Korea police fund seeks loan funds and infrastructure projects: report

Mar 21, 2018 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

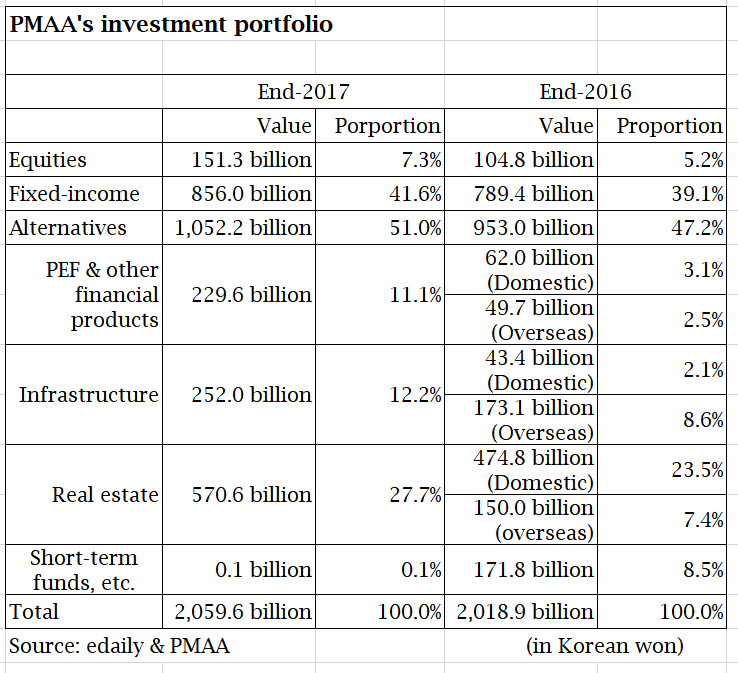

The Police Mutual Aid Association (PMAA), a $2 billion retirement fund for South Korea’ polices officers, will ramp up investment in loan funds and infrastructure projects in search of high-yielding, inflation-hedging assets and allocate 247.2 billion ($231 million) to new alternative investments in 2018, its chief investment officer told a local news media.

New alternative investments will make up 67% of its total fresh investment of 368.8 billion won planned for this year, followed by fixed-income assets (30%), online news provider edaily reported last week.

At end-2017, alternative investments represented 51% of PMAA’s AUM of 2 trillion won. (see table below)

“In the era of interest rate rises, alternative investments tend to produce higher yield. We will aggressively chase loan funds to earn interest incomes and infrastructure projects which provide an inflation hedge,” PMAA’s CIO Doyoon Lee was quoted as saying by edaily.

“Despite concerns about overvaluation in real estate markets at home and abroad, investment demand for commercial real estates in core areas will remain robust, given the ample market liquidity,” he added.

The proportion of global assets in its portfolio will be lifted to 48% as a whole by year’s end from last year’s 28%.

Yeonhee Kim edited this article

-

Real estateMirae Asset to be named Korea Post’s core real estate fund operator

Real estateMirae Asset to be named Korea Post’s core real estate fund operatorApr 29, 2025 (Gmt+09:00)

-

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concern

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concernApr 27, 2025 (Gmt+09:00)

-

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fund

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fundApr 23, 2025 (Gmt+09:00)

-

Real estateRitz-Carlton to return to Seoul, tapped by IGIS Asset for landmark project

Real estateRitz-Carlton to return to Seoul, tapped by IGIS Asset for landmark projectApr 22, 2025 (Gmt+09:00)

-

Real estateS.Korean gaming giant Netmarble eyes headquarters building sale

Real estateS.Korean gaming giant Netmarble eyes headquarters building saleApr 18, 2025 (Gmt+09:00)