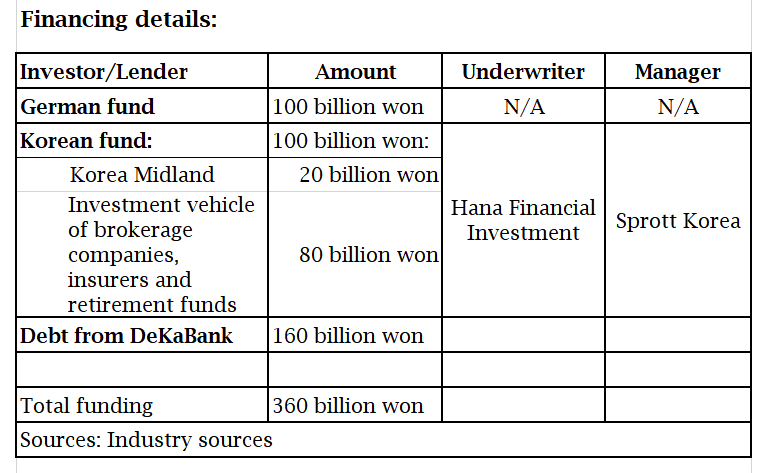

Funding for the deal is composed of 200 billion won in equity financing and 160 billion in a debt, according to investment banking sources on August 29.

Stavro Vind was set up to construct two separate onshore wind farms with a capacity of 254MW in Sweden. They are scheduled to begin commercial operation in October 2021 for 25 years.

The ownership will be split to 50:50 between the Korean investors led by Korea Midland and the German fund.

The German fund reportedly consists of Naev Solventus, a unit of GermanyŌĆÖs Naev Infrastructure Funds and GermanyŌĆÖs Siemens.

Although expected returns from the investment were not disclosed, they are presumed to reach 7-8% per annum, similar to those of previous two investments in Europe's wind power facilities by Korean institutions.

In June, a consortium of Korea Hydro & Nuclear Power Co. Ltd., another KEPCO unit, and Seoul-based Samchully Asset Management Co. Ltd. invested 100 billion won in buying a 14% stake in a GermanyŌĆÖs 400MW offshore wind power company which has been commercially operational since 2016.

Korea Hydro put out 26 billion won for the transaction and Samchully invested 75 billion won for expected annual returns of 7%.

Earlier this year, NH Investment & Securities Co. Ltd. and NH-Amundi Asset Management Co. Ltd. bought a 50% stake in Overturingen wind farm under development in Sweden for 170 billion won.

It is one of Sweden's large onshore wind farms and has a capacity of 235MW.

NH Investment and the affiliate company made the investment in a managed account via CapMan Infra, a Nordic investment firm.

The recent investments in EuropeŌĆÖs renewable energy sector by Korean institutions are in line with the South Korean governmentŌĆÖs goal of raising the proportion of renewable energy to 20% by 2030 from 6.2% in 2017.

ŌĆ£Korean strategic investors are showing strong interest in energy infrastructure abroad. They are expanding to greenfield investments, or projects under development which require more expertise,ŌĆØ said one of the investment banking sources.

By Jung-hwan Hwang

jung@hankyung.com

(Photo: Getty Images Bank)

Yeonhee Kim edited this article

-

-

-

Private equityPrivate markets open to more high-net-worth individuals: Hamilton Lane

Private equityPrivate markets open to more high-net-worth individuals: Hamilton LaneApr 16, 2024 (Gmt+09:00)

-

InfrastructureInfrastructure secondaries continue to rise amid inflation: Stafford

InfrastructureInfrastructure secondaries continue to rise amid inflation: StaffordApr 09, 2024 (Gmt+09:00)

-

Private equityCarlyleŌĆÖs Rubenstein sees commercial real estate undervalued

Private equityCarlyleŌĆÖs Rubenstein sees commercial real estate undervaluedApr 08, 2024 (Gmt+09:00)