NPS to double proportion of overseas fixed-income investment by 2024

Jun 03, 2019 (Gmt+09:00)

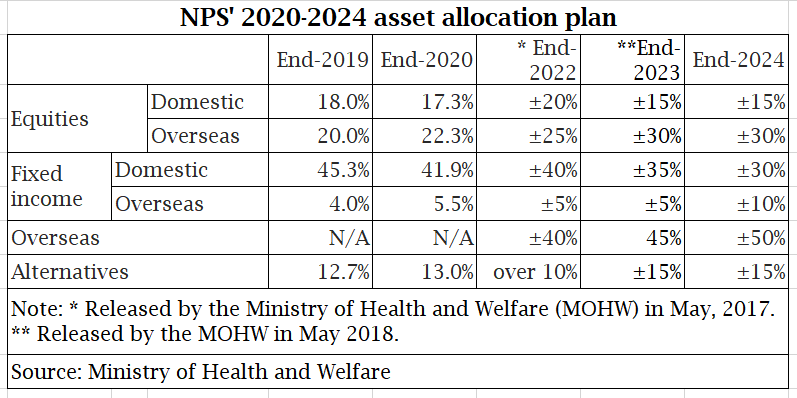

The National Pension Service (NPS) will more than double the proportion of overseas fixed-income investment to around 10% by the end of 2024 by when global investments are expected to make up half of the South Korean pension fundŌĆÖs total portfolio, up from the current 30%, according to the Ministry of Health and Welfare.

NPS put almost half of its $570 billion assets into fixed-income products both at home and abroad at the end of 2018, but overseas fixed-income securities accounted for just 4.2%.

The proportion of global investments will be raised ŌĆ£gradually and step-by-step,ŌĆØ and there will be no drastic short-term adjustment to domestic equities and fixed-income portfolios, the ministry said in a statement on May 31 after it approved the NPSŌĆÖ 2020-2024 mid-term asset allocation plan.

ŌĆ£In particular, for overseas fixed-income investment, (NPS) will boost investment in corporate bonds and the like which offer higher yields than government bonds,ŌĆØ it added in the statement.

Compared with the 2019-2023 allocation plan announced last year, the proportions of alternatives, fixed-income securities and equities remain unchanged at 15%, 40% and 45% between end-2023 and end-2024 targets.

The annual target return is also held steady at 5.3% for the 2020-2024 period.

But within the fixed-income category, the proportion of overseas investment was increased by 5% points to 10% by end-2024, whereas that of domestic fixed incomes was cut by the same margin to 30%.

The planned increase in the proportion of overseas portfolios may not lead to heavy selling in domestic equities and bond markets, given the NPS' steady asset growth.

But it suggests that the worldŌĆÖs third-largest pension fund may no longer inject additional billions of dollars into domestic stock markets for net buying in coming years.

It has been investing an additional 3 trillion won ($2.5 billion) to 10 trillion won in Korean stock markets every year.

By Chang Jae Yoo

yoocool@hankyung.com

(Photo: Getty Images Bank)

Yeonhee Kim edited this article

-

-

-

Private equityPrivate markets open to more high-net-worth individuals: Hamilton Lane

Private equityPrivate markets open to more high-net-worth individuals: Hamilton LaneApr 16, 2024 (Gmt+09:00)

-

InfrastructureInfrastructure secondaries continue to rise amid inflation: Stafford

InfrastructureInfrastructure secondaries continue to rise amid inflation: StaffordApr 09, 2024 (Gmt+09:00)

-

Private equityCarlyleŌĆÖs Rubenstein sees commercial real estate undervalued

Private equityCarlyleŌĆÖs Rubenstein sees commercial real estate undervaluedApr 08, 2024 (Gmt+09:00)