KTB Asset sources $80 mn mezzanine debt deal on London hotel

Mar 08, 2018 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

KTB Asset Management Co. Ltd. has sourced its first Europe real estate debt investment for South Korean institutional investors with a £56.9 million ($79 million) mezzanine debt on a luxury hotel in London, supported by the weaker pound and soaring demand for real estate debts.

Three unidentified South Korean institutional investors invested in the mezzanine debt, which was part of a refinancing package for Grosvenor House by its owner Ashkenazy Acquisition Corp, a New York-based real estate investor.

KTB confirmed the investment first reported by the Maeil Business Newspaper, but declined to give expected returns of the investment.

Grosvenor House, located in the affluent neighborhood of Mayfair in London, has been managed by Marriott International Inc. since 2008 under a 50-year lease agreement.

“The weaker pound sparked a surge in tourist visiting to Britain from other parts of Europe, the US and the middle East. It improved the outlook for London’s five-star hotel industry,” a KTB Asset source was quoted as saying by the Maeil Business in late February.

“FX premiums are boosting demand for Europe lending and debts from (Korean) institutional investors. We will further expand investment in Europe’s blue-chip assets.”

Currently, the rate on one-year pound/won cross currency swaps is quoted at around 45 to 50 basis points.

In 2017, KTB Asset’s deal sourcing was focused on US properties for target returns of 4-5%.

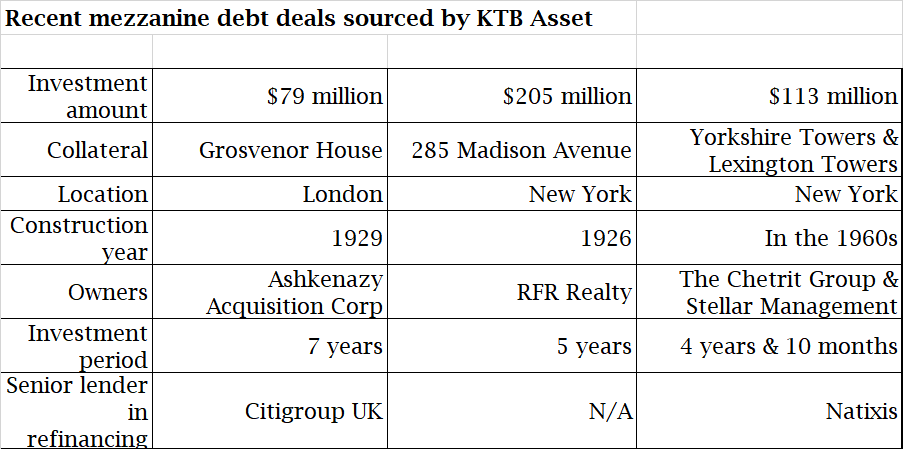

In November, KTB Asset underwrote a $205 million mezzanine debt on 285 Madison Avenue in New York, on behalf of five South Korean institutional investors. (see Table below)

It was part of a $475 million fixed-rate loan originated by KTB Asset and Natixis. Natixis underwrote the senior tranche of $270 million, according to a report from the Commercial Observer.

The building is used as Fashion brand Tommy Hilfiger’s headquarters and also leased to GE Capital.

In December, KTB Asset underwrote a $113 million mezzanine debt on two luxury multifamily buildings, Yorkshire Towers and Lexington Towers, in the upper east side of Manhattan, New York.

The debt is part of the $550 million fixed-rate loan provided by Natixis and UBS for refinancing of the properties, owned by the Chetrit Group and Stellar Management.

KTB Asset manages 2.2 trillion won in alternative investment private funds, half of which is invested abroad, according to the Maeil Business.

By Daehun Kim

daepun@hankyung.com

Photo: Getty Images Bank

Yeonhee Kim edited this article

-

Real estateMirae Asset to be named Korea Post’s core real estate fund operator

Real estateMirae Asset to be named Korea Post’s core real estate fund operatorApr 29, 2025 (Gmt+09:00)

-

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concern

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concernApr 27, 2025 (Gmt+09:00)

-

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fund

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fundApr 23, 2025 (Gmt+09:00)

-

Real estateRitz-Carlton to return to Seoul, tapped by IGIS Asset for landmark project

Real estateRitz-Carlton to return to Seoul, tapped by IGIS Asset for landmark projectApr 22, 2025 (Gmt+09:00)

-

Real estateS.Korean gaming giant Netmarble eyes headquarters building sale

Real estateS.Korean gaming giant Netmarble eyes headquarters building saleApr 18, 2025 (Gmt+09:00)