Morgan Stanley tops 2018 Korea’s M&A advisory firm list

Dec 31, 2018 (Gmt+09:00)

1

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

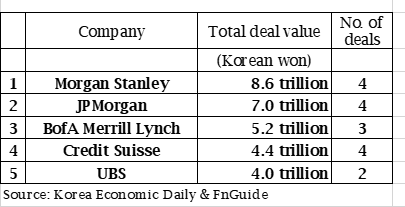

Morgan Stanley led South Korea’s merger advisory services market in 2018, accounting for 8.6 trillion won ($7.7 billion) worth of takeover deals, followed by J.P. Morgan which worked on 7 trillion M&A transactions, according to data compiled by the Korea Economic Daily and research firm FnGuide.

Morgan Stanley advised on four major acquisitions by South Korean companies, including CJ CheiJedang Corp.’s $1.84 billion purchase of US processed foods firm Schwan’s Company in November.

The US bank, of which managing director Sangwook Cho leads the investment banking division in Seoul, also handled the Carlyle Group’s $2.76 billion sale of ADT Caps, a securities service provider, to a SK Telecom-led consortium in the second quarter of this year.

Credit Suisse slipped to the fourth place from the top spot in 2017 when it advised 18.5 trillion won worth of acquisitions, including the 16.9 trillion won purchase by a SK Hynix Inc. of Toshiba Corporation’s memory chip unit.

Rankings of top 2018 M&A advisory firms in South Korea are as follows:

By Dong-hun Lee

leedh@hankyng.com

Photo: Getty Images Bank

Yeonhee Kim edited this article

More to Read

-

Real estateMirae Asset to be named Korea Post’s core real estate fund operator

Real estateMirae Asset to be named Korea Post’s core real estate fund operatorApr 29, 2025 (Gmt+09:00)

-

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concern

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concernApr 27, 2025 (Gmt+09:00)

-

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fund

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fundApr 23, 2025 (Gmt+09:00)

-

Real estateRitz-Carlton to return to Seoul, tapped by IGIS Asset for landmark project

Real estateRitz-Carlton to return to Seoul, tapped by IGIS Asset for landmark projectApr 22, 2025 (Gmt+09:00)

-

Real estateS.Korean gaming giant Netmarble eyes headquarters building sale

Real estateS.Korean gaming giant Netmarble eyes headquarters building saleApr 18, 2025 (Gmt+09:00)

Comment 0

LOG IN