Korea teachers fund allocates $1 bn for new global alternatives in 2018

Mar 15, 2018 (Gmt+09:00)

Samsung shifts to emergency mode with 6-day work week for executives

Alibaba eyes 1st investment in Korean e-commerce platform

Blackstone signs over $1 bn deal with MBK for 1st exit in Korea

NPS loses $1.2 bn in local stocks in Q1 on weak battery shares

MBK eyes stake in Korean software developer Tmaxsoft

The Korean TeachersŌĆÖ Credit Union (KTCU) plans to invest an additional 1.1 trillion won ($1 billion) in overseas alternative assets in 2018, out of the 1.6 trillion won it earmarked for this yearŌĆÖs new global investments.

The biggest retirement savings fund in South Korea, with $23 billion in AUM, will continue to focus on stable income-producing assets such as senior and mezzanine loans secured on cross-border commercial real estate on the prospect for interest rate hikes in major economies.

ŌĆ£KTCU will aggressively look for opportunities to invest in variable-rate loans such as direct lending which are set to benefit from US interest rate hikes,ŌĆØ KTCUŌĆÖs Chief Investment Officer Sung-seog Kang said in a KTCUŌĆÖs statement released on March 12.

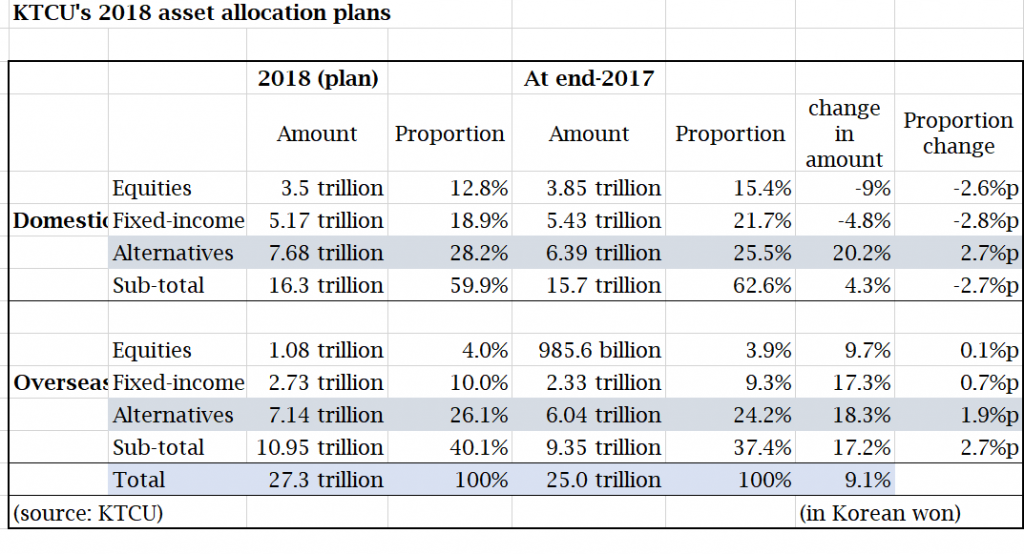

Overall, it will boost the proportion of global portfolios to 40.1% by yearŌĆÖs end from last yearŌĆÖs 37.4%. (see table below)

Its AUM expanded by 11.6% to 25 trillion won ($23 billion) by end-2017 from a year earlier, and is projected to grow by 9% to 27.3 trillion won by end-2018.

Its average return on assets was 7.7% in 2017, beating its target of 4.4% and the previous yearŌĆÖs 5.3%.

Double-digit returns from both domestic and global equities lifted the return, while overseas alternative investments, which made up 24.2% of its AUM, returned 4.8% in 2017.

To boost alternative investments, KTCU said it had invested an undisclosed sum in a US value-add fund of Gaw Capital Partners last year.

It set up a $1 billion joint venture with the Teachers Insurance and Annuity Association of America ŌĆō College Retirement Equities Fund (TIAAŌĆōCREF) to invest in US commercial real estate debt.

Yeonhee Kim edited this article

-

-

-

Pension fundsNPS loses $1.2 bn in local stocks in Q1 on weak battery shares

Pension fundsNPS loses $1.2 bn in local stocks in Q1 on weak battery sharesApr 21, 2024 (Gmt+09:00)

-

-