Korean investors to provide $440 mn financing in their largest US power plant investment

Sep 12, 2017 (Gmt+09:00)

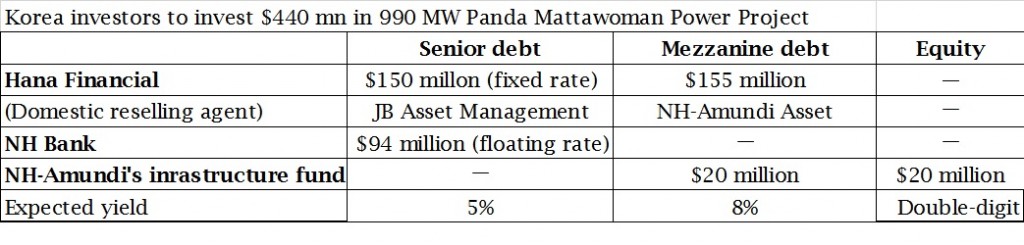

Hana Financial Investment Co. Ltd. and NH Bank of South KoreaŌĆÖs national agricultural cooperative will underwrite an aggregate $400 million of debt sold to finance the construction of a new US gas power plant in Maryland, while a Seoul-based asset manager invests $40 million in debt and equity tranches of the power project.

The $440 million┬Āfinancing for the Panda Mattawoman Power Project, which reportedly costs $1.16 billion, is likely to become the largest investment by South Korean institutional investors in a US power facility, reflecting growing appetite for US infrastructure assets.

The project is to build a natural gas-fueled, 990 MW combined-cycle generating station in Brandywine, Maryland and aims to begin commercial operation in 2020.

Panda Power Funds, a private equity firm, originated the debt and sold part of its equity interest in the power project for the latest financing.

Hana Financial, a coordinating lead arranger of fixed-rate senior notes of the financing, had tapped South Korean insurers and savings funds to arrange 500 billion won of financing for the Mattawoman Power Project, according to a media report in June.

Hana will underwrite $150 million in senior debt and $155 million in mezzanine debt. It hired two asset managers to resell the debt to domestic institutional investors.

NH Bank, a co-arranger of floating-rate senior loan, will acquire $94 million of floating-rate senior debt. It is expected to sell it down to other domestic banks.

Separately, NH-Amundi Asset Management Co. Ltd. will invest $20 million each in equity stakes and mezzanine debt in the power plant through its recently-launched global infrastructure fund.

The global infrastructure fund of NH-Amundi Asset closed on 300 billion won in May. Once the $40 million investment is executed in the Mattawoman Power Project later this month, it will become its first investment in an overseas project. Several units of NongHyup, the financial services group of the agricultural cooperative, have committed capital to the infrastructure fund.

Hana Financial, a unit of South KoreaŌĆÖs leading banking group, has arranged a string of investments in US thermal power projects and solar energy projects for domestic institutional investors. It targets solar energy projects in the west of the US and gas combined-cycle power projects in the east.

ŌĆ£Hana Financial is doing much better than large-size brokerage companies in global deal sourcing, and what is impressive about them is they are bold enough to underwrite a whole tranche,ŌĆØ a South Korean savings fund source told the Korean Investors on Sept. 11.

Last January, Hana arranged $200 million in debt financing for a 1,485 MW gas-fired combined cycle power plant under construction in Pennsylvania, becoming the first Korean firm to underwrite a whole tranche of debt facilities.

Industry sources said that the investment in the Mattawoman Power Project is meaningful in that both Hana Financial and NH Bank were among debt arrangers.

Once built, the power station is expected to supply electricity to up to 990,000 homes, replacing retiring coal-fired power plants in the Pennsylvania, New Jersey and Maryland (PJM) energy market, the largest power market in the US.

By Daehun Kim

daepun@hankyung.com

Yeonhee Kim edited this article

-

-

-

Private equityPrivate markets open to more high-net-worth individuals: Hamilton Lane

Private equityPrivate markets open to more high-net-worth individuals: Hamilton LaneApr 16, 2024 (Gmt+09:00)

-

InfrastructureInfrastructure secondaries continue to rise amid inflation: Stafford

InfrastructureInfrastructure secondaries continue to rise amid inflation: StaffordApr 09, 2024 (Gmt+09:00)

-

Private equityCarlyleŌĆÖs Rubenstein sees commercial real estate undervalued

Private equityCarlyleŌĆÖs Rubenstein sees commercial real estate undervaluedApr 08, 2024 (Gmt+09:00)