NPS to bump up alternatives proportion to 15% by end-2023

Jun 01, 2018 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

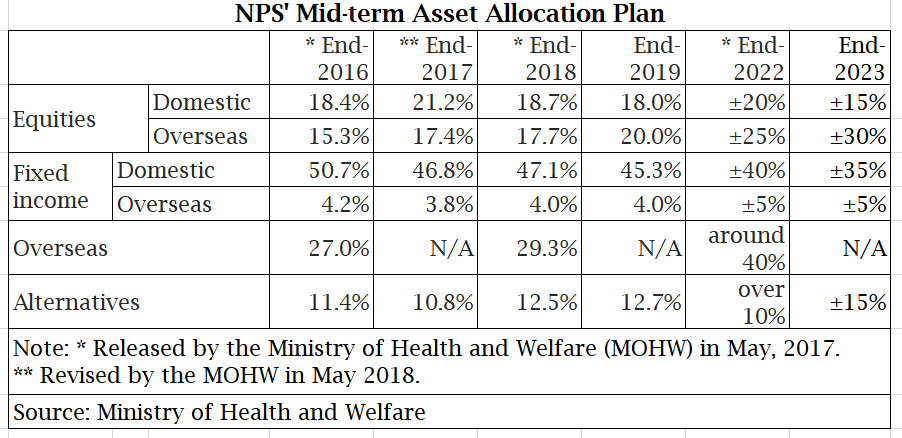

The National Pension Service (NPS) will raise the proportion of alternative investments from last year’s 10.8% to around 15% by end-2023 when its assets under management are expected to exceed 1,000 trillion won ($931 billion), according to the Ministry of Health and Welfare.

Under the mid-term asset allocation plan for the 2019-2023 period, alternatives will represent 12.7% of the NPS’ projected AUM of 729.5 trillion won by the end of next year, or 92.6 trillion won in value, the ministry said in a statement on May 30. It was released just after the ministry presided over a regular committee meeting to discuss the pension fund’s asset management plans.

The average target return for the 2019-2023 period was set at 5.3%, slightly higher than the 5.1% target for the 2018-2022 period.

NPS chairman and chief executive Sung-joo Kim said in the ASK 2018 Global Private Equity & Debt Summit on May 29 that the pension scheme will increase the share of cross-border investments to 40% from the current 29%.

Meanwhile, the proportion of domestic equities in 2019 will be reduced below that of overseas stocks for the first time in the its history.

NPS aims to trim the ratio of domestic equities from this year amid caution about its growing clout in local stock markets and in an effort to diversify portfolios for better returns.

By Chang Jae Yoo

yoocool@hankyung.com

Yeonhee Kim edited this article

-

Real estateMirae Asset to be named Korea Post’s core real estate fund operator

Real estateMirae Asset to be named Korea Post’s core real estate fund operatorApr 29, 2025 (Gmt+09:00)

-

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concern

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concernApr 27, 2025 (Gmt+09:00)

-

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fund

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fundApr 23, 2025 (Gmt+09:00)

-

Real estateRitz-Carlton to return to Seoul, tapped by IGIS Asset for landmark project

Real estateRitz-Carlton to return to Seoul, tapped by IGIS Asset for landmark projectApr 22, 2025 (Gmt+09:00)

-

Real estateS.Korean gaming giant Netmarble eyes headquarters building sale

Real estateS.Korean gaming giant Netmarble eyes headquarters building saleApr 18, 2025 (Gmt+09:00)