Korea scientists fund to commit $37 mn to co-investment funds; $34 mn to PDF

Mar 11, 2018 (Gmt+09:00)

Samsung steps up AR race with advanced microdisplay for smart glasses

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

Seoul-backed K-beauty brands set to make global mark

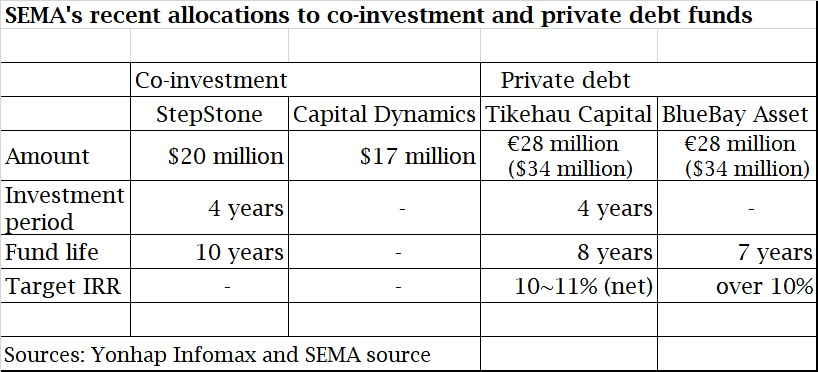

Korea Scientists and Engineers Mutual-aid Association (SEMA) has decided to commit $37 million to co-investment funds of US-based StepStone Group and Swiss asset manager Capital Dynamics, as it is increasingly seeking co-investment opportunities with global partners for higher yields.

The $4.5 billion retirement fund will also commit €28 million ($34 million) to a mid-cap private debt fund of French asset manager Tikehau Capital, following a €28 million commitment to a Europe mid-market private debt fund of BlueBay Asset Management LLP late last year.

Yonhap Infomax first reported the news on March 8 and a SEMA source confirmed them. (see Table below)

Tikehau’s debt fund is focused on the continental Europe, with the UK making up just 10% of the portfolio. In comparison, BlueBay’s debt fund is heavily weighted to the UK.

Tikehau Capital, with €13.8 billion in AUM, opened a representative office in Seoul last year as it is expanding its client base into Asia, in particular in South Korea, according to its press release in February.

Capital Dynamics closed its fourth mid-market direct co-investment fund at $383 million in October 2017, its largest co-investment fund.

Meanwhile, SEMA has been increasing infrastructure investments since 2016, targeting public private partnership projects in developed countries for stable returns. It is now considering investing in the UK water supply facilities, Yonhap Infomax added.

Infrastructure was the best-performing asset class for SEMA in 2017 as at end-September.

Last year, its investment assets returned an average 6.28%, above the target of 4.73%, according to Infomax. The 2017 result beat the previous year’s 6.06% which was the highest among South Korean pension and savings funds in 2016.

For portfolio diversification of its swelling assets, SEMA selected Aberdeen Standard Investments in January as a manager of its first separately managed account of multi-asset strategy for around $120 million.

By Daehun Kim

daepun@hankyung.com

Yeonhee Kim edited this article

-

Pension fundsS.Korea’s GEPS to commit $143 million to foreign mid-cap buyout funds

Pension fundsS.Korea’s GEPS to commit $143 million to foreign mid-cap buyout fundsMay 08, 2025 (Gmt+09:00)

-

Pension fundsNPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

Pension fundsNPS yet to schedule external manager selection; PE firms’ fundraising woes deepenMay 02, 2025 (Gmt+09:00)

-

Real estateMirae Asset to be named Korea Post’s core real estate fund operator

Real estateMirae Asset to be named Korea Post’s core real estate fund operatorApr 29, 2025 (Gmt+09:00)

-

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concern

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concernApr 27, 2025 (Gmt+09:00)

-

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fund

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fundApr 23, 2025 (Gmt+09:00)