NPSŌĆÖ 2017 investment return at 7-yr high; to wrap up CIO selection in April

Mar 27, 2018 (Gmt+09:00)

Samsung shifts to emergency mode with 6-day work week for executives

S.Korea's LS Materials set to boost earnings ahead of IPO process

Alibaba eyes 1st investment in Korean e-commerce platform

Blackstone signs over $1 bn deal with MBK for 1st exit in Korea

NPS loses $1.2 bn in local stocks in Q1 on weak battery shares

The National Pension Service (NPS) chalked up an average investment return of 7.26% in 2017, which was its strongest performance in seven years, while the worldŌĆÖs No.3 pension scheme is aiming to wrap up the selection process of its chief investment officer next month.

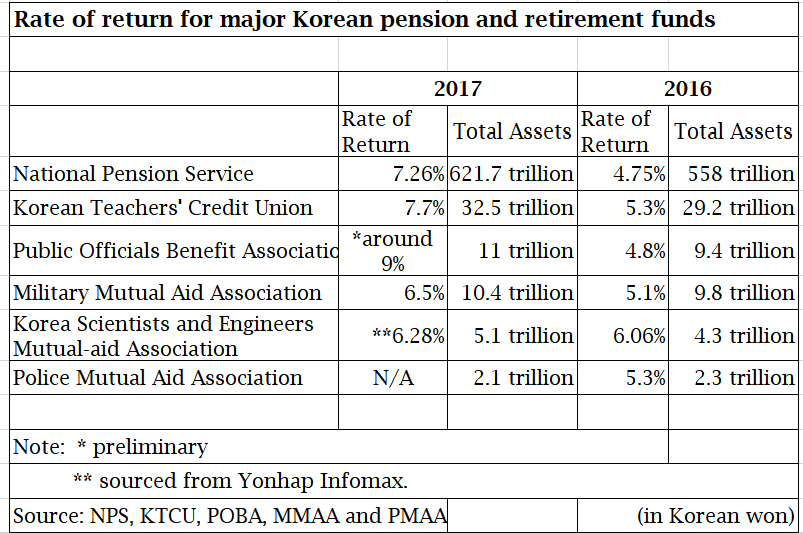

The 2017 number was the highest since 2010 when NPS posted a return of 10.37%, but below those of two major South Korean retirement funds -- the Korean TeachersŌĆÖ Credit Union (KTCU), the countryŌĆÖs largest savings fund and the Public Officials Benefit Association (POBA). (see table below)

Bullish stock markets beefed up investment returns for South Korean pension and retirement funds last year.

ŌĆ£We will continue to diversify investment by increasing the proportion of overseas and alternative investments and boosting responsible investment. We will strengthen our management infrastructure by hiring talented and experienced staff,ŌĆØ Chief Executive Officer Sung-joo Kim said in a statement released on March 26.

Kim was installed as CEO and chairman of the NPS in November 2017.

Separately, Welfare Minister Neung-hoo Park told reporters on March 16 that the ministry, overseeing the NPS, will wrap up the CIO selection process within April, according to edaily, a domestic news outlet.

The CIO search committee will interview 16 applicants on April 3.

ŌĆ£A number of good candidates applied for the position, so we have high expectations for an incoming CIO,ŌĆØ Minister Park was quoted as saying by edaily.

Upon the CIO appointment, NPS will hire 38 asset management employees to fill vacant positions. The number of applicants was 201, according to the NPS.

NPSŌĆÖ 2018 target return is 0.20% point above the market benchmark rates. It is lower than the 2017 goal of 0.25% point above, according to a statement from the Ministry of Health and Welfare released in late December.

The ministry said that the 2018 target return took into consideration the impact of NPSŌĆÖ move to Jeonju, a small city south of Seoul.

In 2018, the proportion of alternatives will rise to 12.5% from 10.8% in 2017. The ministry did not break down overseas and domestic alternatives.

The proportion of domestic equities will slip to 18.7% from 21.2% in 2017, whereas domestic fixed-income assets will edge up to 47.1% from 46.6%.

Yeonhee Kim edited this article

-

-

Pension fundsNPS loses $1.2 bn in local stocks in Q1 on weak battery shares

Pension fundsNPS loses $1.2 bn in local stocks in Q1 on weak battery sharesApr 21, 2024 (Gmt+09:00)

-

-

-

Private equityPrivate markets open to more high-net-worth individuals: Hamilton Lane

Private equityPrivate markets open to more high-net-worth individuals: Hamilton LaneApr 16, 2024 (Gmt+09:00)