Goldman and KKR mezzanine funds seen to raise up to $1.14 bn from Korea

Sep 10, 2017 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

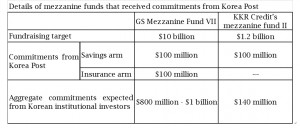

Goldman Sachs’s new mezzanine fund, which aims to raise $10 billion, is expected to gather an aggregate $800 million to $1 billion from South Korean institutional investors, including $200 million commitment from Korea Post.

KKR Credit, part of KKR & Co., is also likely to collect $140 million from South Korea for its latest global mezzanine fund that is seeking to raise $1.2 billion, after Korea Post recently decided to commit $100 million.

The commitment decisions came after Korea Post’s savings unit issued a request for proposals in May to invest up to $300 million in global private debt funds.

The two mezzanine funds will provide financing for private equity buyouts which are taking a bigger share in global mergers and acquisitions deals, fueled by increasing dry powder at private equity firms.

Goldman Sachs Mezzanine Partners (GSMP) VII fund focuses on financing private equity acquisitions of large-cap companies in the US and Europe, according to Korea Post and financial industry sources on Sept. 7.

The fund might surpass the size of its predecessor, GSMP VI, which reportedly closed on $8 billion in 2015 to be one of the largest mezzanine funds ever raised. The mezzanine lending arm has invested more than $30 billion of capital since 1996.

By comparison, the new KKR Credit’s fund will provide mezzanine financing for buyouts of small and mid-cap companies.

The KKR mezzanine fund is far smaller than GSMP VII, because it is just the second such fund for the buyout house. Given its focus on smaller firm buyouts, it is unlikely to finance acquisition deals sealed by KKR buyout funds.

“Buyout funds of global private equity firms such as Blackstone and KKR are growing to several billions of dollars in size. It targets a net IRR of around 8% from lending mezzanine loans to finance PEFs’ acquisitions of large-cap companies,” a Korea Post source told the Korean Investors, referring to GSMP VII.

“GSMP funds have almost no competitors because most of mezzanine funds launched target mid and small-cap companies,” he said.

Previously, Korea Post had invested an undisclosed amount in GSMP V, the mezzanine fund series.

Other South Korean institutional investors that have either decided to invest in GSMP VII, or considering committing include National Pension Service, Korean Teachers’ Credit Union and Military Mutual Aid Association, as well as Dongbu Insurance Co. Ltd. and Nonghyup, South Korea’s national agricultural cooperative.

Their fundraisings reflect growing interest in private debt investment, as investors are wary of high valuations at alternative assets.

Among private debt segments, South Korea’s top asset owners have focused on mezzanine and senior debt secured on office buildings abroad. Mezzanine debt generates higher returns than senior debt, in line with the added risk attached to mezzanine notes.

Direct lending and mezzanine debt were at top of Korean limited partners’ private debt strategies which they planned to expand in 2017, according to a survey of 20 leading domestic institutional investors conducted by the Korean Investors in May.

By Chang Jae Yoo

yoocool@hankyung.com

Yeonhee Kim edited this article

-

Real estateMirae Asset to be named Korea Post’s core real estate fund operator

Real estateMirae Asset to be named Korea Post’s core real estate fund operatorApr 29, 2025 (Gmt+09:00)

-

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concern

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concernApr 27, 2025 (Gmt+09:00)

-

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fund

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fundApr 23, 2025 (Gmt+09:00)

-

Real estateRitz-Carlton to return to Seoul, tapped by IGIS Asset for landmark project

Real estateRitz-Carlton to return to Seoul, tapped by IGIS Asset for landmark projectApr 22, 2025 (Gmt+09:00)

-

Real estateS.Korean gaming giant Netmarble eyes headquarters building sale

Real estateS.Korean gaming giant Netmarble eyes headquarters building saleApr 18, 2025 (Gmt+09:00)