Keppel likely to buy three Seoul buildings in $400 mn package deal

Feb 28, 2019 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

The South Korean unit of Singapore-based asset manager Keppel Capital was picked as the preferred buyer for three Seoul office buildings in a package deal worth an estimated 450 billion won ($400 million), in what appears to be value-add investment.

Among seven to eight bidders for the three small and medium-sized offices, only Keppel and Seoul-based IGIS Asset Management Co. Ltd. expressed intentions to buy them in a lump, according to sources with knowledge of the matter on Feb. 25.

Samsung SRA Asset Management Co. Ltd. put the commercial properties up for sale last year to exit the investment in 10 years.

It acquired them one after another in 2009 on behalf of its single shareholder Samsung Life Insurance Co. Ltd. reportedly for 295.5 billion won in aggregate.

If the sale goes through, Samsung is expected to secure 155 billion won in proceeds, or 50% return on the property investment.

“They need value-add investments by filling them with more tenants, or refurbishing them,” said one of the sources.

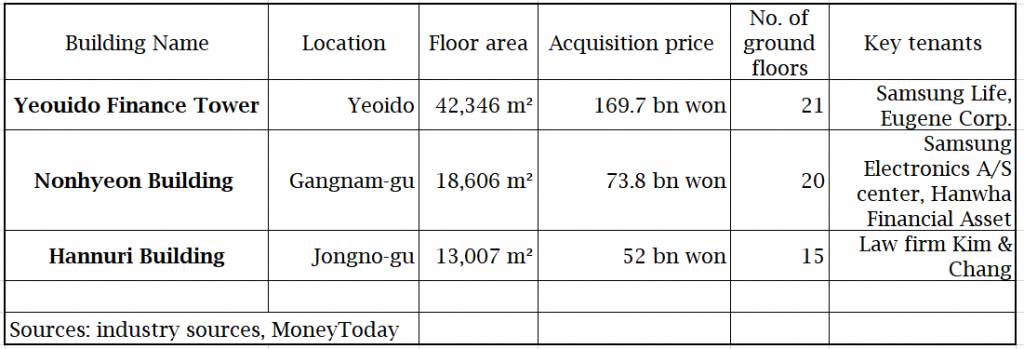

Details of the three offices up for sale:

Keppel Capital, with assets of $22 billion under management, is also expected to participate in the acquisition as an equity investor, according to the sources.

For Keppel, the expected deal will be its first property investment in South Korea since its South Korean arm was launched in April 2018.

Last year, it pulled out of a joint deal worth 985 billion won to acquire Seoul Square with NH Investment & Securities Co. Ltd. because of controversy over a conflict of interest.

The seller of the 132,806-square-meter building is Alpha Investment Partners Ltd., a wholly-owned unit of Keppel Group.

Instead, NH Investment is teaming up with another Singapore-based ARA Asset Management Ltd. to close the acquisition this year.

By Daehun Kim

daepun@hankyung.com

(Photo: Getty Images Bank)

Yeonhee Kim edited this article

-

Real estateMirae Asset to be named Korea Post’s core real estate fund operator

Real estateMirae Asset to be named Korea Post’s core real estate fund operatorApr 29, 2025 (Gmt+09:00)

-

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concern

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concernApr 27, 2025 (Gmt+09:00)

-

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fund

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fundApr 23, 2025 (Gmt+09:00)

-

Real estateRitz-Carlton to return to Seoul, tapped by IGIS Asset for landmark project

Real estateRitz-Carlton to return to Seoul, tapped by IGIS Asset for landmark projectApr 22, 2025 (Gmt+09:00)

-

Real estateS.Korean gaming giant Netmarble eyes headquarters building sale

Real estateS.Korean gaming giant Netmarble eyes headquarters building saleApr 18, 2025 (Gmt+09:00)