Ares Management secures $300 mn in US gas project debt from Korea

Aug 04, 2018 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Ares Management LP has raised a total of $300 million in credit facilities from South Korean institutional investors, including Hana Financial Investment Co. Ltd. and Mirae Asset Daewoo Co. Ltd., on two US gas midstream projects in which the US private equity firm has equity stakes.

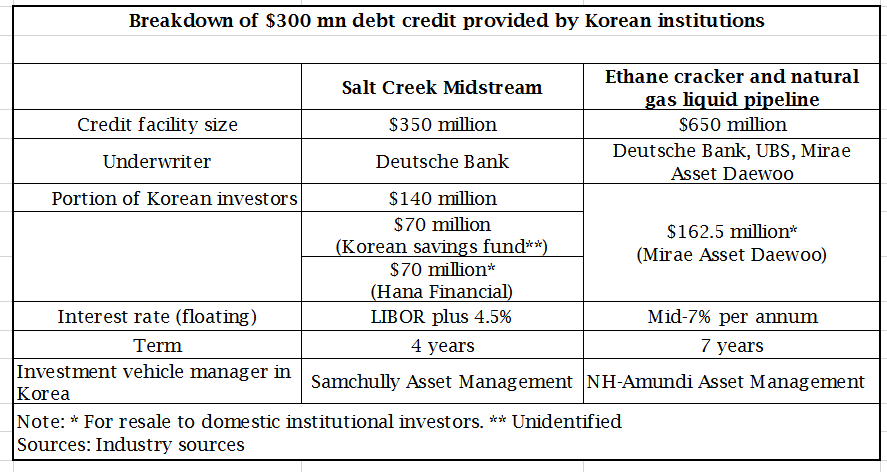

The two financing packages consist of $140 million loan on Salt Creek Midstream LLC in Texas and $162.5 million loan on an ethane cracker and natural gas liquid (NGL) pipeline project in the US state, according to investment banking sources on August 3.

Both projects are in the same value chain because Salt Creek Midstream has a strategic arrangement with the NGL pipeline, for which BP Energy Co. has agreed to become the first customer.

The debt facilities are expected to yield annual returns in the range of 6% to mid-7%.

The $140 million loan is part of the $350 million term loan facility raised for Salt Creek Midstream to process and transport crude and gas extracted from Permian Basin in Texas and New Mexico, one of the top shale oil and gas producing states in the US. (for details, see table)

Ares Management announced the closing of the credit facility in a joint press release in April.

Salt Creek Midstream is a project company jointly owned by Ares Management and ARM Energy Holdings. It will be comprised of multiple cryogenic processing facilities, as well as gas and crude gathering pipelines, compression and treating facilities.

The additional $162.5 million loan, underwritten by Mirae Asset Daewoo, is a senior tranche of the $650 million debt financing for the ethane cracker and NGL pipeline in Texas, a project into which Ares had pumped $810 million in equity investment.

Deutsche Bank and UBS, the other underwriters, will take up the mezzanine tranche of the package for the remainder, according to the Seoul Economic Daily on August 2.

Mirae Asset is not only reselling the senior note to other domestic institutional investors, but considering making principal investment.

The pipeline to be built will run 1,100km to transport natural gas liquids from shale gas produced at Salt Creek Midstream facilities to Corpus Christi, a coastal city on the Gulf of Mexico. Under the project, a 2 million barrel-per-day cracking plant will be constructed.

NGL production in the US has been soaring, powered by ethane production growth. US ethane prices surpassed natural gas prices in 2016 and 2017.

Los Angeles-based Ares Management had approximately $106.4 billion of assets under management at the end of 2017.

By Daehun Kim

daepun@hankyung.com

Yeonhee Kim edited this article

-

Real estateMirae Asset to be named Korea Post’s core real estate fund operator

Real estateMirae Asset to be named Korea Post’s core real estate fund operatorApr 29, 2025 (Gmt+09:00)

-

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concern

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concernApr 27, 2025 (Gmt+09:00)

-

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fund

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fundApr 23, 2025 (Gmt+09:00)

-

Real estateRitz-Carlton to return to Seoul, tapped by IGIS Asset for landmark project

Real estateRitz-Carlton to return to Seoul, tapped by IGIS Asset for landmark projectApr 22, 2025 (Gmt+09:00)

-

Real estateS.Korean gaming giant Netmarble eyes headquarters building sale

Real estateS.Korean gaming giant Netmarble eyes headquarters building saleApr 18, 2025 (Gmt+09:00)