Brookfield seeks refinance of $1.5 bn debt on IFC Seoul

Jul 24, 2019 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Brookfield Asset Management Inc. is seeking to refinance 1.8 trillion won ($1.5 billion) of debts it borrowed on the International Finance Center in Seoul (IFC Seoul) which it acquired for 2.55 trillion won in late 2016.

Brookfield has recently selected South Korea’s Kookmin Bank as the lead manager for the refinance and picked Samsung Life Insurance Co. Ltd. and NH Investment & Securities Co. Ltd. as co-managers, according to investment banking sources on July 23.

The move is seen aimed at borrowing more on the property, the value of which is estimated to have grown by 25-30% over the past three years so that it can return more than half of around 700 billion won it has invested in the South Korean commercial complex to its investors.

The planned refinancing also comes just after the Bank of Korea cut interest rates by 25 basis points to 1.50% on July 18, in its first monetary easing step in three years.

In late 2016, the Canada-based investment company borrowed 1.8 trillion won in five-year debts, or 70% of the acquisition price.

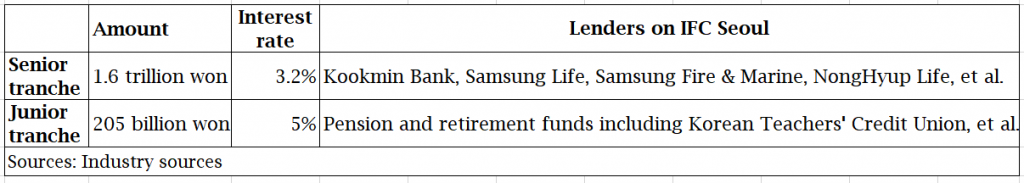

The debt consists of 1.6 trillion won in a senior tranche and 205 billion won in a mezzanine tranche.

ASSET VALUE APPRECIATION

IFC Seoul comprises IFC Mall, Conrad Seoul Hotel and three office buildings.

Its asset value is now estimated at 3.2 trillion-3.3 trillion won, up 25-30% from the purchase price after Brookfield filled empty office spaces with new tenants and operating margins on shopping malls improved.

Applying the 70% loan-to-value ratio, Brookfield will be able to borrow up to 2.2 trillion-2.3 trillion won, or 400 billion-500 billion won more than it borrowed in 2016. The increased debt amount could be used to return to investors as dividends.

Interest rates on refinanced senior loans are expected to drop to 2% from 3.2%.

“It seems that Brookfield sought after the debt refinancing as soon as the five-year debt entered its third year in the term when the early repayment charge goes down,” said one of the sources.

Most of the lenders are expected to join the refinancing package.

“Because it is difficult to find such a big prime asset as IFC in Korea, the existing investors will have no choice but to accept a refinancing deal,” another industry source told the Korean Investors.

The recent rate cut by the Bank of Korea may trigger other real estate investors and corporate borrowers to seek after debt refinancing, putting the squeeze on investment returns for insurance companies and retirement funds.

“Falling investment returns have already sent margins in certain segments into negative territory. We’re under increasing pressure on how to manage assets in the future,” said a leading Korean insurance company source.

By Hyun-il Lee and Donghun Lee

hiuneal@hankyung.com

Yeonhee Kim edited this article

-

Real estateMirae Asset to be named Korea Post’s core real estate fund operator

Real estateMirae Asset to be named Korea Post’s core real estate fund operatorApr 29, 2025 (Gmt+09:00)

-

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concern

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concernApr 27, 2025 (Gmt+09:00)

-

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fund

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fundApr 23, 2025 (Gmt+09:00)

-

Real estateRitz-Carlton to return to Seoul, tapped by IGIS Asset for landmark project

Real estateRitz-Carlton to return to Seoul, tapped by IGIS Asset for landmark projectApr 22, 2025 (Gmt+09:00)

-

Real estateS.Korean gaming giant Netmarble eyes headquarters building sale

Real estateS.Korean gaming giant Netmarble eyes headquarters building saleApr 18, 2025 (Gmt+09:00)